Ah, the witching hour of Halloween dawns upon our digital coliseum, where the market, still nursing the bruises from last week’s grand liquidation-some six hundred million souls fleeing the ETF arks like rats from a sinking galleon-begins its spectral dance. Bitcoin, that capricious czar, lounges at $110,000, poised tantalizingly betwixt the steadfast buy-sentinels of $107,000 and the ominous sell-bastions nearing $114,000. What a ballet of avarice and apprehension! 🎭

The ETF chronicles, those meticulous ledgers of investor caprice, unfold with grim eloquence: On the eve of All Hallows’ vigil, October 30, the Bitcoin funds hemorrhaged $488 million, bereft of even a whisper of inflow. Ethereum‘s coffers, too, were plundered for $184 million, leaving only the plucky Solana to flaunt a $37 million gain, clinging to its $190 perch with the tenacity of a barnacle on a becalmed bark. 🐌

Enter Strategy’s quarterly missive, that bulwark against chaos, restoring a modicum of architectural poise to the week’s frenzy. Earnings per share tallied $8.42, revenues swelled to $128.7 million, and the balance sheet proudly displayed 640,808 BTC, appraised at a staggering $47.44 billion-like a dragon’s hoard guarded by the unflinching Michael Saylor. 📈

The firm’s unyielding mantra remains Saylor’s prophetic psalm: Bitcoin shall ascend to $150,000 by 2025’s close. How droll, this unwavering faith amid the tempests! 😏

TL;DR

- XRP ETF’s hourglass sands hasten-November 13 emerges as the fateful terminus. ⏳

- Michael Burry, the oracle of omens, resurfaces after biennial silence with “bubbles” his cryptic clarion. 🫧

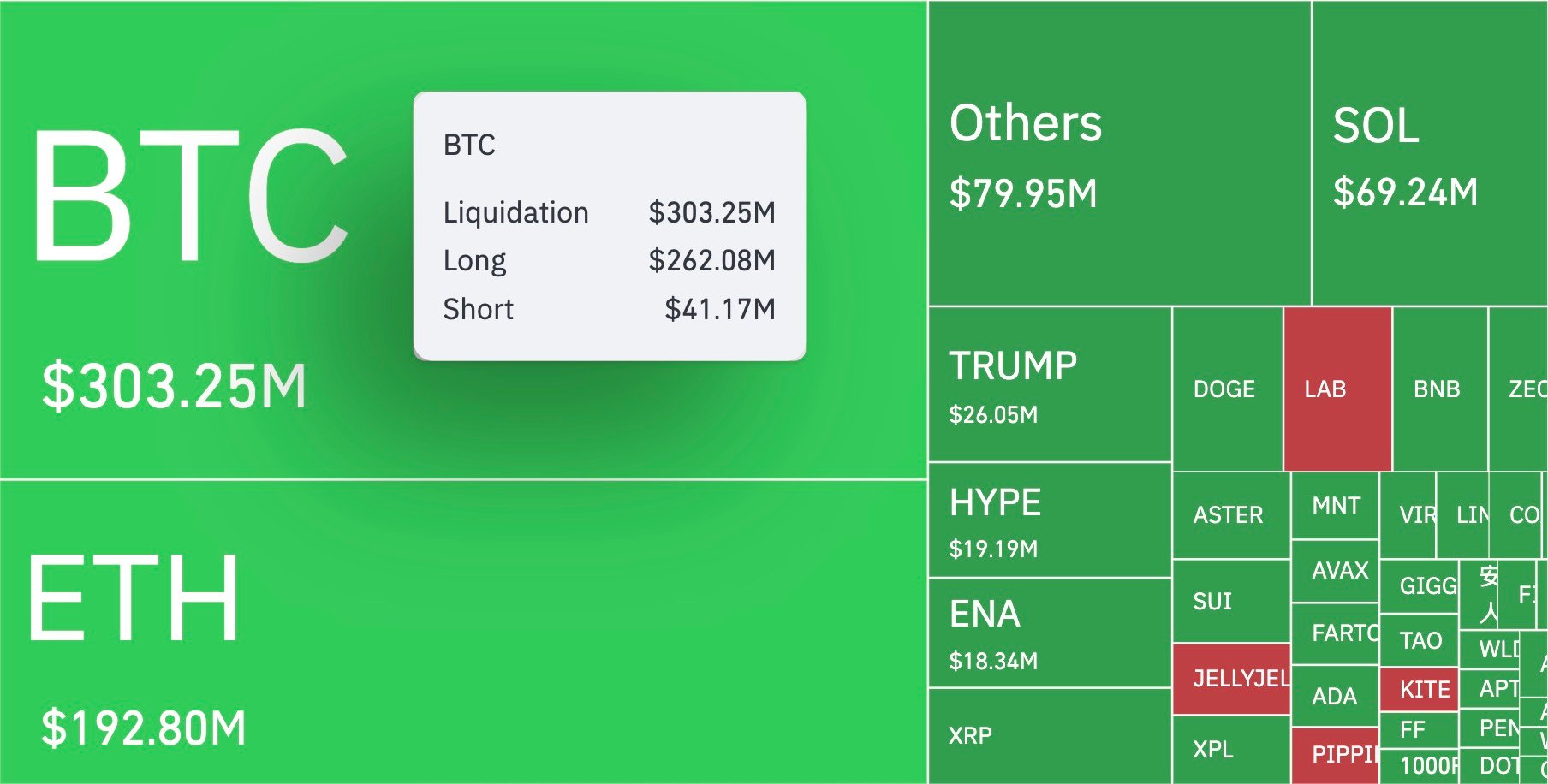

- Bitcoin’s long liquidations eclipse shorts by a ludicrous sixfold frenzy. 💥

- Strategy clings to its $150,000 reverie and $47 billion treasure trove. 🏦

XRP ETF countdown: Why Nov. 13 gleams with eldritch promise

From the quill of Canary Capital’s XRP filing springs the “delaying amendment’s” demise, igniting a 20-day chronometer of cosmic import. Should the SEC’s meddlesome shadows abstain, the inaugural spot XRP ETF shall unfurl its wings on November 13-like a butterfly emerging from its chrysalis, or perhaps a moth to the regulatory flame. 🦋

