So, the crypto market lately has been like watching a soap opera – full of dramatic exits and plot twists. Over the past three months, we’ve had a “liquidity sweep” worthy of a Hollywood blockbuster, where long and short positions-using enough leverage to make a gym buff jealous-got wiped out faster than your dad’s dance moves at a wedding. 💥

Turns out, the market’s as clear as mud. No one’s really in charge; it’s more like a chaotic game of liquidity hide-and-seek. The game? Bidirectional liquidity hunts-fancy talk for “who can scare the other side more?”

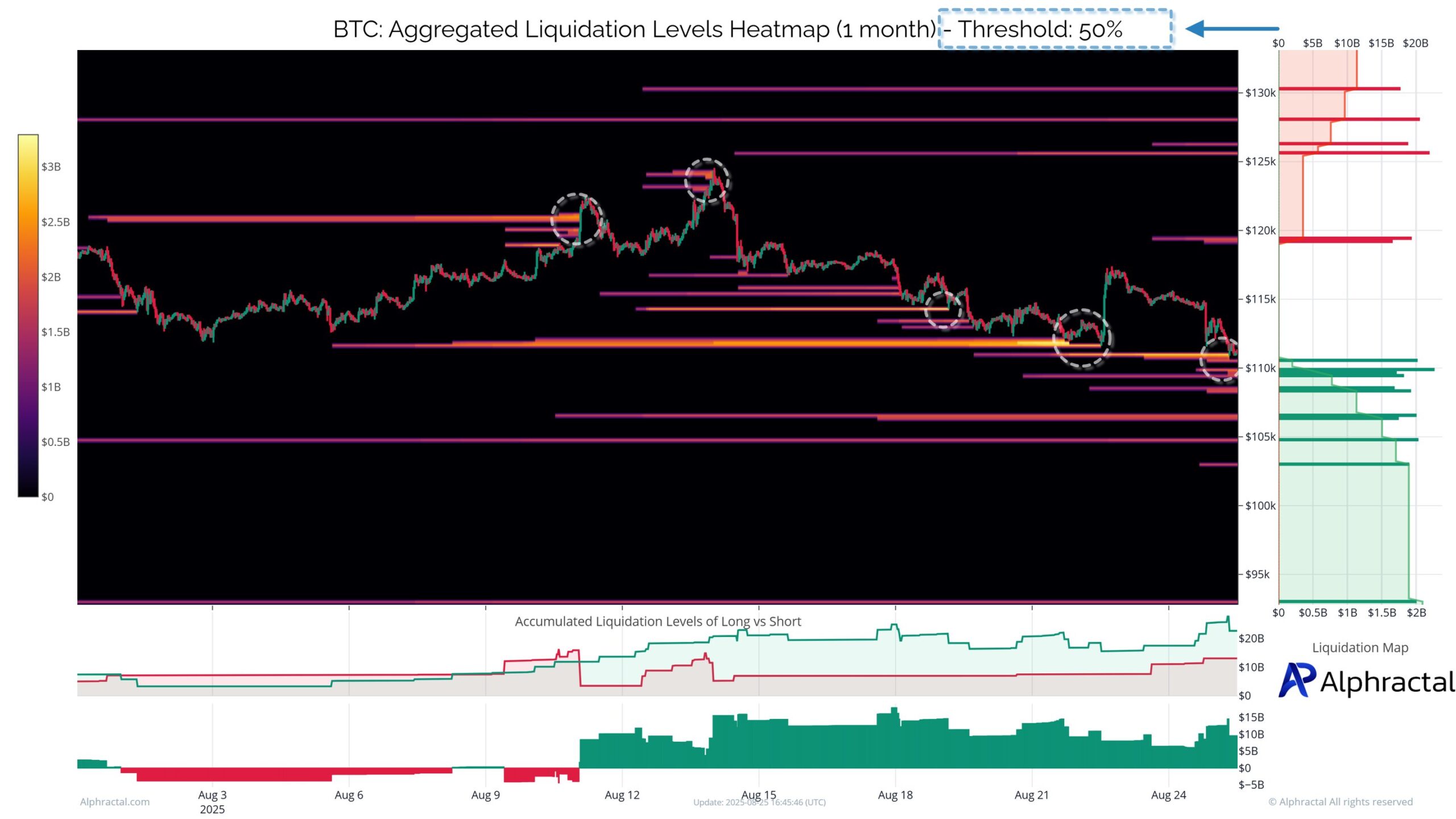

Mass Liquidations for Bitcoin

Data from Alphractal reveals a staggering 94% of traders were dashed to bits during this chaos. With a 50% Liquidity Threshold filter, only the big, fat order zones remain-like the remnants of a wreckage. The price is actively hunting down giant clusters of orders, clearing anyone who didn’t bring their A-game.

Ethereum isn’t much better, suffering long and short position casualties as if it were a demolition derby.

Most notably for Bitcoin, there’s a massive long cluster hanging out around $104,000-$107,000. This area acts like an accidental magnet, drawing the price to the support zone from $100,000-$107,000, which some genius analysts, like Axel Adler Jr., have pinned down using on-chain data. Fancy, huh?

This level isn’t just a happy coincidence – it’s where the Short-Term Holder Realized Price (basically, what short-term folk paid for their coins) bumps into the 200-day SMA. It’s like the market’s version of a high school dance-everyone’s watching, and it’s kinda serious. If this support crumbles, get ready for a quick trip down to $92K-$93K, because the market’s got a backup plan of sorts.

“The nearest strong support zone is the 100K-107K range, where the STH Realized Price and SMA 200D intersect. Below that is support around 92-93K, a deeper level that reflects what short-term investors paid. This will be the market’s backup dance if the first one fails,” Axel Adler Jr. explained.

As BeInCrypto pointed out, Bitcoin’s activity has shifted toward the sell side, with buyers fading faster than your New Year’s resolutions. A drop toward $107,557 support looms if buyer interest doesn’t pick up.

Meanwhile, the $108,800 mark is the “dividing line”-the line in the sand-between a bullish romp and a bearish crash. Murphy Chen notes that if Bitcoin stays above this, it’s a sign of fewer tears; below, it’s more like a scene from The Walking Dead.

This $108,800 zone is basically Bitcoin’s version of a gateway-do we go up for a victory lap or slide into a bear market? Stay tuned.

“At $108,000, we’re a 13% dip from the high. Breach that, and there’s possibly another 10-15% downside, unless something disastrous happens-which, let’s be honest, would make good TV,” Murphy Chen quipped.

All in all, the past three months have been a masterclass in liquidations-94% of accounts, poof, gone. High-leverage trading during this liquidity hunt? More dangerous than trying to walk a pet crocodile. So, if you’re trading, remember: slow and steady wins the race-and maybe keep a spare liver somewhere.

As the 50% filter suggests, trading near big liquidity zones is basically playing with fire. Defensive tactics, stop-loss orders, and careful positioning? Your new best friends.

Read More

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

- EUR USD PREDICTION

- Best Finishers In WWE 2K25

- Top 8 UFC 5 Perks Every Fighter Should Use

- Uncover Every Pokemon GO Stunning Styles Task and Reward Before Time Runs Out!

- All Shrine Climb Locations in Ghost of Yotei

- How to Unlock & Upgrade Hobbies in Heartopia

- Sony Shuts Down PlayStation Stars Loyalty Program

- How to Increase Corrosion Resistance in StarRupture

2025-08-26 17:35