One shudders to think, but Bitcoin‘s Open Interest (OI) has executed a rather vulgar leap of 15.8%, like a nouveau riche attempting to gatecrash a decent party. The weekly CME futures, those dens of iniquity, closed at a preposterous $84,000. One almost expects champagne socialists to start taking notice. 🥂

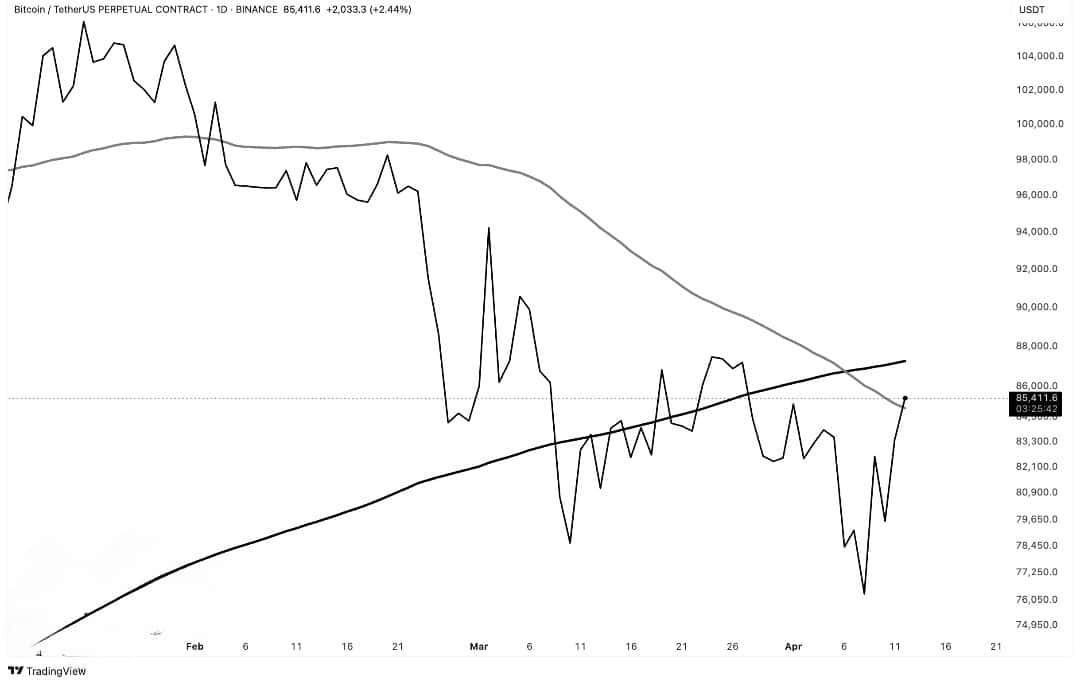

BTC, in its relentless, if somewhat uncouth, ascent, has sliced through the 50-day SMA with the grace of a butcher through a Christmas goose. The next hurdle, the 200-day SMA at $87,000, looms with the threat of a particularly nasty hangover. 🤢

