So, Bitcoin just hit the high note of nearly $112,000, and now it’s doing the cha-cha down to below $104,000. 🎉 Why? Well, it seems like everyone decided to cash in their chips, geopolitical drama is heating up, and the Federal Reserve is giving us all the “let’s wait and see” vibes. A 7% dip? Pfft, just a blip in the grand scheme of things, right? It’s like a rollercoaster that’s still climbing, but someone just screamed “profit-taking!”

And speaking of climbing, Bitcoin (BTC) is getting more popular than avocado toast! Companies like GameStop and Trump Media are adding it to their treasure chests like it’s the latest must-have accessory. But hold your horses! With only 450 coins mined daily, this dip might just be a dramatic pause before the next big leap. Think of it as a Netflix cliffhanger—what’s going to happen next? 🎬

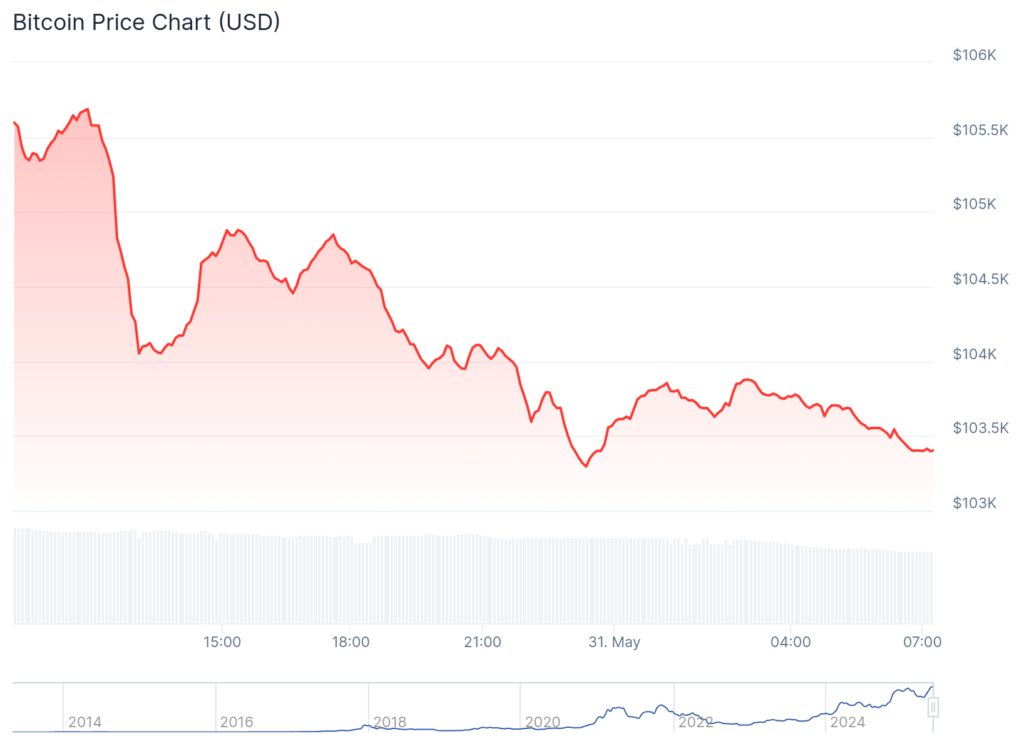

Let’s break it down: Bitcoin took a little tumble, dropping 7% from its all-time high of $111,900. But hey, it’s not like it’s the end of the world. Just a Saturday stroll in the crypto park!