Upon Nasdaq’s benediction via Form 8-A, Canary claims primacy in direct XRP exposure across the U.S., untainted by the REX Osprey XRPR fund’s convoluted 1940 Act trappings. This purer vessel promises veritable liquidity, faithful price-shadowing, and unadulterated allure for institutional epicures. Pundits akin to Nate Geraci prognosticate a debut as lustrous as Bitwise’s Solana soiree. Franklin Templeton and Bitwise linger in the antechamber with their petitions, but Canary leads the parade. 🎪

Nov. 13 is likely to be a pivotal day for $XRP holders

– U.Today (@Utoday_en) October 30, 2025

XRP, that nimble numismatist, cavorts at $2.50, buoyed by a 3% diurnal elevation. Its bulwark at $2.45 endures, whilst resistance at $2.73 looms like an unyielding dowager since September’s sortie. A triumphant breach above $2.73 unlocks the portals to $2.90-$3.00. Should the ETF alight mid-month, that lofty band shall test liquidity’s mettle through Q4’s gloaming. How delightfully precarious! 😉

“Big Short” savant Michael Burry reawakens, and the markets quiver in mock repose

Michael Burry, that laconic seer of subprime sorceries, shatters his two-year vow of silence, sufficient to petrify the risk-takers’ revelry for a diurnal interlude. His utterances, sparse as they are, carry the weight of doomsdays past. He materializes precisely as AI valuations and crypto leverages crest like overripe fruits on the vine of folly-ah, the exquisite timing, a sarcasm of fate! 🍎

Nvidia, that silicon colossus, vaults beyond $5 trillion this week, its symbiotic waltz with OpenAI evoking Burry’s erstwhile alarms over mortgage miasmas: capital begetting capital in an incestuous whirl. To the traderly horde, the epistle rings clear: valuations transmute into creeds, not mere numerals. What a theological twist in our pecuniary pulpit! 🙏

Sometimes, we see bubbles.

Sometimes, there is something to do about it.

Sometimes, the only winning move is not to play.– Cassandra Unchained (@michaeljburry) October 31, 2025

Burry had earlier amassed stakes in Alibaba, JD.com, and Baidu via Scion Asset Management, reaping dividends from China’s DeepSeek AI epiphany. Yet his reemergence amid techno-crypto effervescence signals a siren’s song. Funding rates for Bitcoin and Ethereum futures plummeted overnight; open interest withered by 8%, and erstwhile bulls bartered for protective puts. The crypto bazaar endured no cataclysm, but it most assuredly “blinked”-a humorous hiatus in hubris. 😉

Bitcoin: 600% liquidation lopsidedness on All Hallows’ Eve

CoinGlass’s oracle reveals $303 million in Bitcoin positions exorcised within the past diurnal cycle: $262 million from longs, a mere $41 million from shorts-a 600% asymmetry that underscores the market’s bullish bias, as if bears were but footnotes in a bull’s autobiography. 🐂

BTC oscillates betwixt $108,266 and $110,452 through Halloween’s hush, approximating a $110,086 close with a 1.6% gain-momentum mild as a maiden’s blush, yet ETF exoduses gnaw at spot suitors. Support hunkers at $107,500, thrice tested this week; a rupture thence propels to $105,000, confluence of CME and spot sanctuaries. Ascent beckons solely post a pristine close above $111,200, charting toward $114,000 and thence $117,500-the October apogee ere the plunge. 📉

This calendric caper adheres to Bitcoin’s decadal divination.

- 2015: $312.

- 2020: $13,537.

- 2023: $34,494.

- 2025: $110,000.

Each October’s verdant finale heralds November’s procession. Absent macro cataclysms, the $108,000 realm savors reloading over requiem. How predictably poetic! 🌟

Evening outlook

Halloween’s Friday twilight merges into the U.S. symposium with ambivalent airs-traders juggling Burry’s baleful augury against Strategy’s sanguine soothsaying. Volumes whisper, fixated on BTC, XRP, and SOL; funding rates compose themselves post-yesterday’s deluge. 🎃

Key levels into trading’s vesperal vow

- Bitcoin: Support near $107,500, pivot at $111,200, initial resistance $114,000, then $117,500 should vigor revive. ⚖️

- Ethereum: Basal bulwark circa $3,200, resistive realm $3,380.

- XRP: Support at $2.45, breakout talisman $2.73, aspirant ambit $2.90-$3.00 if ETF euphoria endures. 🚀

- Solana: Support $180, superior conduit $198-$200.

Spotlight pivots to Nasdaq’s decree on Canary’s Form 8-A, and perchance tardy Fed murmurings on liquidity or inflationary phantoms. A monthly Bitcoin closure above $110,000 seals its quintuple emerald streak, crowning October the mightiest prehalving prelude since 2019’s fanfare. The morrow’s marquee looms: November 13, wherein XRP courts its ETF coronation-or yet another postponement’s sardonic jest. 😂

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-10-31 15:07