Right, so, Bitcoin. Apparently, it’s been having a bit of a *moment* with the stock market. Since August ’24, they’ve been practically inseparable. Like me and a bottle of gin after a disastrous date. 🥂

- Bitcoin was up by 5.95% over the past 24 hours until press time. (Oooh, fancy numbers.)

- The king coin has been highly correlated with the stock market since August 2024. (Seriously, get a room, you two.)

So, these global tariffs happened six days ago, and the U.S. market threw a proper tantrum. The S&P 500? Three days of consecutive decline. *Dramatic sigh*.

And, naturally, this market drama spilled over into the crypto world. CryptoQuant analyst Frost (sounds like a Bond villain, doesn’t he?) reckons Bitcoin’s basically joined at the hip with the stock market. 🙄

How much is Bitcoin correlated with the stock market?

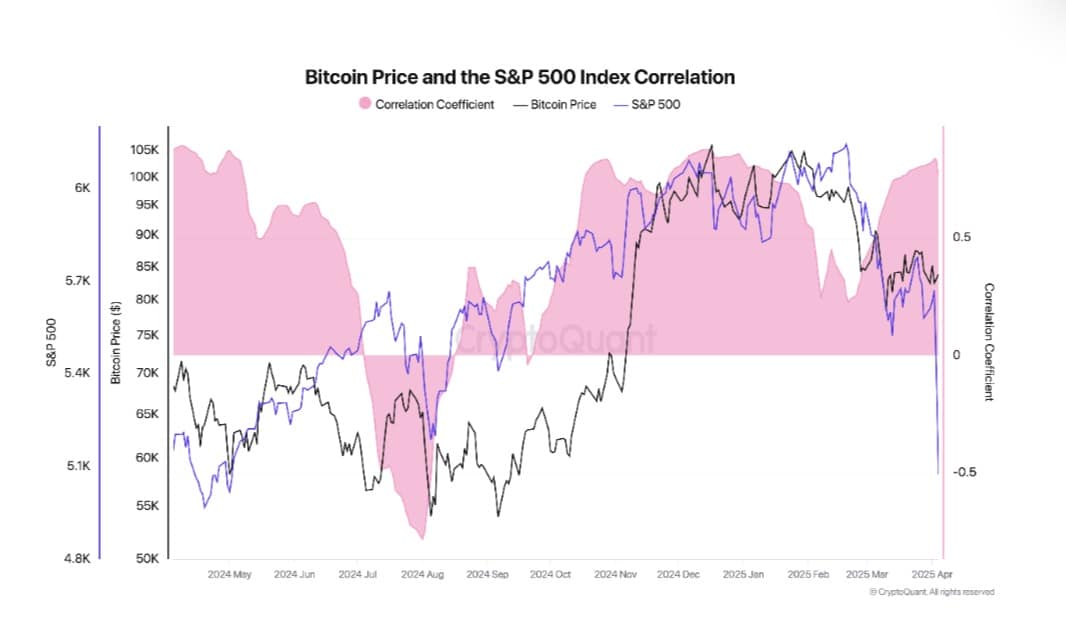

Apparently, according to CryptoQuant, Bitcoin’s been getting rather cozy with the S&P 500. A correlation ratio of 0.8? That’s practically marriage material in the world of finance. 💍

Since September ’24, they’ve been inseparable. Like, seriously, someone needs to give them some space.

