Picture this: U.S. Bitcoin spot ETFs have just sauntered in with a jaw-dropping $3.06 billion net inflow for the week ending April 25, 2025. Why, this is their sprightliest jaunt since the halcyon days of November 2024—one might almost suspect the markets are throwing a party and forgot to invite Bitcoin itself.

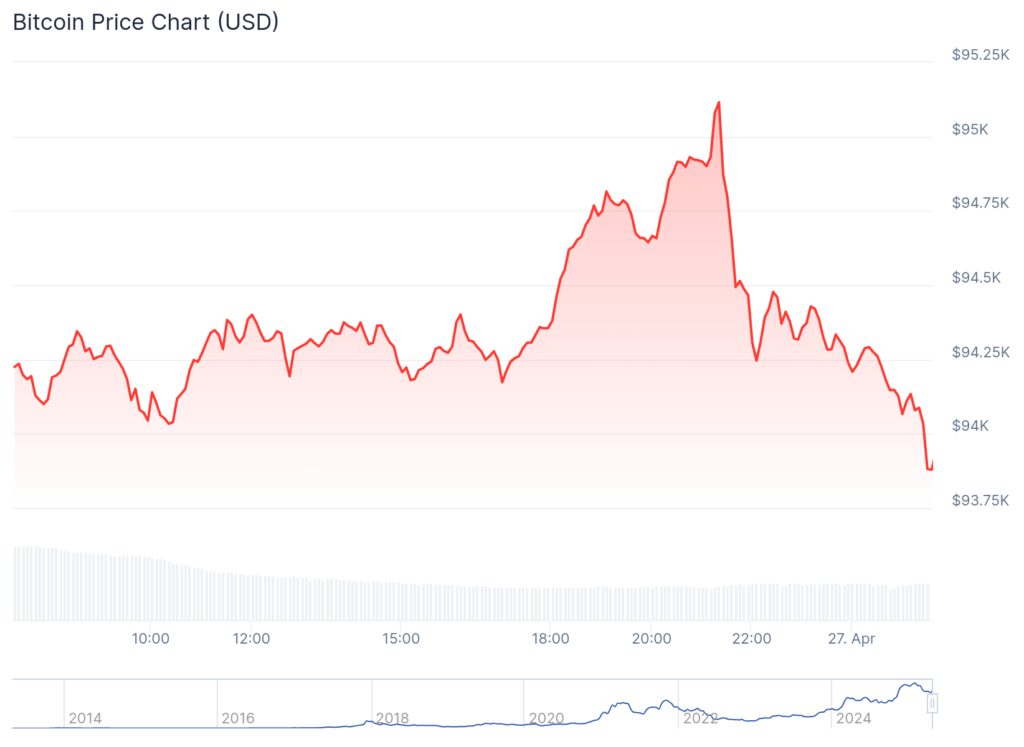

Speaking of which, Bitcoin, that capricious scamp, decided to dip below $94,000 on Sunday and is currently wearing its most charming shade of red. One might say it’s sulking—see the evidence below.

Now, the merry band of ETF products hold a grand total of $109.27 billion in net assets—enough to make even the stoniest-faced banker blush—and represent a neat 5.8% slice of Bitcoin’s entire market cap pie, according to our trusty informants at SoSoValue.

BlackRock: The Big Cheese of Bitcoin ETF Inflows

Latest intel reveals a surging Tsunami of investor ardor, following a few weeks where enthusiasm was about as consistent as a cat’s affection. On April 25 alone, a staggering $379.99 million strolled into the coffers, amassing to that smashing $3.06 billion weekly total.

By way of comparison, the week ending April 11 was more of a ghost town, with $713.30 million slipping out the back door, followed by a modest and polite $15.85 million tip-toeing in during the week ending April 17.

At the helm, BlackRock’s IBIT charms its way to the lead with a daily inflow of $240.15 million and holds the crown as the largest Bitcoin ETF, guarding $56.03 billion in assets like a dragon hoarding gold. Since launch, it’s raked in a cool $41.20 billion in cumulative net inflows—goodness, that’s more than my Aunt Agatha’s biscuit tins.

Trailing behind with a polite nod is Fidelity’s FBTC, boasting $108.04 million in daily inflows and a respectable $19.12 billion in total net assets. Others trying to elbow in on the party include ARKB (ARK 21Shares) at $11.39 million and Grayscale’s BTC with $19.87 million. Alas, Grayscale’s converted GBTC flagship has been caught talking with the exit door, shedding $7.53 million on April 25 alone.

The trading floor has been bustling too, with $18.76 billion exchanging hands this week compared to a mere $7.15 billion in the previous, as if Wall Street suddenly fancied a spree at the crypto carnival.

Altogether, since these Bitcoin spot ETFs made their debut, they’ve amassed a staggering $38.43 billion in net inflows—quibble all you like, but that’s not chump change.

Even Grayscale’s GBTC is somewhat the party pooper, having seen $22.69 billion slip through its fingers since its trust-to-ETF metamorphosis. But fear not! The ETF ecosystem as a whole continues to gulp down fresh capital like a thirsty camel at an oasis.

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- How to Unlock the Mines in Cookie Run: Kingdom

- Nine Sols: 6 Best Jin Farming Methods

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- USD ILS PREDICTION

- REPO’s Cart Cannon: Prepare for Mayhem!

- Invincible’s Strongest Female Characters

- AI16Z PREDICTION. AI16Z cryptocurrency

2025-04-27 14:57