It is a truth universally acknowledged, that a firm in possession of a large quantity of Bitcoin, must be in want of a soaring stock price 🚀. However, as a recent report by Nansen so astutely observes, the markets are not so easily swayed by the mere presence of this most coveted of cryptocurrencies.

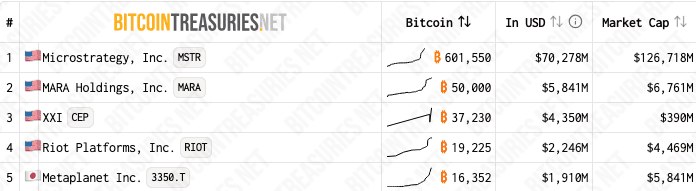

No, dear reader, the markets are a discerning mistress, and they care not just that a company holds Bitcoin, but how it holds it. It is a distinction that has led to some most intriguing disparities in the valuation of certain firms. For instance, Strategy, that great bastion of Bitcoin enthusiasm, trades at nearly double the valuation of its BTC holdings, while Marathon Digital, with its 85% Bitcoin-backed market cap, trades at a mere par with its reserves 🤔.

But what, pray tell, is the secret to Strategy’s success? Ah, dear reader, it is quite simple really: debt. That most wondrous of financial instruments, which allows Strategy to consistently accumulate Bitcoin, and thereby act as a leveraged bet on its price 🤑. It is a strategy (no pun intended) that has given Strategy’s stock both more upside and greater volatility than Bitcoin itself.

As the Nansen report so wryly notes, “Investors treat MicroStrategy akin to a leveraged Bitcoin ETF, amplifying exposure to Bitcoin price movements. Consequently, its stock typically exhibits 2–3× Bitcoin’s volatility” 📊. And it is not just Strategy that has benefited from this approach, for the Japanese firm Metaplanet also trades above the value of its BTC holdings, at a 3.5x multiple, thanks in no small part to its first-mover advantage in Asia 🌟.

But alas, dear reader, not all firms have been so fortunate. Marathon Digital, for instance, has seen its stock price languish, despite its substantial Bitcoin holdings 🤕. It is a stark reminder that, in the world of finance, there is no one-size-fits-all solution, and that even the most seemingly sound strategies can go awry.

And so, dear reader, let this be a lesson to you: the markets are a cruel mistress, and they will not be swayed by mere enthusiasm or bravado. No, to succeed in this game, one must be cunning, resourceful, and above all, willing to take risks 🎲. For in the world of finance, as in life itself, there is no reward without risk, and no success without sacrifice 💸.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- TRX PREDICTION. TRX cryptocurrency

- How to Unlock & Upgrade Hobbies in Heartopia

- Xbox Game Pass September Wave 1 Revealed

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2025-07-17 17:25