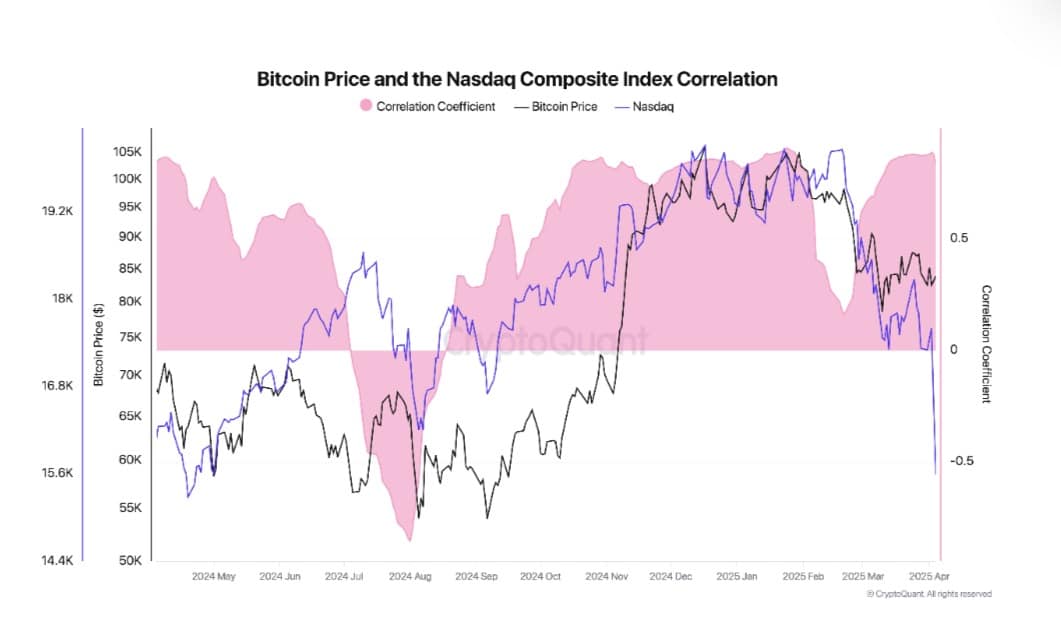

And it’s the same with Nasdaq and BTC. Stuck together since mid-August ’24. Ratio around 0.8. Honestly, it’s like watching a really dull rom-com. 😴

This correlation is even *more* constant than the S&P 500. Someone get these markets a therapist.

This love-in got even stronger when the global market had a bit of a wobble, thanks to those delightful tariffs. Cheers, world leaders! 🥂

Same thing happened after whispers of a 90-day tariff pause. Major indexes did a little jig, and the Nasdaq composite perked up by 0.1%. Whoop-de-doo.

And Bitcoin? It surged to a dizzying $81180. The excitement! The drama! (I need a drink.) 🍸