This little dip is happening while investors are cashing in after a whopping 50% jump from its April lows. It’s like a party where everyone leaves right after the cake is served—totally normal! 🎂

But wait, there’s more! Bitcoin’s price drop is also linked to trade tensions. Scott Bessent, the Treasury Secretary, is saying U.S.-China talks are about as productive as a cat at a dog show. Meanwhile, Trump is throwing around accusations like confetti and hinting at a 50% tariff on steel and aluminum. 🎊

Meanwhile, the Federal Reserve is playing it cool, not rushing to cut interest rates. They’re just sitting back, popcorn in hand, watching how tariffs affect the economy. 🍿

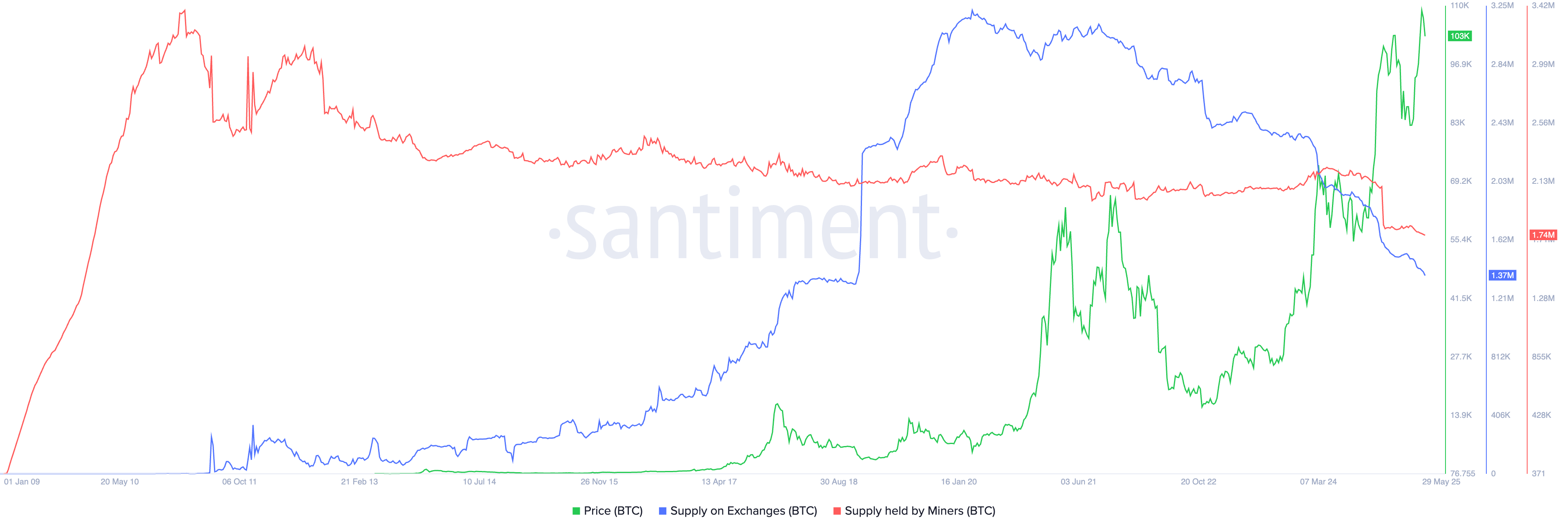

On the bright side, Bitcoin’s supply and demand dynamics are looking pretty solid. Demand for spot Bitcoin ETFs is skyrocketing, with inflows hitting over $44 billion. Companies like Trump Media and GameStop are buying Bitcoin like it’s going out of style!

But here’s the kicker: the supply of Bitcoin on exchanges has plummeted by 57% since March 2020. It’s like a magic trick—now you see it, now you don’t! 🪄 Bitcoin’s supply has dropped from 3.22 million to 1.37 million. And with only 450 coins mined daily, this supply crunch is real. Miners are holding onto just 1.74 million coins, the lowest since 2010. So, buckle up, because the supply and demand dynamics suggest this coin is on the rise again!

Bitcoin Price Technical Analysis

Check out the daily chart below! It shows that BTC has fallen from its all-time high of $111,900 to $104,170. It’s like watching your favorite show go through a rough season—still worth it!

This chart is holding strong above the 50-day and 100-day Exponential Moving Averages. Plus, it’s formed a bullish flag pattern—basically the “keep calm and carry on” sign of technical analysis. 📈

And guess what? Bitcoin has formed a cup-and-handle pattern and is currently in the handle phase. The cup’s depth is about 32%, which means we could be looking at a target price of $144,650. That’s calculated by measuring the depth of the cup from its upper edge. So, grab your popcorn, folks, because this show is just getting started!

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-05-31 20:10