In a world where the lines between reality and absurdity blur, BitMine Immersion Technologies has decided to add a rather hefty sum to its already substantial pile of Ethereum. Yes, you read that right-$358 million worth of ETH, in a single day. It’s almost as if they’re trying to corner the market, or perhaps they’ve just discovered the secret to alchemy in the digital age. 🧙♂️🔥

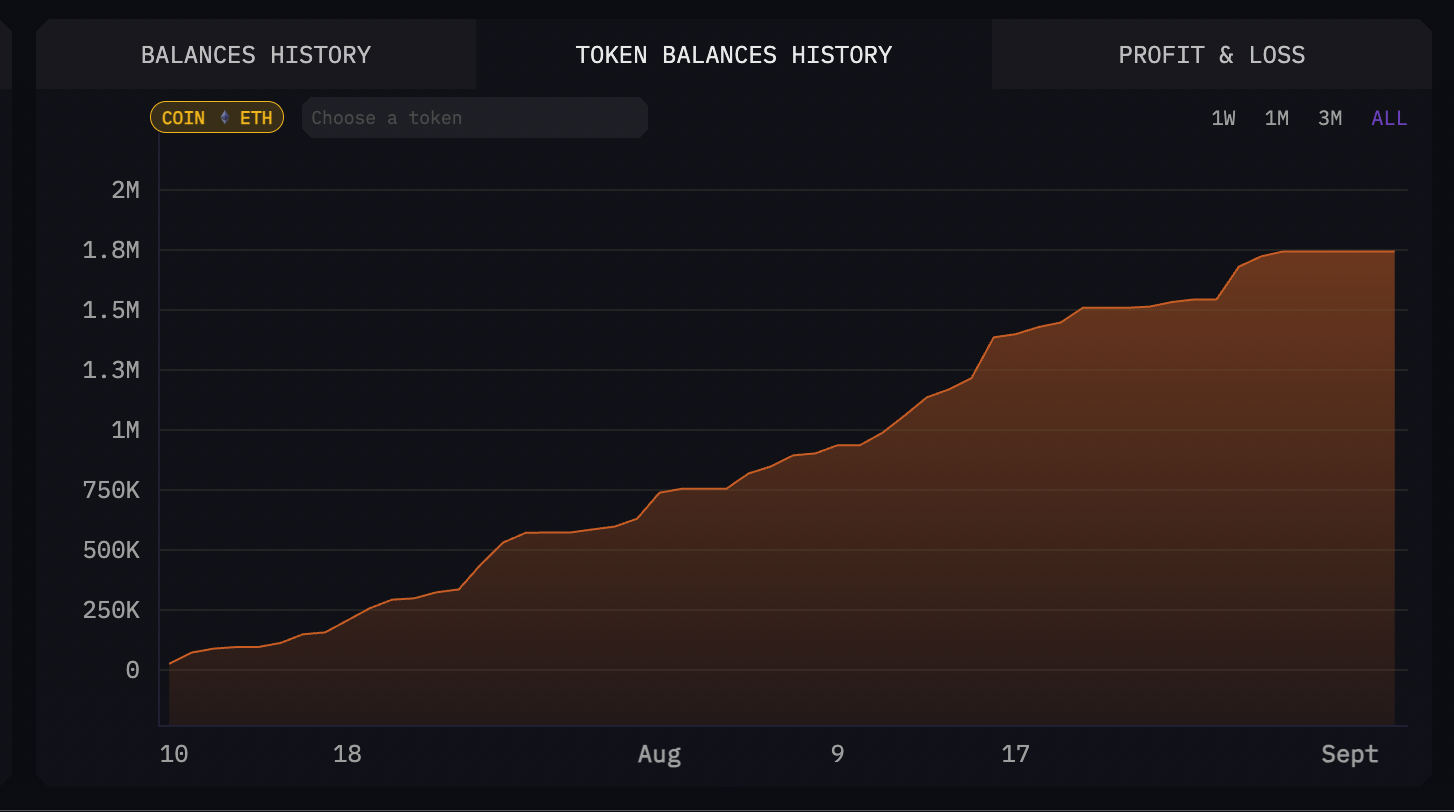

- BitMine, in a stroke of what can only be described as financial wizardry, bought 80,325 ETH worth $358 million, bringing their total stash to 1.87 million ETH, valued at $8.1 billion. 🧾💰

