Bybit’s 2026 crypto outlook argues that macro policy and institutional flows may matter more than historical cycles. Options data, regulatory shifts, and structural changes are expected to shape crypto markets in the year ahead.

Evolving Risks and Opportunities for 🚀Crypto🚀 in 2026

Bybit has released its 2026 crypto outlook, outlining the key forces likely to influence digital asset markets over the coming year. The report centers on bitcoin and the broader crypto market, drawing on derivatives data, options-implied probabilities, volatility trends, and cross-asset correlations. It also considers macroeconomic conditions, regulatory developments, and institutional adoption to assess how market behavior may evolve through 2026. 🎭💸

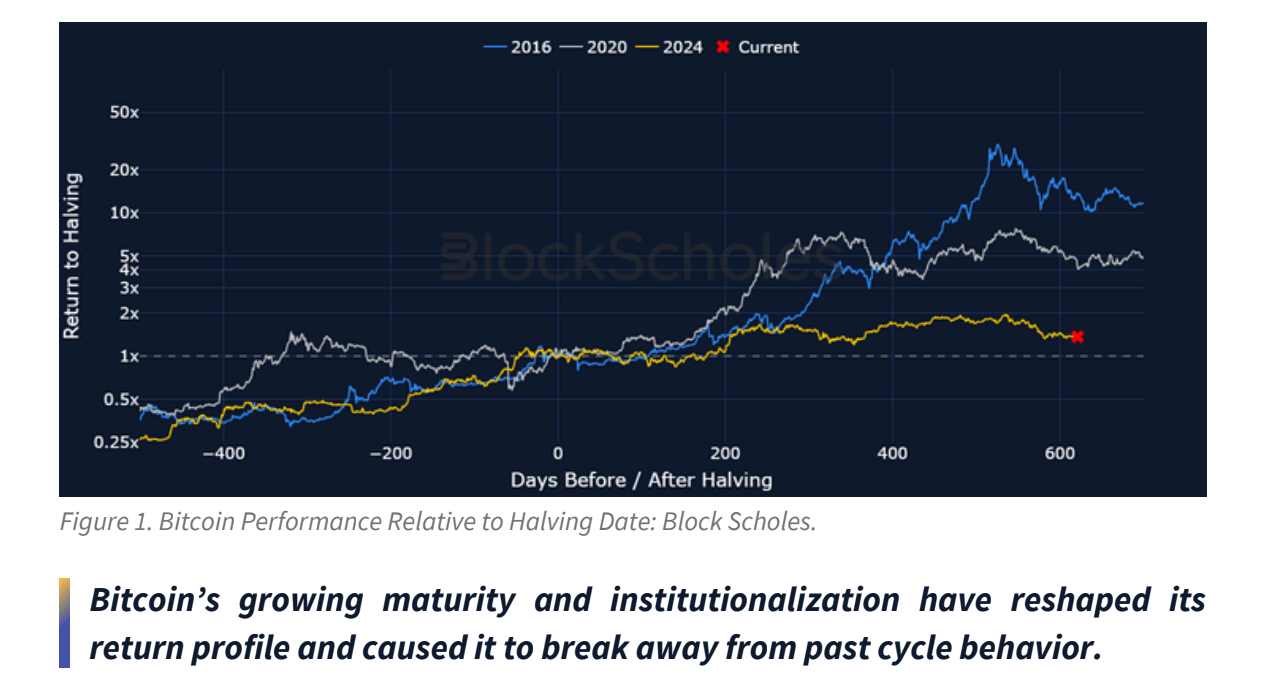

A core theme of the outlook is whether the traditional four-year crypto cycle, closely linked to bitcoin halving events and subsequent drawdowns, still provides a reliable framework. Bybit’s analysis suggests that while past cycles remain relevant, their influence may be weakening as macroeconomic policy, institutional participation, and market structure take on a larger role in price formation. 🤯📈

On the macro front, the report notes that markets are increasingly pricing in further monetary easing by the U.S. Federal Reserve. Such an environment could support risk assets broadly. Bitcoin has recently underperformed U.S. equities, but Bybit highlights the potential for a renewed positive correlation between bitcoin and major stock indices if accommodative conditions persist. 📈📉

Derivatives data offers a more cautious signal. Based on current options pricing, the implied probability of bitcoin reaching $150,000 by the end of 2026 stands at 10.3%. The report stresses that this figure reflects market positioning rather than a price forecast, and suggests options markets may be conservatively aligned given the broader macro and regulatory backdrop. 🤔🧪

Looking further ahead, Bybit points to real-world asset tokenization as a key structural theme, building on the expansion of stablecoin use by regulated institutions in 2025. 🏦🔐

Overall, Bybit concludes that crypto markets are entering a more complex phase, where cycles still matter, but are increasingly shaped by macro forces, regulation, and institutional involvement. 🧠⚖️

FAQ 📊

- What is the main takeaway from Bybit’s 2026 crypto outlook?

Macro policy, regulation, and institutional flows may outweigh traditional crypto cycles in 2026. A tale as old as time, but with more spreadsheets. 📊📚 - Are Bitcoin halving cycles losing influence?

Bybit suggests the four-year cycle still matters but is becoming less dominant in price formation. Like a waning star, it’s still bright but not as flashy. 🌟📉 - What do options markets imply for Bitcoin in 2026?

Options pricing shows a 10.3% implied chance of bitcoin reaching $150,000 by end-2026. A mere whisper of hope, but enough to keep the traders awake at night. 🤔💤 - Which structural trends could shape crypto next year?

Real-world asset tokenization and stablecoin adoption are seen as key long-term drivers. The future, it seems, is both digital and stable. 🏦🔄

Read More

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- How to Discover the Identity of the Royal Robber in The Sims 4

- God Of War: Sons Of Sparta – Interactive Map

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2026-01-09 10:02