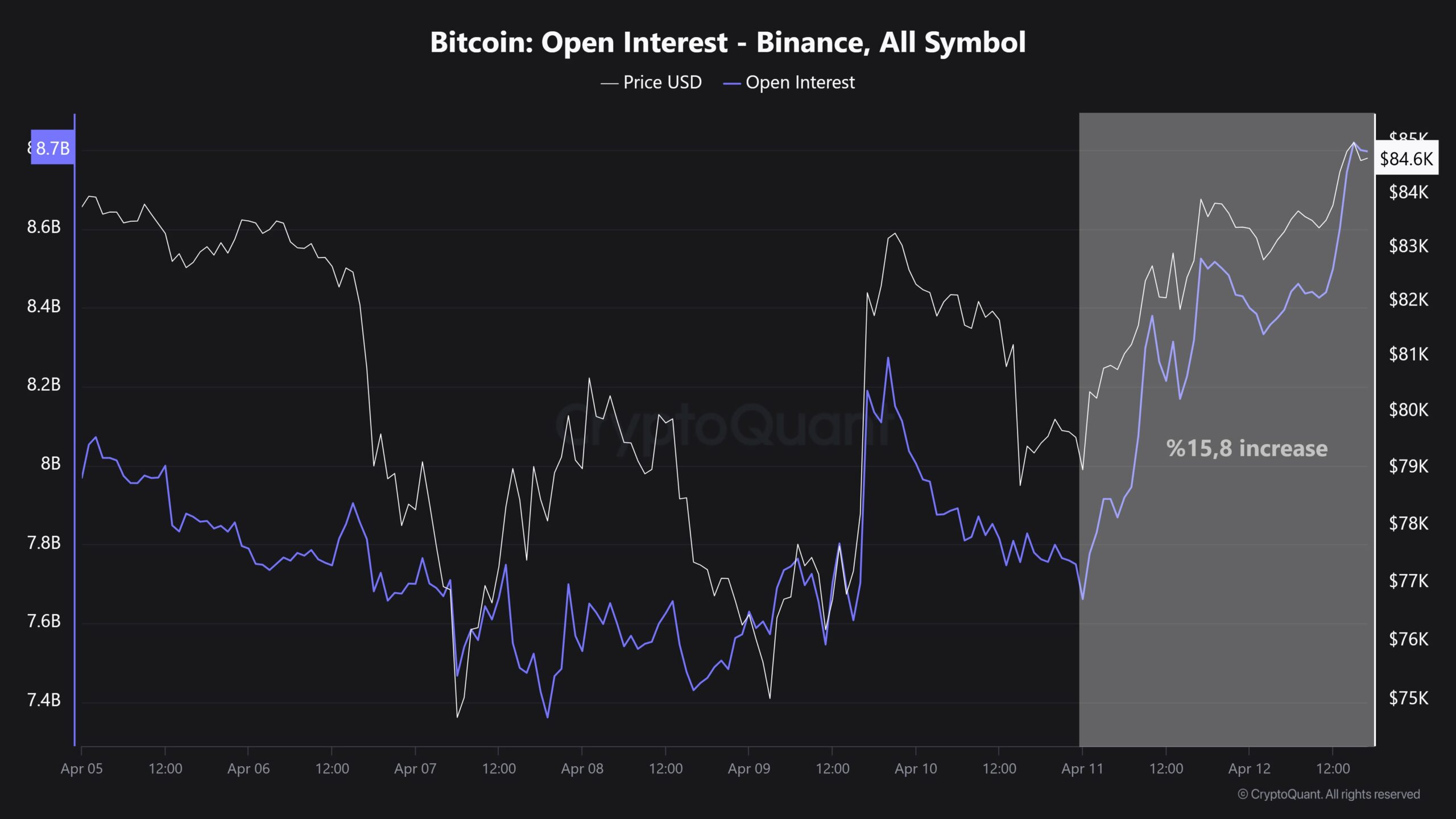

Binance, that sprawling emporium of digital whatsits, saw its Bitcoin [BTC] Open Interest (OI) swell by 15.8% in a single day, transforming it from a mere $7.6 billion to a positively vulgar $8.8 billion. The market, much like a dowager faced with a particularly scandalous rumour, is all aflutter. 👀 This rapid $1.2 billion increase suggests that even the most discerning are now dabbling in this digital madness.

Binance remains, alas, dominant in crypto derivatives trading, its OI position occupying a staggering 31.4% of the $28 billion total. One can only imagine the scenes of frantic trading and ill-advised wagers. 💸

This fast-rising OI, like a social climber at a debutante ball, signals the risk of market volatility. These wide-ranging liquidations could impact both extended long and short positions with the force of a scorned mistress. 🔥

An increase in OI often indicates a growing bullish sentiment, a sort of collective delusion that everything will continue to rise indefinitely. However, it can also trigger opposing market movements or prompt aggressive position unwinding, like a card house collapsing in a gale. 💨

A sharp rise in OI may result in brief price fluctuations, primarily driven by shifts in market sentiment or failed attempts to maintain critical resistance levels. Such is the fickle nature of the beast. 😈