- Corporate treasuries, it seems, have become the new digital gold rush, with over 4.7 million ETH held by various firms. BitMine leads the pack, followed by SharpLink Gaming and The Ether Machine. 🏆🏆

- The company’s “alchemy of 5%” goal, a whimsical yet ambitious target, aims to secure 5% of ETH’s supply, solidifying their role as a cornerstone of Ethereum’s infrastructure. 🔨💎

According to on-chain data from Arkham, BitMine’s latest acquisition involved 80,325 ETH, a purchase worth about $358 million. Of this, 14,665 ETH valued at $64.7 million came through Galaxy Digital’s over-the-counter desk, executed in six separate transactions. The remaining bulk, over 65,000 ETH worth nearly $293 million, was sourced from FalconX. This series of transactions marks one of the largest institutional Ethereum acquisitions of the year, a testament to BitMine’s unwavering commitment to their digital treasure hunt. 🗝️🔍

With this latest haul, the Tom Lee-led company has taken its ETH reserves to new heights, further cementing its position as a dominant force among institutional buyers. The company has been vocal about its long-term ambition of amassing as much as 5% of the total ETH supply, a milestone it describes as the centerpiece of its Ethereum accumulation strategy. It’s almost as if they’re planning to build a digital fortress, one Ether at a time. 🏰🛡️

BitMine now holds approximately 1.87 million ETH valued at around $8.1 billion, making it the largest institutional Ethereum holder in the world. This reserve, which already accounts for more than 1 percent of circulating ETH, underscores the scale of its accumulation drive and sets the stage for its move towards its “alchemy of 5%” goal. It’s like they’re building a digital empire, one block at a time. 🏰📈

Corporate ETH Treasuries and BitMine’s Vision

Corporate ETH treasuries continue to grow, a trend that suggests Ethereum is increasingly being recognized as a durable, yield-generating reserve asset. According to data compiled by crypto.news, public firms collectively hold over 4.7 million ETH worth over $20 billion at current prices. This marks an era where Ethereum is not just a currency but a foundation for the future. 🌐💡

Among these players, BitMine stands tall, followed closely by firms including SharpLink Gaming and The Ether Machine, each contributing significant ETH reserves to the growing corporate treasury ecosystem. It’s almost as if they’re all part of a grand digital symphony, each playing their part in the orchestra of the future. 🎶🎶

BitMine views ETH as more than just a digital asset. As Chairman Tom Lee put it, “ETH Treasuries are providing security services for the ethereum network, by native staking and thus, BitMine is a critical digital infrastructure partner for ethereum.” This mindset positions the company’s holdings as strategic, permanent infrastructure, not speculative bets. It’s like they’re planting trees, knowing full well that the shade will come later. 🌳🌱

BitMine’s long-term ambition is bold and infrastructure-focused. The firm recently appointed David Sharbutt, a former American Tower director known for scaling infrastructure-heavy companies, to its board, underscoring its intention to methodically grow and operationalize its ETH strategy. It’s a move that suggests they’re not just building a castle, but a kingdom. 🏰👑

Meanwhile, ETH has reclaimed the $4,400 mark, likely driven by the latest buying activity. This represents a modest recovery after days of being stuck around $4,300. The asset is up 1.13% on the day, though it remains down roughly 4% for the week. It’s a rollercoaster ride, but then again, isn’t that what makes the journey exciting? 🎢🚀

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- INR RUB PREDICTION

2025-09-04 15:57