On Tuesday, Bitcoin spot exchange-traded funds (ETFs) recorded over $300 million in net inflows, marking the fifth consecutive day of capital influx into these funds. Who knew money could flow like my Aunt Edna’s gossip at family reunions?

BlackRock’s iShares Bitcoin Trust (IBIT) attracted the largest portion of Tuesday’s inflows as the leading coin closed above $106,000 for the first time since January 21. I mean, at this rate, I might just start accepting Bitcoin for my homemade cookies. 🍪

Bitcoin ETF Inflows Hit 5-Day Streak

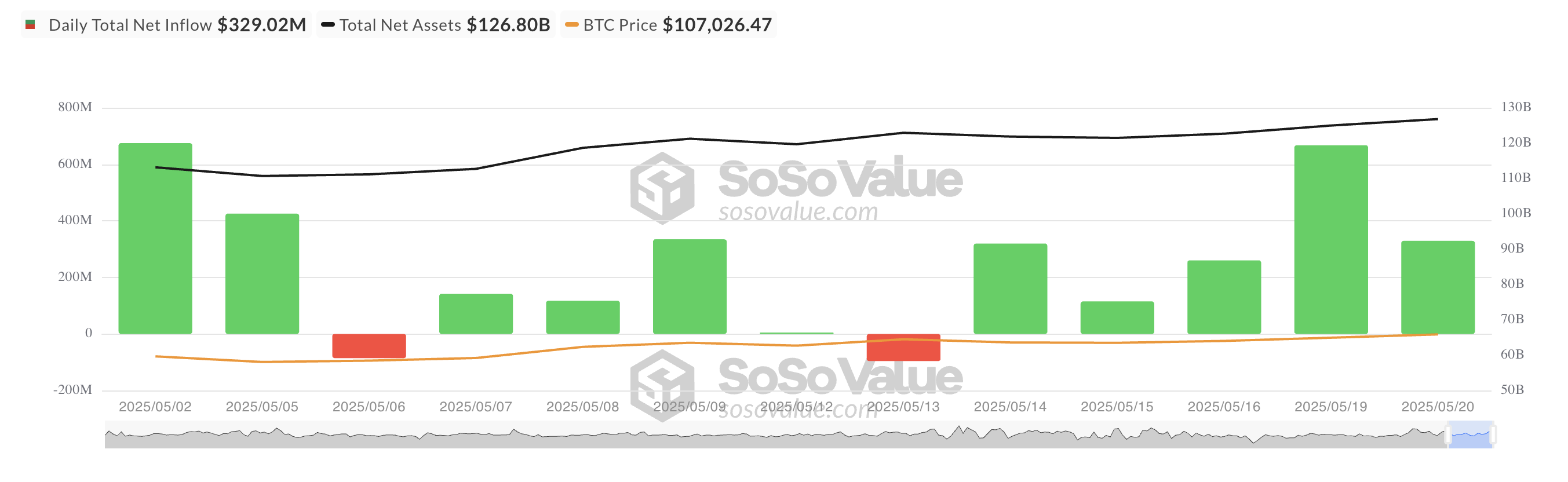

Yesterday, net inflows into BTC spot ETFs totaled $329.02 million, marking the fifth straight day of inflows into these products. It’s like a party that just won’t stop, and I’m still waiting for my invitation!

The steady pace of inflows over the past five days indicates a broader shift in market sentiment. Institutional players appear increasingly confident in BTC’s medium-term trajectory, prompting them to consistently allocate capital to the funds backed by the coin despite short-term market fluctuations. Meanwhile, I’m still trying to figure out how to allocate my lunch budget. 😅

On Tuesday, BlackRock’s ETF IBIT recorded the largest daily net inflow, totaling $287.45 million, bringing its total cumulative net inflows to $46.15 billion. That’s more money than I’ve seen in my entire life, and I’m still waiting for my lottery ticket to pay off!

