Oh, what a silly little number 540,000 is! It’s the biggest transaction count in 2025, and the Bitcoin network is having a *whimsical waltz* of joy. Can you believe it? A cryptocurrency so cheeky, it’s practically doing cartwheels on the blockchain!

Analysts, those wise old owls, say this surge in activity is like a birthday party for demand. “It’s a sign!” they cackle. “The next bullish phase is just around the corner!” But who’s counting? The Bitcoin network is too busy giggling to notice.

Rising On-Chain Transactions Signal Growing Demand

QryptoQuant’s report is a tale of two things: chaos and confusion. They say the Bitcoin network is buzzing like a beehive, but who’s keeping track? The numbers are so high, they’ve probably forgotten their own age!

CryptoOnchain’s study is a delightful disaster. They’ve been watching Bitcoin’s transactions, which are like confetti in a hurricane. In 2025, the 14-day average is 540,000-so high, it’s practically touching the clouds! The analysts, ever the optimists, think this is because people are using Bitcoin like a toy, not a tool. “Protocols like Bitcoin Ordinals and Runes?” they snort. “More like a circus!”

The report also mentions a “bullish convergence” between Bitcoin’s price and its transactions. “Oh, how charming!” they say. “It’s not just speculation anymore! It’s real, *real* usage!” But let’s be honest, the network is just trying to keep up with the party. And if it can’t, well… the party will just move on.

Market Outlook

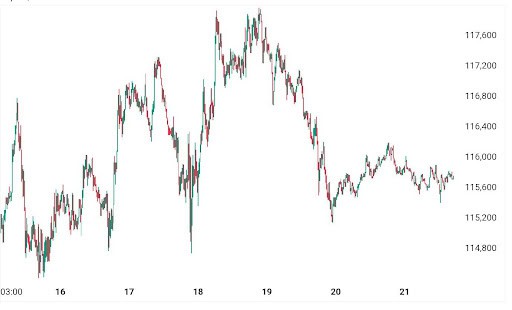

Bitcoin is currently trading at $112,500, which is like a sad little sigh after a long day. It’s down 4% on the day, and it’s breaking down from its consolidation range like a poorly built sandcastle. The price has been swinging wildly, like a pendulum with a bad case of the giggles. It fell below $113,000, then jumped to $117,800, and then settled back down. What a rollercoaster!

Since September 9, US spot Bitcoin ETFs have gobbled up $2.8 billion, like a hungry hippo. Institutional demand is the stabilizing factor, but let’s not get too excited. It’s like a friendly elephant in the room-big, loud, and slightly awkward.

Technical indicators are playing hide and seek, and network activity is still catching its breath. Miner incentives are under scrutiny, which is like asking a toddler to clean their room. Sentiment indicators are neutral, and MACD signals are mixed. Investors should keep an eye on macroeconomic shifts and ETF flows, because who knows what’s around the corner? Probably something wild, that’s for sure!

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

2025-09-23 01:10