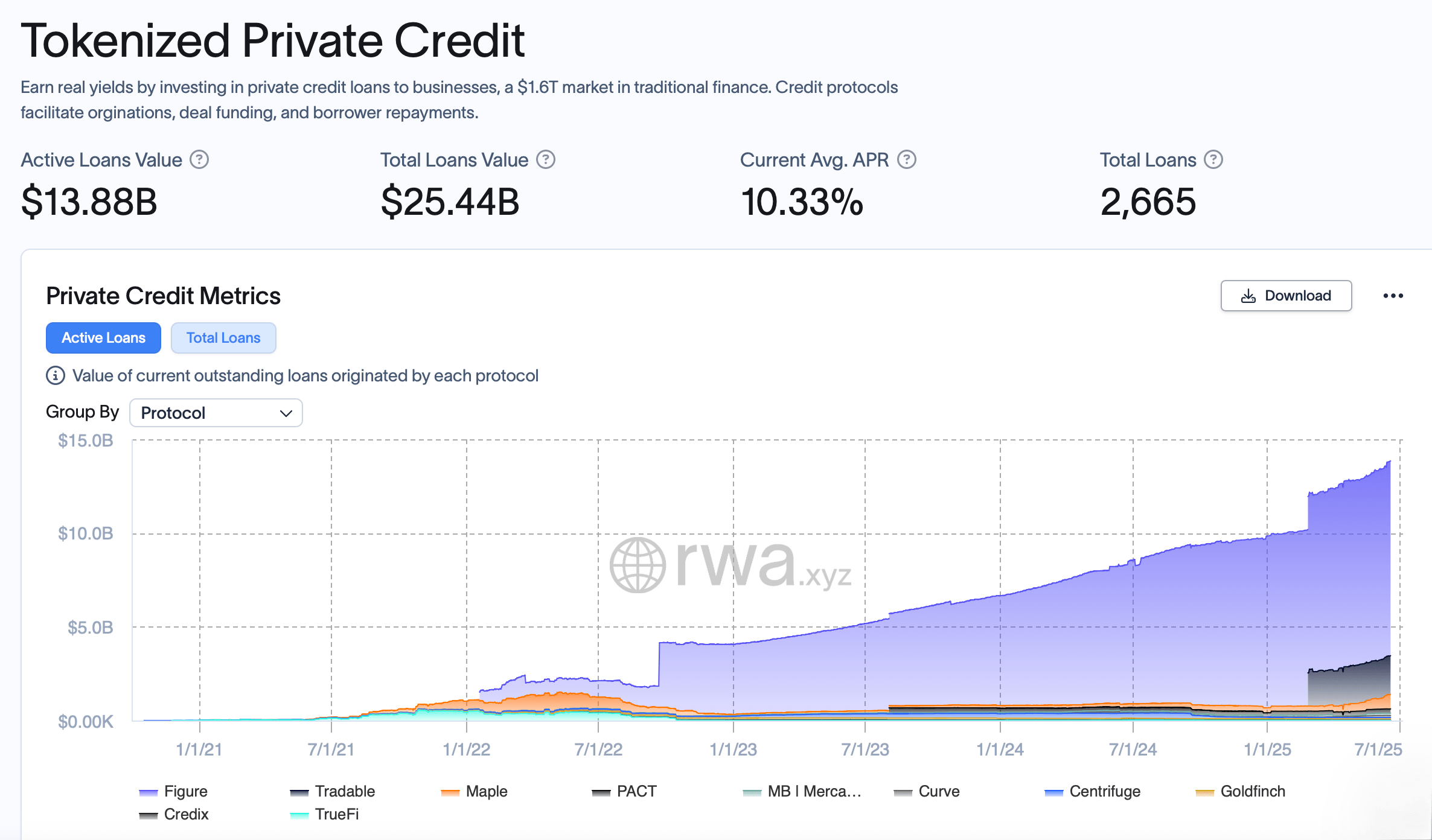

Tokenized private credit, the latest darling of the real-world asset (RWA) tokenization market, has soared to dizzying heights, with active outstanding loans now totaling a staggering $13.88 billion—far surpassing the mere $7.38 billion in tokenized U.S. Treasuries. Who would have thought that digital tokens could outshine the good old greenbacks? 🤑

This peculiar alchemy transforms traditional private credit assets—loans or debt instruments typically issued by non-bank lenders—into digital tokens on a blockchain. Essentially, these tokens represent ownership stakes in underlying credit assets, enabling digital trading and management. It’s like turning a mundane loan into a shiny, tradeable digital gem. 🌟

According to rwa.xyz stats, the market is dominated by a handful of key protocols. Figure, the reigning monarch, boasts $12.78 billion in total originated loans, commanding approximately 92% of the sector. Other major players include Tradable ($4.72 billion), Maple Finance ($3.38 billion), and TrueFi ($1.72 billion). It’s a veritable digital aristocracy. 🏰

Mid-tier protocols like Centrifuge ($594 million), PACT ($1.08 billion), and Curve Finance ($261 million) round out the ecosystem, alongside emerging platforms such as Goldfinch ($170 million) and Creditx ($46 million). It’s a digital feudal system, with each protocol vying for its slice of the pie. 🍕

Protocols operate across diverse blockchain networks, reflecting the sector’s technological maturity. Tradable leverages Zksync Era for scalability, TrueFi operates on Ethereum, and PACT utilizes Aptos. This multi-chain infrastructure supports nearly $25 billion in cumulative loan originations, while the active loans currently stand at $13.88 billion. It’s a digital symphony of innovation and ambition. 🎶

Tokenization addresses the core limitations of traditional private credit. By fractionalizing loans into blockchain-based tokens, proponents believe it broadens access for retail investors and enhances liquidity for historically illiquid assets. It’s like turning a stagnant pond into a bustling marketplace. 🏪

Smart contracts automate settlements, reducing administrative costs while onchain data ensures transparency in asset performance. The sector shows strong growth, adding approximately hundreds of millions monthly in new loans. It’s a digital gold rush, with new miners joining the fray every day. 🛠️

Despite this momentum, tokenized credit represents less than 1% of the broader $1.6 trillion traditional private credit market—indicating substantial expansion potential. The future is bright, but the road ahead is long and fraught with challenges. Will this digital marvel stand the test of time, or will it fade into obscurity like a forgotten fad? Only time will tell. ⏳

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Top 8 UFC 5 Perks Every Fighter Should Use

- Who Is the Information Broker in The Sims 4?

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

2025-06-20 01:57