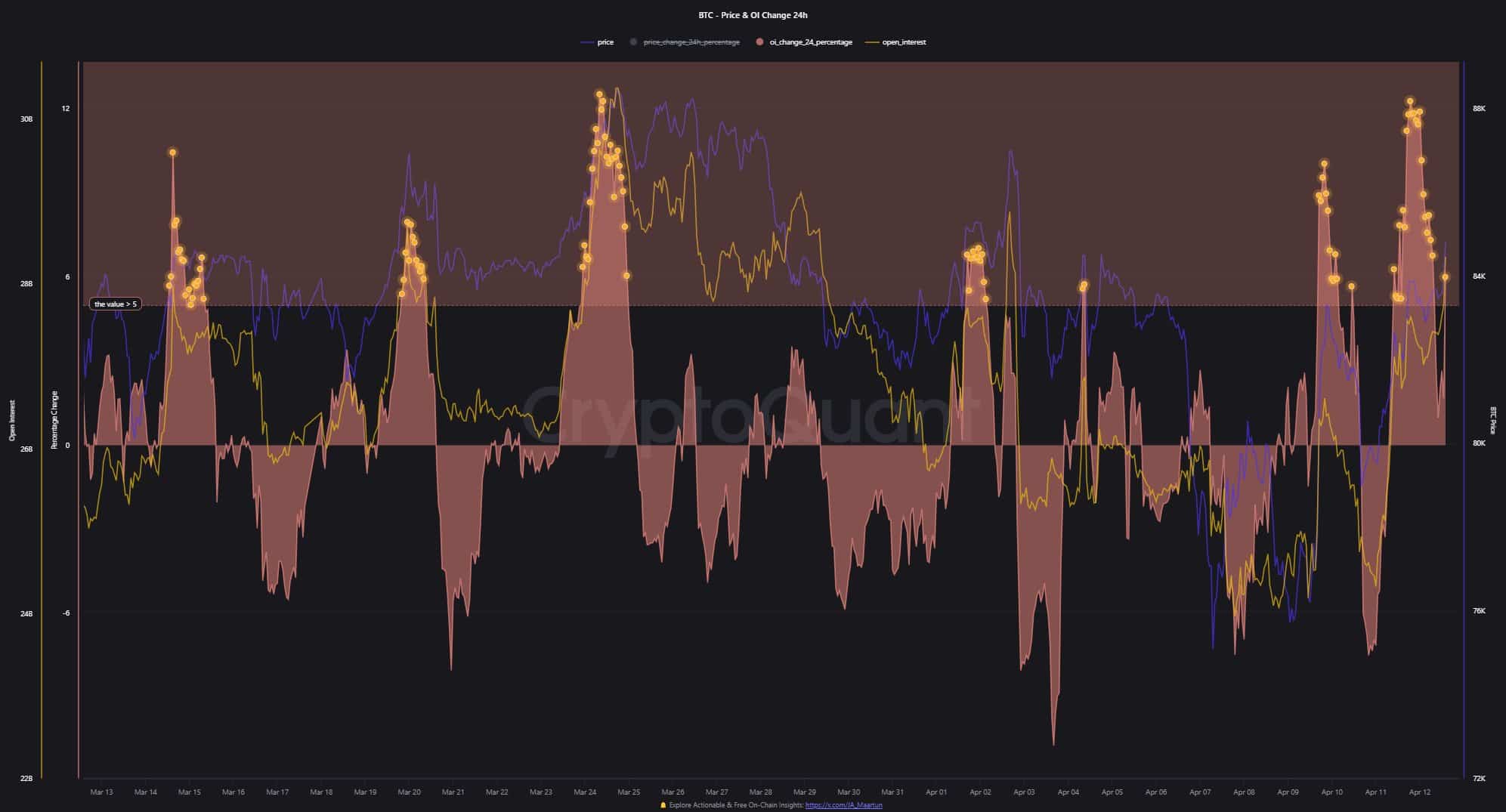

Leverage driven pump and activity

Following this, BTC spot prices closed at the $84,000 level, as recorded in the weekly CME futures. The pump, fuelled by increases in excessive leverage, causes risks for short-term market traders. One might say it’s a game for those with more money than sense. 🤡

This strong uptrend in the 24-hour percentage changes in OI showed multiple points exceeding +5, indicating extreme long sentiment. The air is thick with optimism, or perhaps just the scent of impending doom. 💣

The recent price surge, driven by high-leverage positions, highlighted risks of rapid forced sales, similar to trends observed in the past. This level of market leverage underscores the importance of caution for traders. Caveat emptor, as they say. 💀

