As an analyst with a background in traditional financial markets and a growing interest in digital assets, I find the current market dynamics intriguing. The recent selloff in Bitcoin and Ethereum, driven by institutional investor pessimism towards rate cuts and the broader digital asset market correction, has led to a flight to alternatives like Solana and XRP.

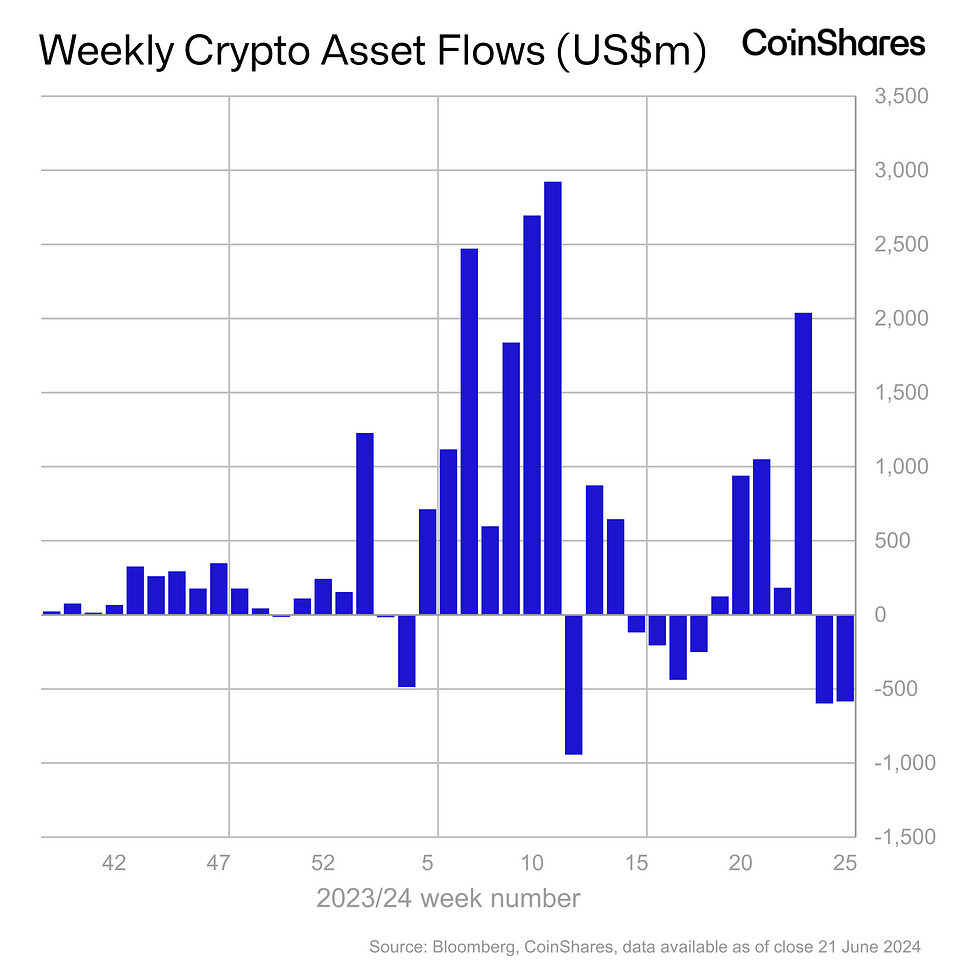

As a researcher studying the current trends in the digital asset market, I’ve noticed that while institutional investors have become cautious towards Bitcoin and Ethereum, there’s growing interest in alternative coins like Solana and XRP. CoinShares, a leading digital asset management firm, has reported significant outflows from global digital asset funds, indicating what they call a “true correction” is underway. Over the past two weeks, investment products for digital assets have seen a net withdrawal of $1.2 billion.

Crypto Assets Saw Second Consecutive Week Of Selloff

As an analyst, I would interpret the $1.2 billion decrease in global digital asset investments this year as a sign of institutional investors’ growing apprehension towards anticipated interest rate cuts by the US Federal Reserve (FED). In the recent week alone, digital asset investment products experienced an outflow of approximately $584 million, according to the latest CoinShares report published on June 24.

James Butterfill, the research chief at CoinShares, commented, “Bitcoin experienced a significant outflow of $630 million during this period. However, despite the recent bearish sentiment, investors haven’t shown interest in increasing their short positions. Conversely, multi-asset investment products attracted inflows totaling $98 million, indicating that some investors view the current downturn in altcoins as a chance to buy.”

As a crypto investor, I’ve noticed that the recent selloff was primarily driven by investors based in the United States and Canada, with losses amounting to approximately $475 million and $109 million, respectively. In contrast, countries like Germany, Hong Kong, and Sweden experienced outflows of $238 million, $156.5 million, and $37.5 million, respectively. Surprisingly, investors in Switzerland and Brazil bucked the trend and added to their crypto holdings, with inflows of $39 million and $48.5 million, respectively.

Solana and XRP Recorded Buying

In contrast to Bitcoin and Ethereum, which experienced selling pressure and saw their prices drop by 5% within the last 24 hours (Bitcoin to under $61k, Ethereum to below $3,300), altcoins like Solana, XRP, Litecoin, and Polygon attracted inflows.

Last week, investors purchased approximately $2.7 million worth of Solana on the market. At present, the price for one SOL token is around $125. The value has decreased by 6% today in conjunction with a broad market downturn. Over the past 24 hours, the SOL price reached a low of $123.67 and a high of $134.22.

As an analyst, I’ve observed that XRP attracted approximately $0.7 million worth of investments over the past week. However, its price experienced a 2% decrease within the last 24 hours, and now hovers around $0.475. The lowest and highest points in the past day were recorded at $0.469 and $0.485 respectively. Notably, the trading volume has significantly surged by 165% over the past 24 hours.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- EUR ILS PREDICTION

- USD COP PREDICTION

- USD PHP PREDICTION

- Best JRPGs That Focus On Monster Hunting

- Best Turn-Based Dungeon-Crawlers

- OOKI PREDICTION. OOKI cryptocurrency

2024-06-24 15:11