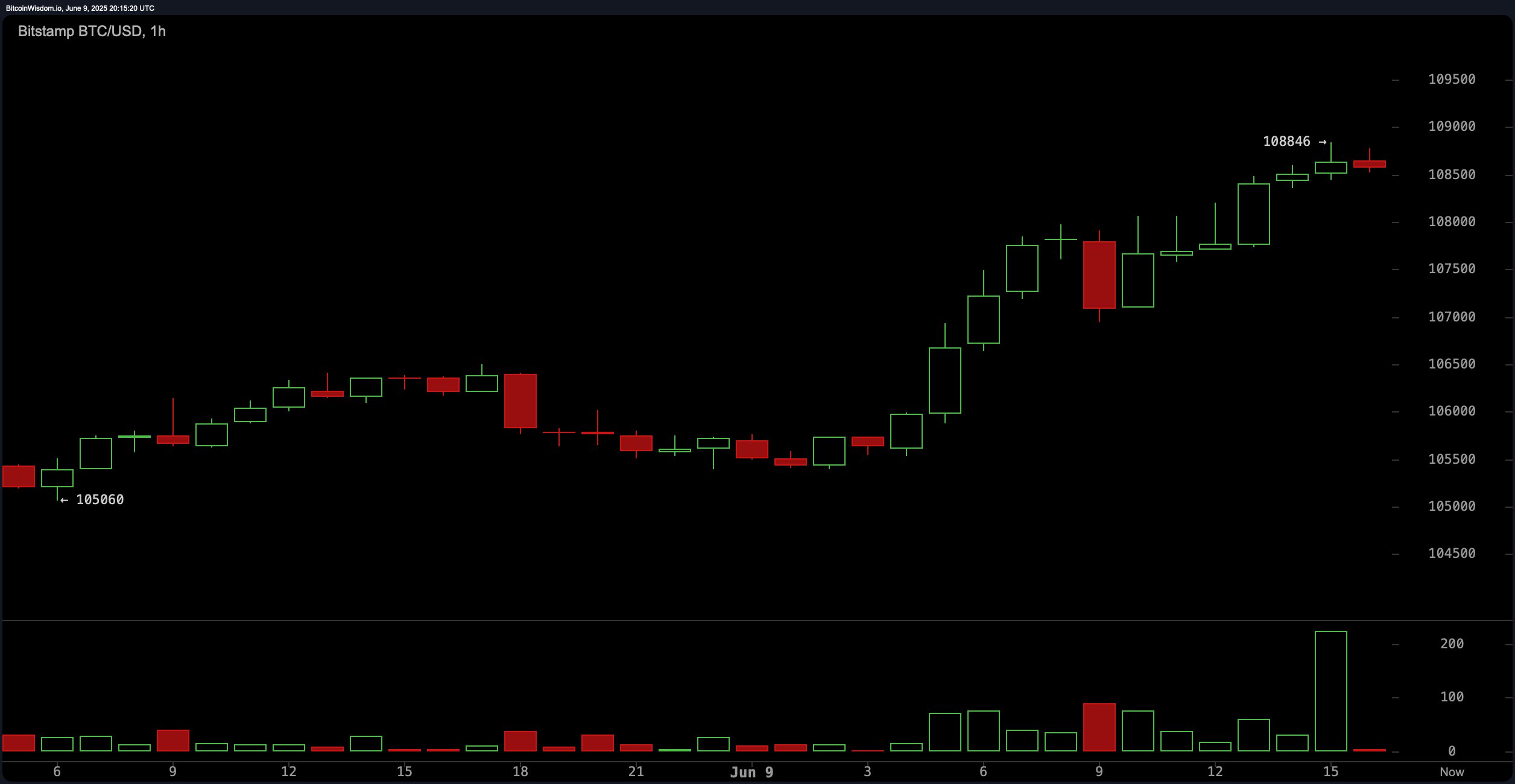

Ah, Bitcoin! The digital gold that dances like a drunken cowboy at a barn dance, now strutting its stuff at a staggering $108,610. A rise of over 2% in just 24 hours! Meanwhile, the entire digital currency market is puffing up its chest, boasting a hefty $3.38 trillion. This price surge comes just a week before the Federal Open Market Committee (FOMC) meeting, scheduled for June 18. Talk about timing! 🎉

Bitcoin Shrugs Off Credit Downgrade—Experts Say Confidence Is Growing

On this fine Monday, June 9, 2025, bitcoin (BTC) is floating above the $108,000 mark like a balloon at a child’s birthday party, leading to a staggering $155.57 million in short liquidations over the past day. Out of that, a cool $81 million was from those who thought they could outsmart the crypto beast. James Toledano, the chief operating officer at Unity Wallet, told our news desk that “Bitcoin’s rebound from $100K on June 5 speaks to its resilience. This robustness is being powered by sustained institutional inflows into spot ETFs and easing concerns around U.S. regulations.”

“The markets didn’t flinch at the news of the U.S. losing its AAA credit rating, which shows that investors are either brave or just plain crazy,” Toledano explained. He continued:

Additionally, the expectations of a Federal Reserve rate cut — possibly as early as July — have reignited bullish positioning. Together, these elements have restored momentum after Friday’s dip, suggesting continued institutional appetite and improved investor confidence are the primary forces driving today’s recovery.

Bitcoin’s cheerful ascent comes just before the FOMC meeting, and while July is still on the table, it’s certainly a thought. Data from the CME Fedwatch Tool and forecasts from Polymarket and Kalshi suggest that any rate change in June is about as likely as finding a needle in a haystack. The CME Fedwatch tool indicates a 99.9% chance the Fed will keep rates the same this month. But for July, there’s a 14.9% chance of a quarter-point reduction, according to CME’s futures. Who knew math could be so thrilling? 📈

“Looking ahead, a dovish shift by the Federal Reserve, particularly a summer rate cut of between 25-50 basis points, would likely accelerate bitcoin’s climb by making risk assets more attractive,” Toledano concluded. “Persistent ETF inflows and continuing regulatory progress would also bolster upward momentum. However, BTC must also overcome strong resistance around $112K–$125K, where profit-taking could trigger temporary pullbacks before any new highs are tested.”

Could a Pullback to $92K Happen? 🤔

Sergei Gorev, the risk head at Youhodler, pointed out that both bitcoin and gold have been responding to the whims of the U.S. monetary markets. “[Bitcoin] quotes are currently in a state of uncertainty,” Gorev said in a note shared with our newsdesk. “On one hand, many global traders are gradually withdrawing from the U.S. currency and shifting to more risky assets, including cryptocurrencies.”

Gorev added:

This has a positive effect on the BTC exchange rate. On the other hand, the price on the BTC chart is behaving like a cat on a hot tin roof, and there’s a possibility of a local price hike. There’s a ‘Head and Shoulders’ pattern, which, if it plays out, could lead to a correction in the price of BTC to the level of $92,000 per 1 BTC.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Game of Thrones Writer George R. R. Martin Weighs in on ‘Kickass’ Elden Ring Movie Plans

- Don’t Expect Day One Switch 2 Reviews And Here’s Why

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Hollow Knight: Silksong is Cutting It Close on a 2025 Release Window

- Silent Hill f 2025 Release Date Confirmed, And Pre-Orders Are Already Open

2025-06-09 23:58