Markets

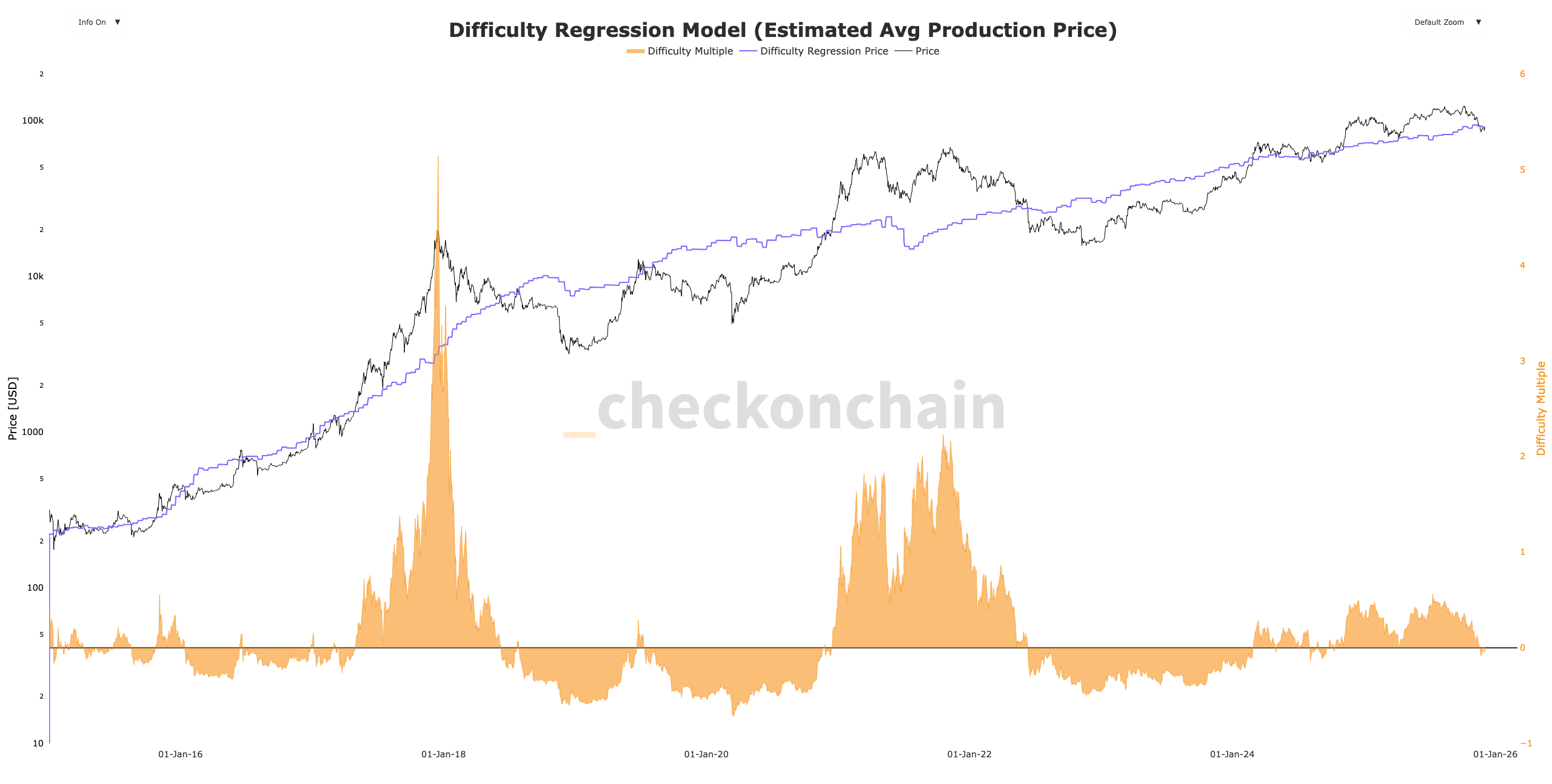

In the grimy alleyways of crypto, where hope and despair sip tea from the same rusted kettle, Bitcoin stumbles like a drunkard clinging to the Difficulty Regression Model. At $92,300, the model glares at BTC with the cold eye of a capitalist overseer, whispering, “You’re worth no more than your sweat and electricity.” And there BTC lingers, like a beggar clutching a $20 bill, pretending it’s a fortune.

This model, a relic forged from Metcalfe’s Law and the ashes of shattered hype, declares BTC’s “fair value” with the authority of a soothsayer who’s never profited from a trade. It’s a balancing act worthy of a circus clown-BTC teeters above the line, and the bulls cheer; it stumbles below, and the bears laugh until their crypto wallets burst.

April 2025 was a grand performance: BTC fell to $76,000, kissed the model’s boots, and bounced back like a trampolinist. For months, it danced at a 50% premium, a delusional optimist. Then came 2022, the Great Crypto Depression, where BTC traded at half the model’s price-because what’s a digital asset if not a modern-day tulip?

Remember 2017? BTC quintupled the model’s estimate. A bold lie wrapped in moonshot dreams. Now, in its “mature” phase, BTC has outgrown its fairy tales. Premiums? Those are for children and fools. Today, BTC’s “fair value” is a bitter joke: $90,000, where miners sip coffee and ask, “Is this all there is?”

The market, ever the jester, hums a tune of balance. BTC’s price hovers near production cost, a weary worker clocking in and out. Is it bull or bear? Perhaps it’s just crypto’s version of Gorky’s The Lower Depths-a tale of survival, where every dollar feels like a coin tossed into a wishing well. 🤡💰

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- How to Unlock all Substories in Yakuza Kiwami 3

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

2025-12-04 00:29