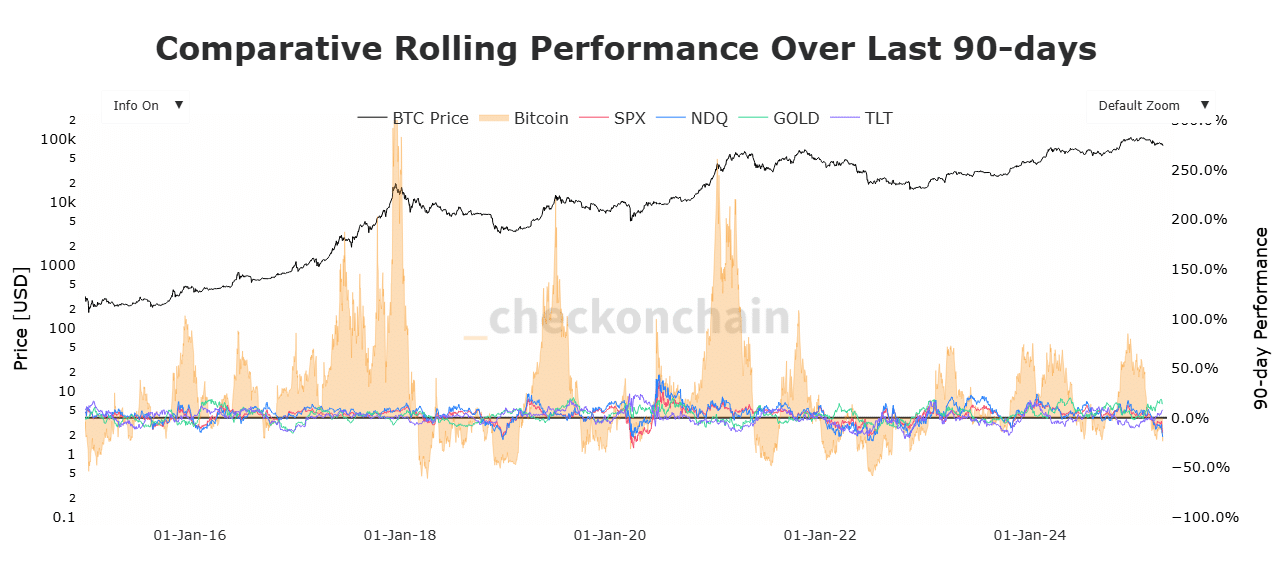

Looking at these rolling performances, BTC, SPX, and NDQ have been doing the same dance since March and April ’25. It’s like watching synchronized swimmers, but with more money and less spandex.

Over this period, everything tanked. Macroeconomic stress, risk-off sentiment. Basically, everyone’s a bit stressed and no one knows what’s going on. Sounds about right. 🤷♀️

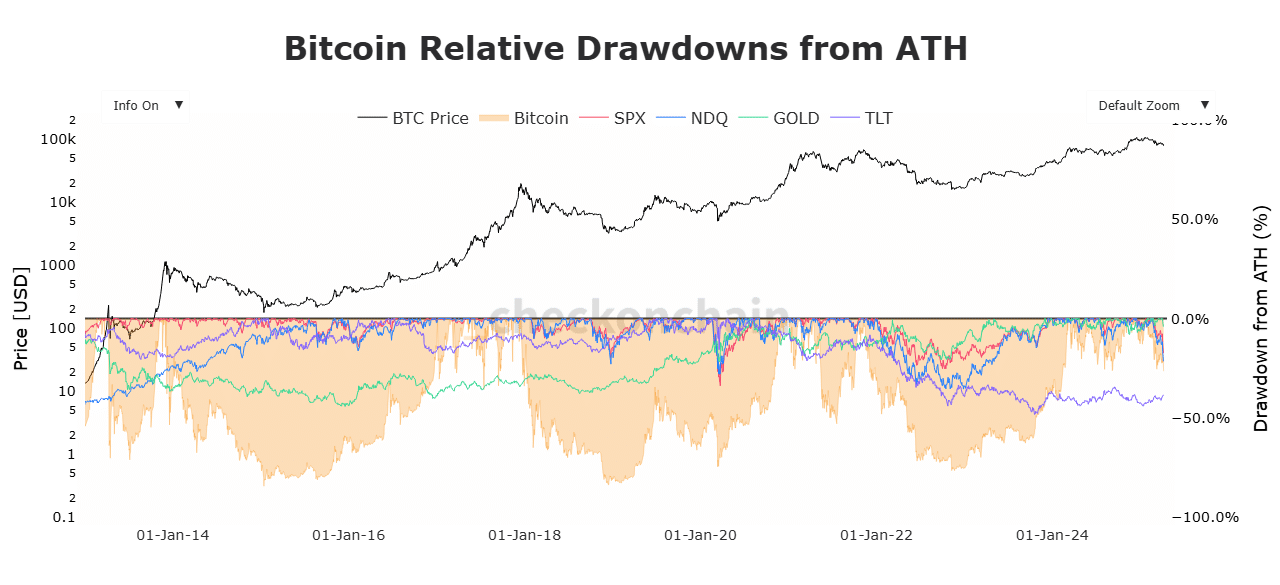

And the drawdowns? Synchronized with equities. More proof that we’re all doomed… or something. 💀

So, yeah. No doubt about it. BTC is still very much attached to the stock market. Get a grip, Bitcoin!

What’s next for BTC?

According to AMBCrypto’s analysis (whoever they are), Bitcoin’s still clinging to the stock markets like a lovesick puppy. So, if the stock markets have a wobble, Bitcoin’s going down with them. 📉

But, hey, if the economy recovers and the stock markets cheer up, then institutional investors might get a bit frisky and boost BTC prices. Maybe. 🤞

If the stock market continues to be a bit of a mess, BTC will keep bobbing around with $74k as a safety net. If things calm down, BTC *might* reclaim $82500. Don’t hold your breath, darling.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-04-08 22:21