Oh, Bitcoin. The cryptocurrency that makes your heart race faster than a triple espresso shot ☕️. This month, it’s been doing what it does best-acting like a hormonal teenager on a sugar high. VanEck, the cool kids in the investment world, are still waving their pom-poms for an $180,000 year-end target, even after Bitcoin took a little tumble from its recent peak. Institutional buyers aren’t running away screaming; instead, they’re doubling down like they just found out avocado toast is back in style 🥑.

Institutional Buyers Are Hoarding Like Squirrels Before Winter 🐿️

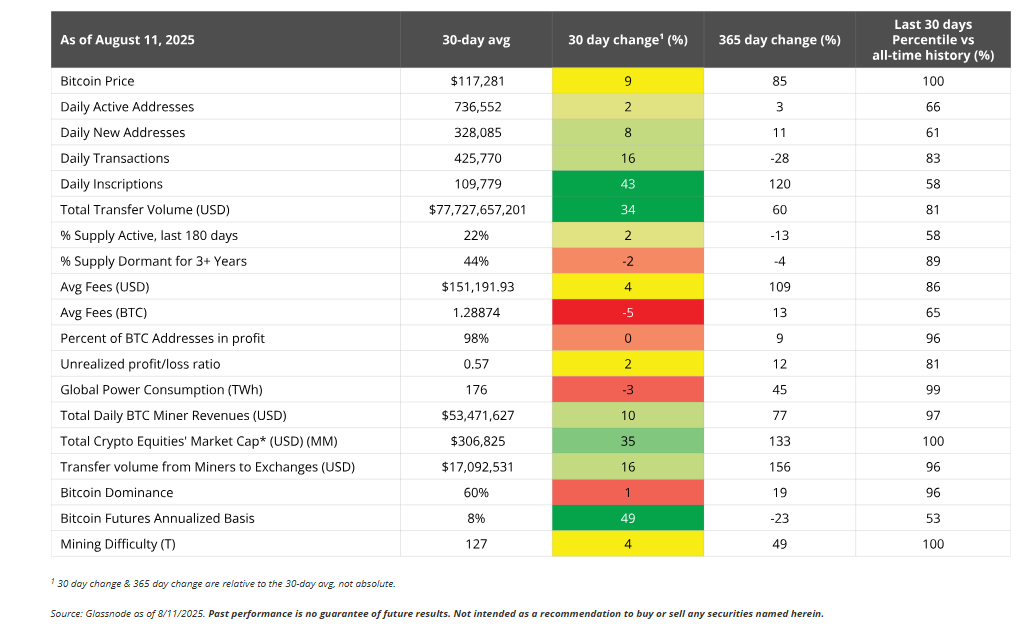

Turns out, big players have been stockpiling Bitcoin like it’s canned soup before a snowstorm. In July alone, exchange-traded products gobbled up 54,000 BTC, while Digital Asset Treasuries added another 72,000 BTC to their stash. That’s not pocket change-it’s more like pocket treasure chests 💰. VanEck first started hyping Bitcoin back in November 2024 when it was trading at $88,000. Fast forward, and US-listed miners now control 31% of the global Bitcoin hashrate (up from 30%, because apparently fractions matter here). Meanwhile, equity indexes dropped 4%, unless you count Applied Digital’s 50% surge, which we probably shouldn’t because life isn’t fair.

Volatility So High You Might Need Motion Sickness Pills 🌀

Bitcoin slid to $112,000 earlier this month but bounced back quicker than your ex apologizing via text message. On August 13, it hit a new all-time high above July’s $123,838. As I type these words, it’s hovering near $115K, about 8% below its recent peak. Traders are calling this dip “repositioning” rather than “doom.” Sure, Jan, let’s go with that 🙄.

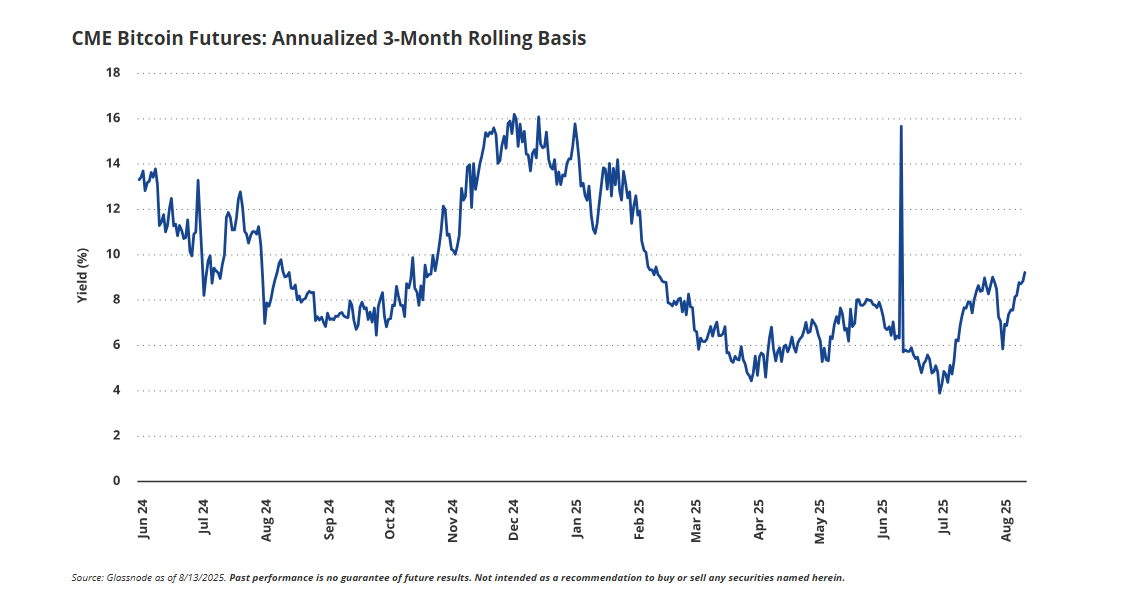

Derivatives metrics show speculative interest is hotter than a summer romance. CME basis funding rates soared to 10%, the highest since February 2025. Options markets reveal call/put ratios climbing to 3.21x-the strongest since June 2024-with investors dropping $792 million on call premiums. But wait, there’s more! Implied volatility has dipped to 32%, making options cheaper than a knockoff designer bag 👜. Futures open interest sits above $6 billion, though a $2.3 billion unwind during corrections proves no one panic-sold… oh wait, yes they did.

Opinions on where Bitcoin is headed next are as divided as pineapple on pizza lovers versus haters 🍍. Coinbase CEO Brian Armstrong joined the hype train, predicting $1 million by 2030 thanks to clearer regulations and institutional adoption. Meanwhile, Galaxy Digital’s Mike Novogratz warned that hitting seven figures might mean the US economy is circling the drain-not exactly the happy ending we were hoping for. And Preston Pysh chimed in with concerns about Wall Street turning Bitcoin into something unrecognizable, like turning a scrappy indie band into a boy band 🎤.

If you’re into charts and numbers, listen up: Many experts see the $100,000-$110,000 range as key support. A break below $112,000 could send prices tumbling toward $110,000-or worse, $105,000 if things get really ugly. For now, the story is as mixed as a bowl of Lucky Charms cereal 🍀. Institutional demand and speculative flows are pushing prices higher, while cheap options make bullish bets easier to swallow. Whether Bitcoin reaches VanEck’s $180,000 dream depends on whether those inflows keep coming and if key support holds steady. Spoiler alert: Nobody knows 😅.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Who Is the Information Broker in The Sims 4?

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-08-26 00:07