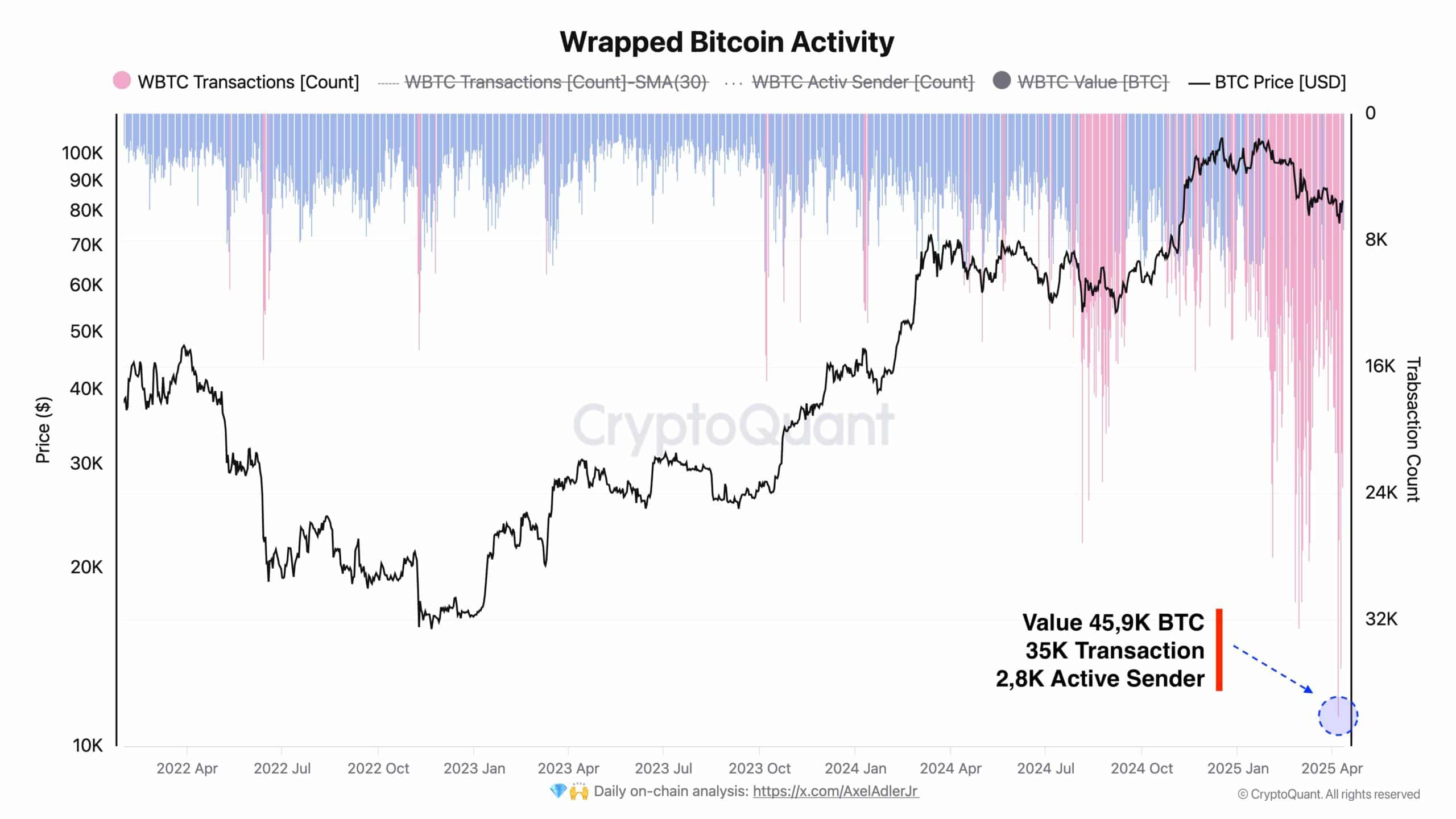

At the same time, Wrapped BTC [WBTC] activity reached an all-time high, with 35,000 transactions executed across 2,800 active wallets, and a total movement of 45.9K BTC. One can only marvel at the sheer volume of transactions taking place in this digital bazaar. 💰

These developments occurred amidst heightened market volatility caused by geopolitical crises and trade conflicts between nations. Despite these macroeconomic pressures, WBTC users showed resilience, continuing to drive a notable increase in transactions. The spirit of speculation, it seems, knows no bounds. 🕊️

Despite the two oppositional evaluations where leveraged positions seemed to cause short-term price fluctuations, WBTC activity signaled enduring functionality in the BTC space. A glimmer of hope amidst the chaos, perhaps? 🙏

BTC potential price moves

BTC also sliced the 50-day Simple Moving Average (SMA) as it approached the resistance at the 200-day SMA, like a hot knife through butter, albeit digital butter. 🧈

This breakout showed an increasing bullish trend, and a move above $87,000 could likely validate ongoing growth toward $94,000, while seller intervention is possible near that level. The bulls are charging, but the bears are lurking in the shadows. 🐻

If the price stays below $87,000, it could confirm the warnings connected to recent leverage-based pump actions. A sobering thought, indeed. 😟

This could mean reaching as low as $79,000 or $76,000 if prices drop below $84,000, which would suggest further bearish momentum. A veritable bloodbath, if one is to be dramatic. 🩸

The market’s indecision was confirmed by its stationary movement, which stayed between two fundamental moving averages. A state of ennui, if you will. 😴

Investors needed to observe strong price movements on either side to get BTC’s future direction. A waiting game for the patient, or a torment for the impatient. ⏳

Market sentiment may flip bullish if prices exceed $87,000, but continuous bearish performance below that level will probably sustain a consolidation phase or extend the existing correction period. The only certainty, it seems, is uncertainty. 🤔

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Top 8 UFC 5 Perks Every Fighter Should Use

- Game of Thrones Writer George R. R. Martin Weighs in on ‘Kickass’ Elden Ring Movie Plans

- Hollow Knight: Silksong is Cutting It Close on a 2025 Release Window

- Don’t Expect Day One Switch 2 Reviews And Here’s Why

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

2025-04-13 17:18