At precisely 11 a.m. EST, the venerable cryptocurrency known as Bitcoin, that digital chameleon of the financial world, was trading at $91,892 on Wednesday, having briefly flirted with $93,928 in the morning’s more spirited moments, while the derivatives markets, like a post-Christmas turkey, began to show early signs of rebuilding after the November carnage.

Bitcoin Derivatives Rebuild After November Washout

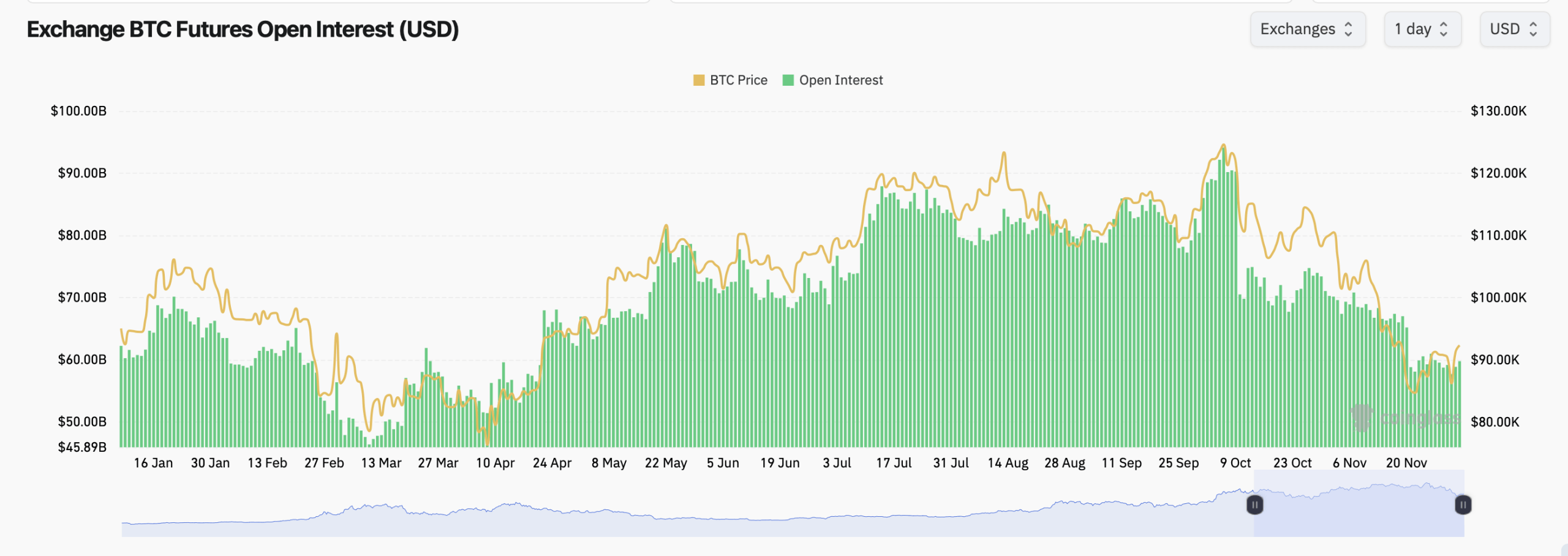

According to coinglass.com stats, bitcoin’s futures market stands at 646.84K BTC in open interest (OI), valued at $59.74 billion, with a modest hourly wobble but a +2.07% rise over 24 hours. It’s not a cavalry charge, but rather a polite nod from traders who’ve finished their tea and are tentatively stepping back into the fray.

CME, that grand old institution of futures trading, holds a 19.24% market share with 124.48K BTC in OI, while Binance, that cheeky upstart from the East, trails closely behind with 121.46K BTC and 18.78%. Bybit, ever the plucky underdog, saw a 4% rebound, while Kucoin and Gate, those mid-tier charmers, sipped their champagne and welcomed fresh inflows.

After weeks of financial hemorrhaging, the aggregate futures OI chart finally stabilizes near $60 billion, like a vicar’s sermon after a particularly rowdy parish fair-calm, if slightly dampened by the memory of chaos.

