According to on-chain information, this is the current estimated profit for various large Bitcoin holders (whales) and miners.

Bitcoin Whale & Miner Profits Compared Across Cohorts

Ki Young Ju, the founder and CEO of CryptoQuant, recently shared on X his insights about the aggregate profits that are yet to be realized by different groups in the cryptocurrency market.

Ju has discussed four different categories of investors. The first group consists of “recently purchased whales.” Whales are usually defined as individuals holding a minimum of 1,000 coins in their wallets. On the other hand, these recently purchased whales have acquired their coins within the last 155 days.

In simpler terms, STH whales refer to new large investors who have recently joined the market. On the other hand, LTH whales are experienced investors who have held their positions for over 155 days, making them market veterans.

Two other significant player categories in this context are miners holding between 100 and 1,000 Bitcoins, and those with 1,000 Bitcoins or more (referred to as “miner whales”). The smaller miners fall into the first group, while the second group comprises mining companies.

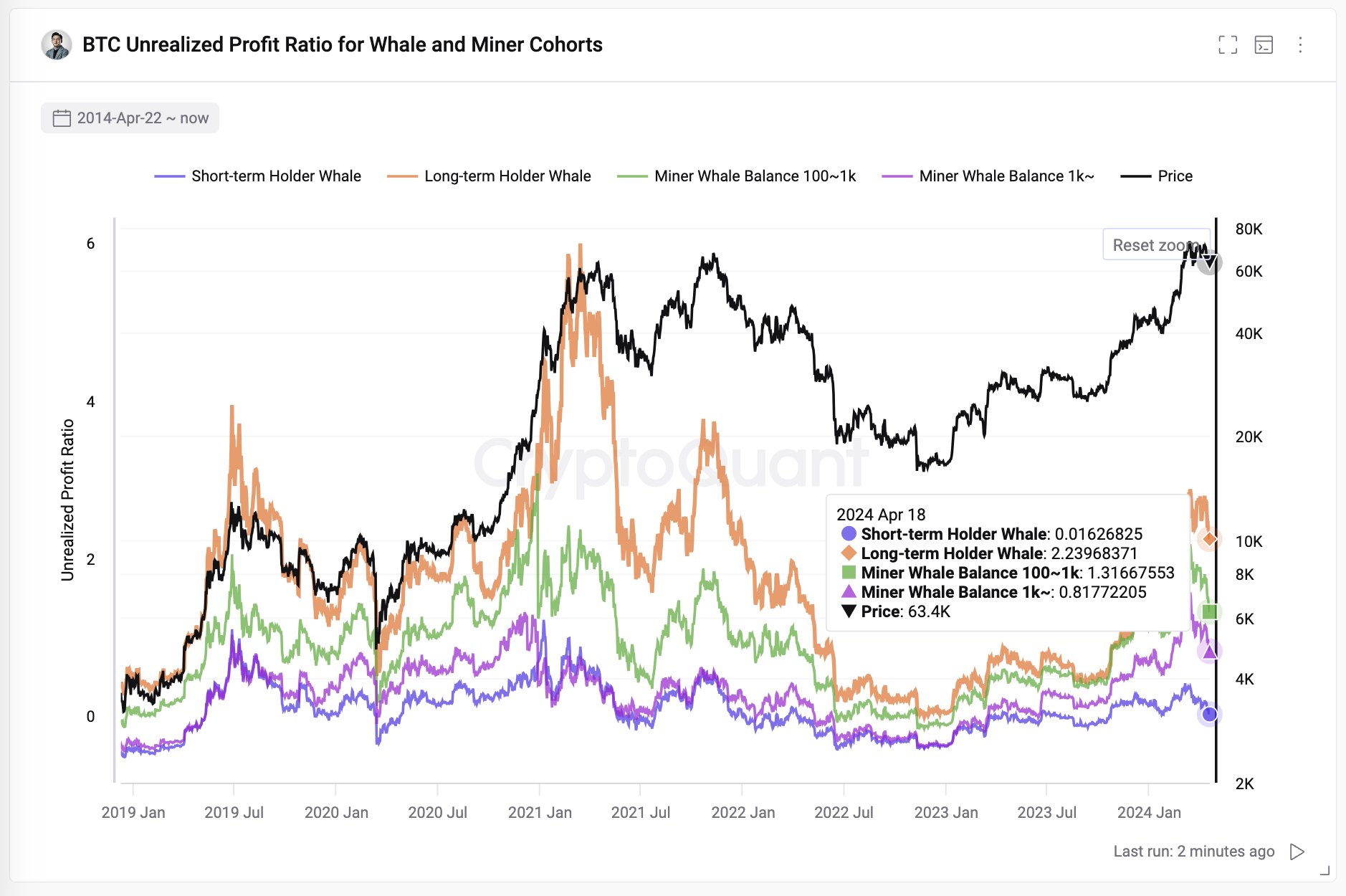

Currently, CryptoQuant’s founder has provided a chart displaying the development of the Unrealized Profit Ratio for the last few years concerning the following four groups of Bitcoin.

The Unrealized Profit Ratio is a metric that examines the investment history of coins owned by these investors to determine the price at which they bought each coin.

Using the given information, the calculation determines the proportion of unrealized gains among the holders within this group, and then expresses that amount in relation to the entire market capitalization of the cohort.

Three groups in the chart have experienced a significant increase in their Unrealized Profit Ratios following the recent rally. The ratios stand at 2.23 for large whale investors, 1.31 for small miner investors, and 0.81 for mining companies.

The LTH whales have earned over 223% in profits in the market, making them the most profitable group of investors. Their prolonged investment has paid off handsomely.

Small-scale miners have achieved impressive returns of 131%, making them major contenders for profitability, surpassing the 81% earnings of large miner whales. Although their profits pale in comparison to the LTH (Large Holder) whales, they remain noteworthy gains.

The Unrealized Profit Ratio for large whale investors is only 0.016, or 1.6%, suggesting they hold just a small percentage of their profits. These investors are represented by the substantial funds that have recently flowed into spot exchange-traded funds (ETFs).

Due to the need to pay steep prices for these large entities, their point where they recoup their costs (break-even point) is significantly greater than that of the Small Players. Consequently, their earnings are comparably lower.

In summary, according to the Unrealized Profit Ratio data for these groups of Bitcoin, the CryptoQuant CEO has remarked that there isn’t sufficient profit to signal the end of this market cycle in my opinion.

BTC Price

The price of Bitcoin hovers near $64,300 at present, reflecting its recent pattern of limited upward or downward progression.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- USD CLP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- LAZIO PREDICTION. LAZIO cryptocurrency

- KATA PREDICTION. KATA cryptocurrency

- PLI PREDICTION. PLI cryptocurrency

- MENDI PREDICTION. MENDI cryptocurrency

2024-04-20 08:11