Well now, after a good round of tumbleweeds blowin’ through the crypto market, the mighty Bitcoin seems to have caught its breath and is prancin’ above the $86,000 mark. Folks been tryin’ their hand at a quick buck-probably more fingers than dollars-sendin’ a pile of coins to those centralized gambling halls called exchanges. Last week, nearly $2 billion worth of Bitcoin decided to make a trip to the cash-out counters-just to remind us all that even the Emperor has to check his trousers now and then.

The Grand Inflow Spectacle: When Bitcoin Turns Into a Cash Register 🤑

Some wisecrack on the social media platform X, Ali Martinez, pointed out that a heap of Bitcoin-roughly 20,000 of them-headed straight to the exchange doors. That’s a mighty river of crypto flowin’ in, like a flood of mud at a hog-killin’. Santiment, that clever little data watchdog, reports the inflow as a sort of “goodbye, my friends,” indicating investors might be lookin’ to sell off a few coins-maybe to buy a new boat or a shiny new hat.

This “Exchange Inflow” measure is like watchin’ a cattle drive-only it’s Bitcoin goin’ in, and when it gets real high, it usually means the herd’s fixin’ to get sold off. More supply on the market, and less demand-well, that’s just fancy talk for a downhill slide. And downhill Bitcoin is sort of like a pig on a slip-n-slide-it’s bound to pick up some speed.

Meanwhile, Julio Moreno, a smart fella from CryptoQuant, dropped a nugget of wisdom confirming that last Friday’s inflow was the highest since July-about 81,000 Bitcoin, or $2 billion dancing out the door. This flood of coins explains the price rollercoaster-down to just above $80,000 before weekend kicked in. But hold onto your hats-right now, it’s climbing back up, standing tall at a crisp $86,070, with a little more zip in its step.

Profit-Taking: A Bit of a Cattle Rustler in the World of Coins 🤠

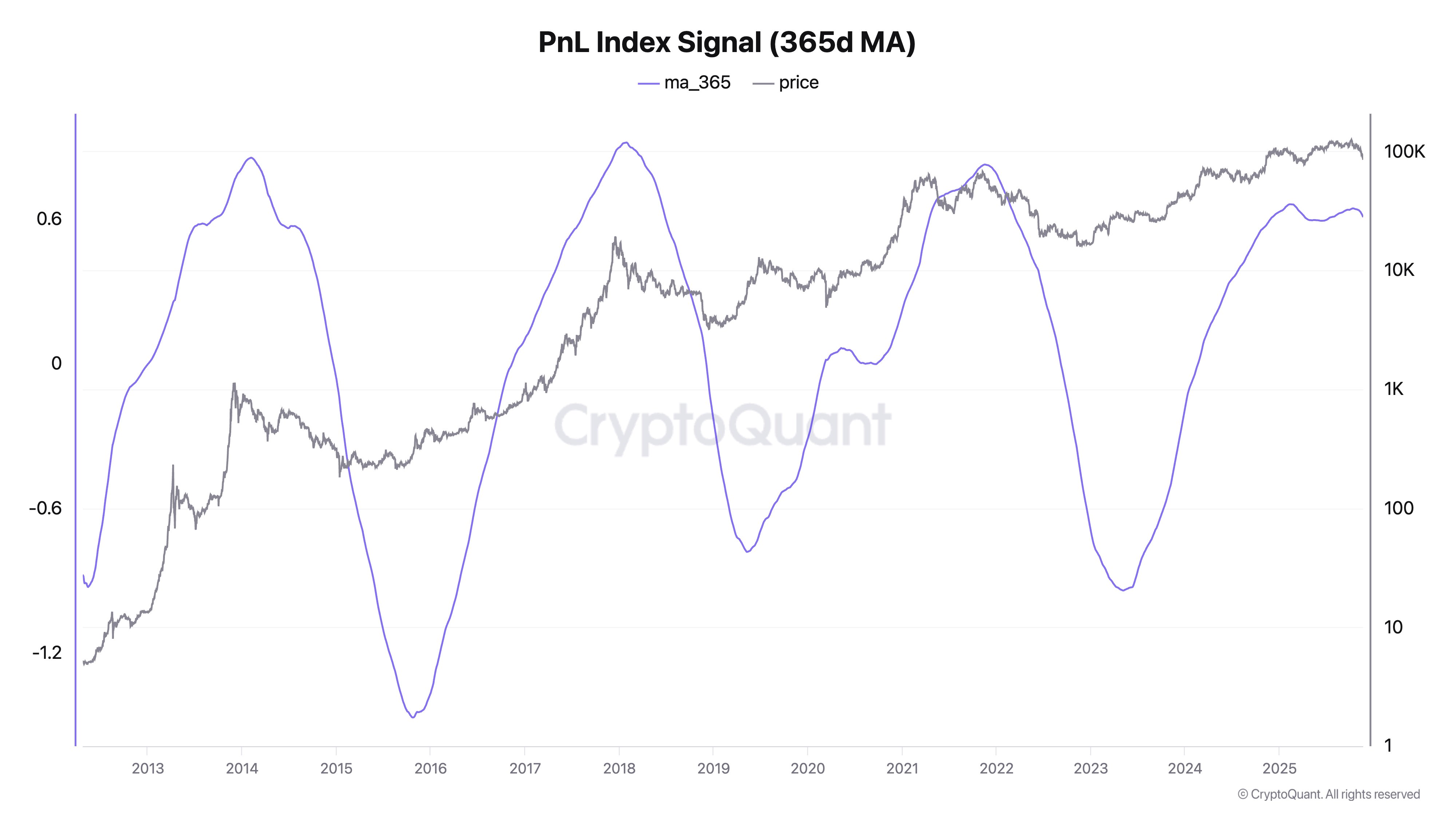

Now, the head honcho at CryptoQuant, Ki Young Ju, tinkered with his numbers and declared that Bitcoin’s in a “profit-taking” phase-as sure as a fish can’t swim without water. His trusty PnL Index Signal shows folks are sellin’ off because they’ve got a profit-and they’re lookin’ to cash out before the whole thing turns into a mudslide again. Classic cycle, he says-just like the old days of 2020, when we weren’t even sure if the sky was falling or just takin’ a nap.

All eyes now are on the Federal Reserve’s December shindig, where folks reckon they won’t be cuttin’ interest rates. That’s like waitin’ for the cows to come home-never quite sure if they’re gonna show up or meander off to greener pastures. Whatever happens, it’s clear that the market’s in a bit of a knot-confused, nervous, and just waitin’ for the next move.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

2025-11-23 23:11