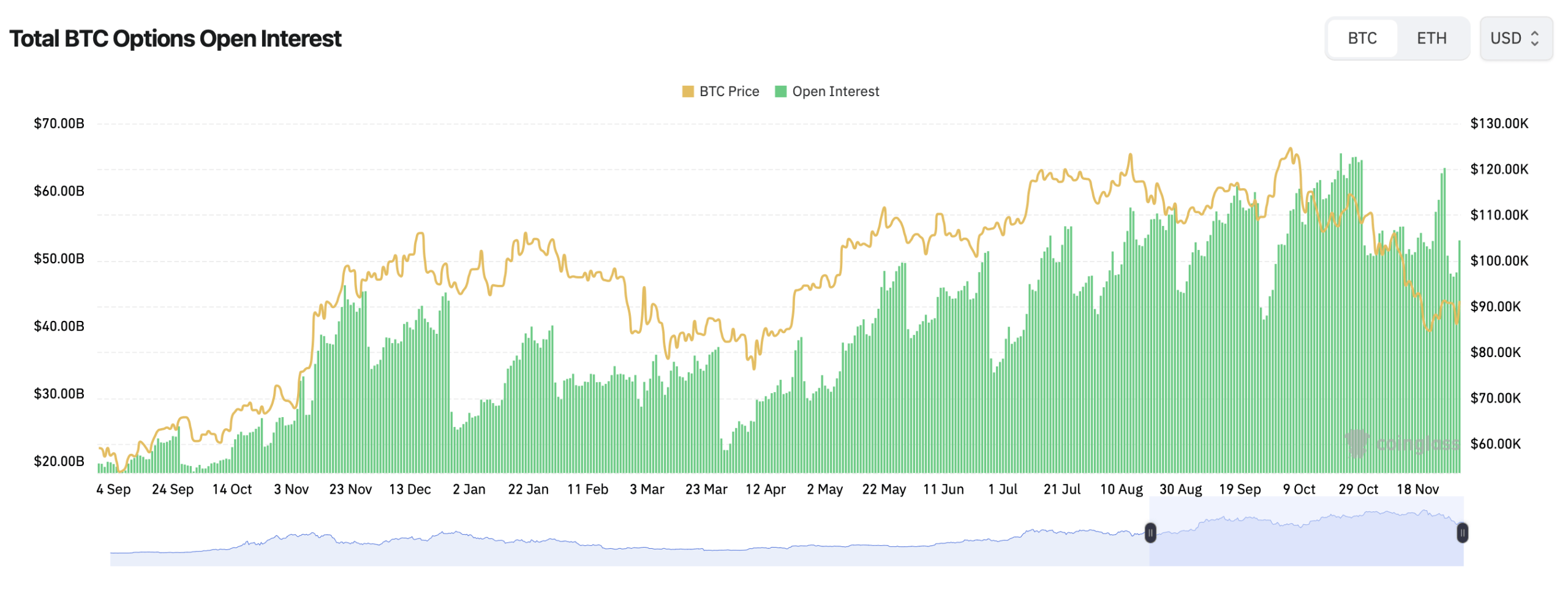

Options markets, that most theatrical of financial arenas, offer a glimmer of optimism. Calls hold 345,483.7 BTC, puts 192,956.85 BTC, giving calls a 64% edge. Over the past 24 hours, calls outshone puts like a well-timed quip at a dinner party, suggesting traders still dare to dream of a festive rally rather than a post-Christmas slump.

On Deribit, the grand bazaar of bitcoin options, traders eye December 26 expiries, fixated on strike prices between $100,000 and $118,000. Though Bitcoin hasn’t yet reached six figures, the betting frenzy suggests gamblers haven’t abandoned their dreams of a fairy-tale ending.

Put demand lingers near $85,000, but it’s the bullish bets that dominate, like a well-attended garden party with more strawberries than guests. Max pain levels, that most uninvited guest at any financial soiree, cluster in the upper-$80,000s to low-$90,000s. With Bitcoin at $92,295, it’s perched like a teetering top hat on the edge of a waltz between bulls and bears.

Deribit, Binance, and OKX all agree on the max-pain zone, a price range so cozy it could make a hedgehog shiver with delight. While max pain doesn’t dictate price, it does encourage the kind of indecision that leaves traders as flustered as a gentleman in a hat-check line during a blackout.

Spot market action echoes this tale of cautious optimism. Wednesday’s daily chart shows Bitcoin climbing from the $80,537 nadir like a gentleman retrieving his umbrella from a rain-soaked puddle. Volume remains a mixed bag, but the November sell-off’s momentum is fading faster than a poorly timed joke at a family reunion.

Bitcoin’s derivatives markets are shifting from defensive crouch to a polite toe-dip in the water. Futures OI has halted its slide, options traders are bullish as a man in a top hat at a derby, and max pain keeps prices boxed in like a well-pressed cravat. If this trend continues, December may see a directional romp-but for now, Bitcoin enjoys the rare luxury of balance, like a well-brewed Earl Grey on a rainy afternoon.

FAQ ❓

- What is bitcoin’s current total futures open interest?

Bitcoin futures open interest stands at 646.84K BTC, valued at $59.74 billion. - Are bitcoin options traders leaning bullish right now?

Yes, calls remain firmly ahead of puts, indicating modest bullish sentiment. - Where are max-pain levels landing this week?

Most major platforms cluster max pain in the upper-$80,000s to low-$90,000s. - Which exchanges lead bitcoin futures activity today?

CME and Binance hold the top two spots in total bitcoin futures open interest.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-12-03 20:19