Fidelity’s spot Bitcoin ETF, FBTC, recorded the second-largest daily inflow that day, attracting $23.26 million. This brings its total historical net inflows to $11.81 billion. I guess I should have invested in Bitcoin instead of that collection of ceramic frogs. 🐸

Bitcoin Blasts Past $107,000

Today, the king coin has broken above the psychological $107,000 resistance level, indicating a spike in bullish pressure in the spot markets. As of this writing, the leading cryptocurrency trades at $107,421, noting a modest 2% gain over the past day. Meanwhile, my bank account is still stuck in the ‘please wait’ phase.

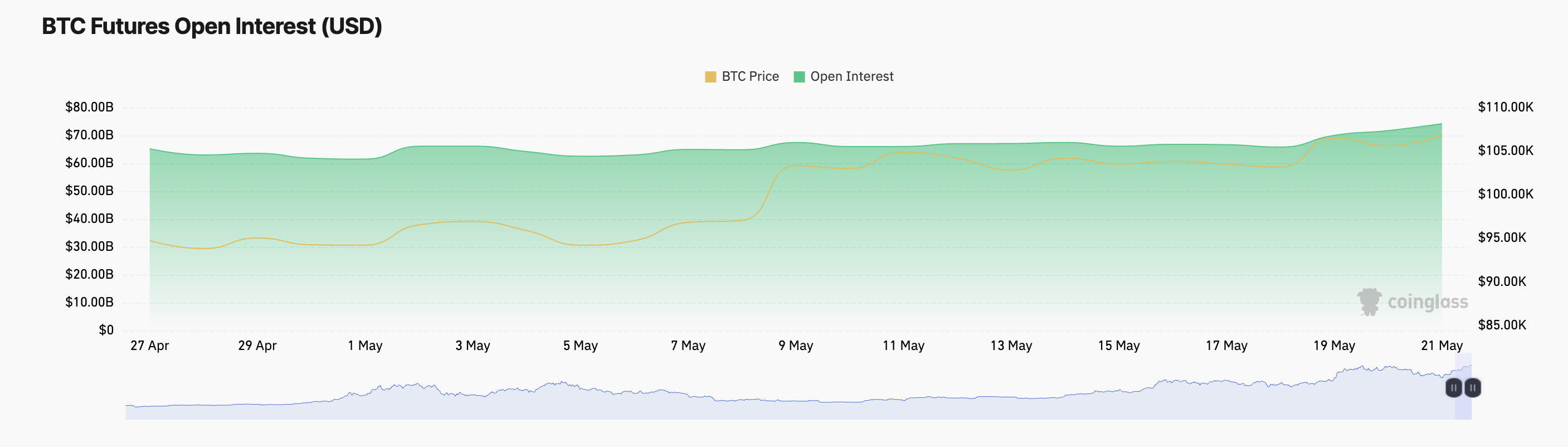

Open interest in BTC futures has also surged as the price climbs, indicating increased capital inflow across its derivatives markets. At press time, this is at $74.24 billion, up 4% during the review period. I can only imagine how many avocado toasts that could buy! 🥑

When an asset’s price and open interest increase, it signals that new money is entering the market and that the current trend, usually bullish, is gaining strength. This trend reflects growing investor confidence behind BTC’s price move. Meanwhile, I’m just trying to gain confidence in my ability to fold a fitted sheet.

