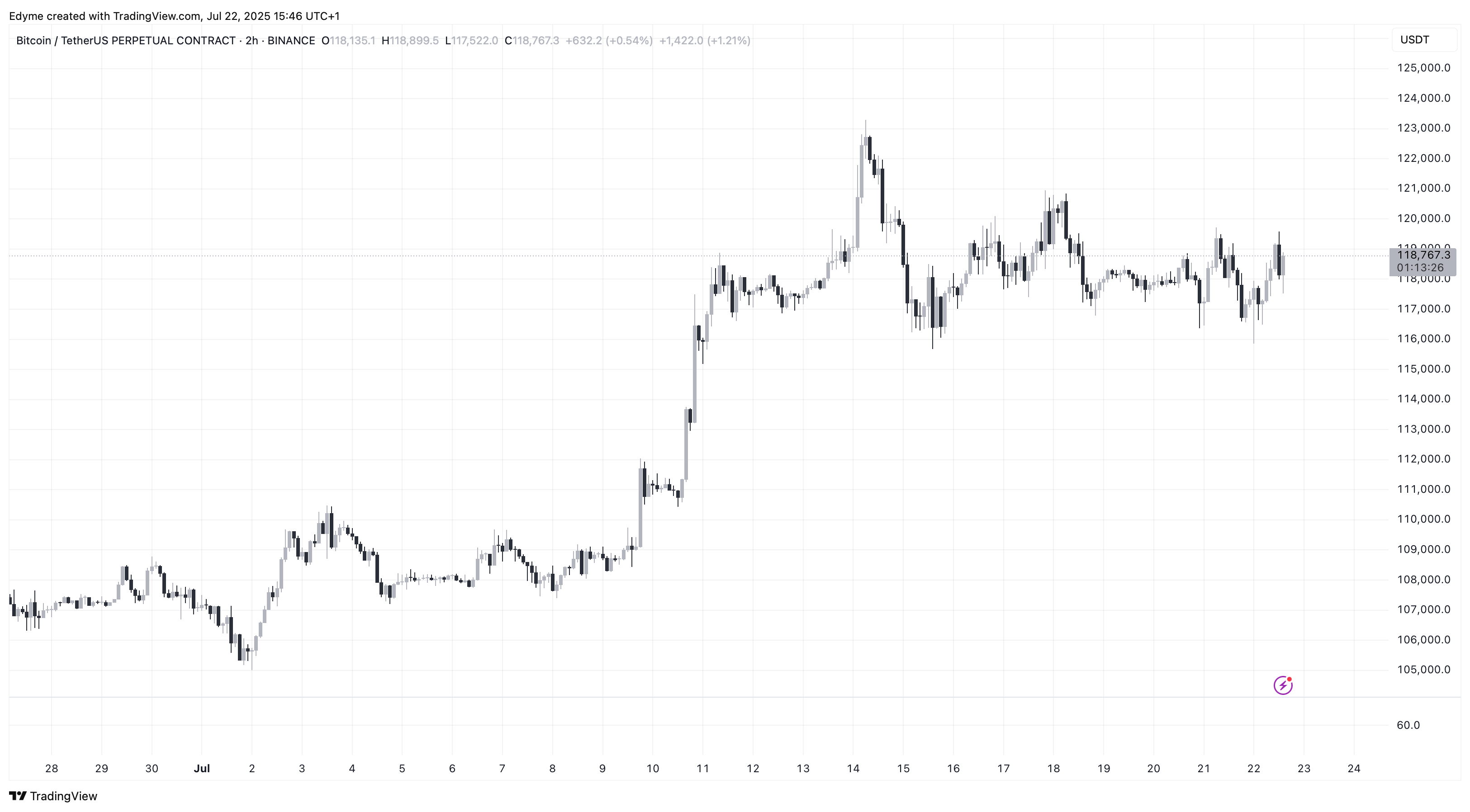

Pray, allow me to impart the latest tidings from the realm of Bitcoin, that most fickle of financial fancies. The dear creature, having once ascended to the giddy heights of $123,000, now finds itself in a most precarious position, lingering below $120,000 with all the grace of a wallflower at a ball. At the time of this missive, it rests at $119,343, a figure that scarcely warrants a second glance from the more discerning investor. 🧐

A 2% gain over the past week, you say? Fie! Such trifling progress is but a mere whisper in the tempest of the market. Yet, it leaves our dear BTC some 3% shy of its recent pinnacle, a gap that speaks volumes of its current languor. The market, it seems, is in a state of consolidation, caught between the conflicting whispers of on-chain indicators and the capricious demands of regional traders. 🌀

The sages at CryptoQuant, ever vigilant, have observed a waning appetite for Bitcoin in the lands of the US and South Korea, two realms once famed for their voracious trading appetites. Alas, the Coinbase Premium Index, that barometer of American enthusiasm, has scarcely budged, despite Bitcoin’s July escapades. Could it be that our Yankee friends are content to sit on their hands, or might they be quietly pocketing their profits? Arab Chain, that astute analyst, suggests the latter, hinting at a wave of profit-taking that leaves one wondering if a correction looms on the horizon. 🤑

And what of South Korea, that bustling hub of crypto fervor? The Korea Premium Index, once a beacon of retail zeal, now points southward, suggesting that Korean traders are selling with a caution that borders on the comical. Are they, too, awaiting a discount, like bargain hunters at a sale? Arab Chain nods sagely, noting that such reticence may well presage a broader market pause. 🛍️

But lo! There is more to this tale of woe. ShayanMarkets, another of CryptoQuant’s luminaries, has spied a most unsettling trend: Bitcoin’s largest net inflow to exchanges since July 2024. Such a movement, dear reader, is akin to a dinner party where all the guests arrive with dishes in hand, only to find the host has forgotten to cook. It suggests that holders are preparing to sell, a prospect that could well weigh upon the price like an uninvited guest. 🍽️

Yet, fear not, for there is a silver lining to this cloud of uncertainty. Should Bitcoin’s allure fade, the broader crypto market may yet flourish, as funds flow into the arms of altcoins. Volatility, that ever-present companion, may well make its presence felt, bringing with it a spectacle of speculative movement that would put a Regency ball to shame. 🎢

In conclusion, dear reader, the fate of Bitcoin hangs in the balance, much like a heroine in one of my novels. Will it rebound with the vigor of a Darcy, or shall it succumb to the whims of the market, like a certain Mr. Collins? Only time will tell. Until then, let us observe this drama with the detached amusement it so richly deserves. 🌟

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- How to Unlock & Upgrade Hobbies in Heartopia

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Borderlands 4 Still Has One Ace Up Its Sleeve Left to Play Before It Launches

2025-07-23 07:38