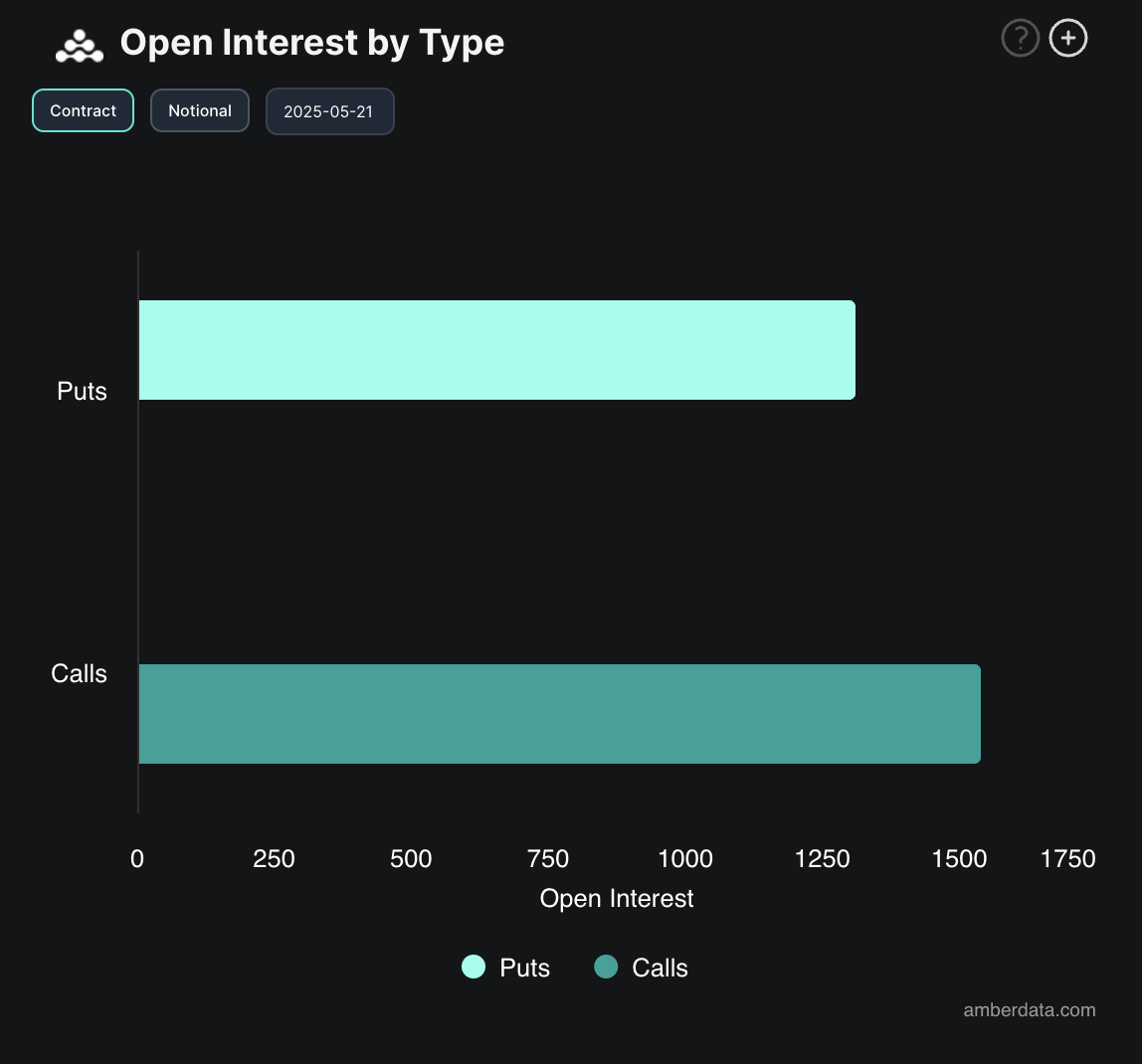

Moreover, options market data shows growing demand for call contracts, supporting the bullish outlook above. This indicates that traders continue to position for further upside in BTC’s price. If only I could position myself for a little upside in my dating life! 😜

If these trends persist, the leading coin may be entering a new phase of accumulation, pushing it to a new all-time high in the near term. And here I am, still accumulating dust bunnies under my couch.

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Slormancer Huntress: God-Tier Builds REVEALED!

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- Invincible’s Strongest Female Characters

- How to Unlock the Mines in Cookie Run: Kingdom

- Nine Sols: 6 Best Jin Farming Methods

- One Piece Episode 1130: The Shocking Truth Behind Kuma’s Past Revealed!

2025-05-21 10:51