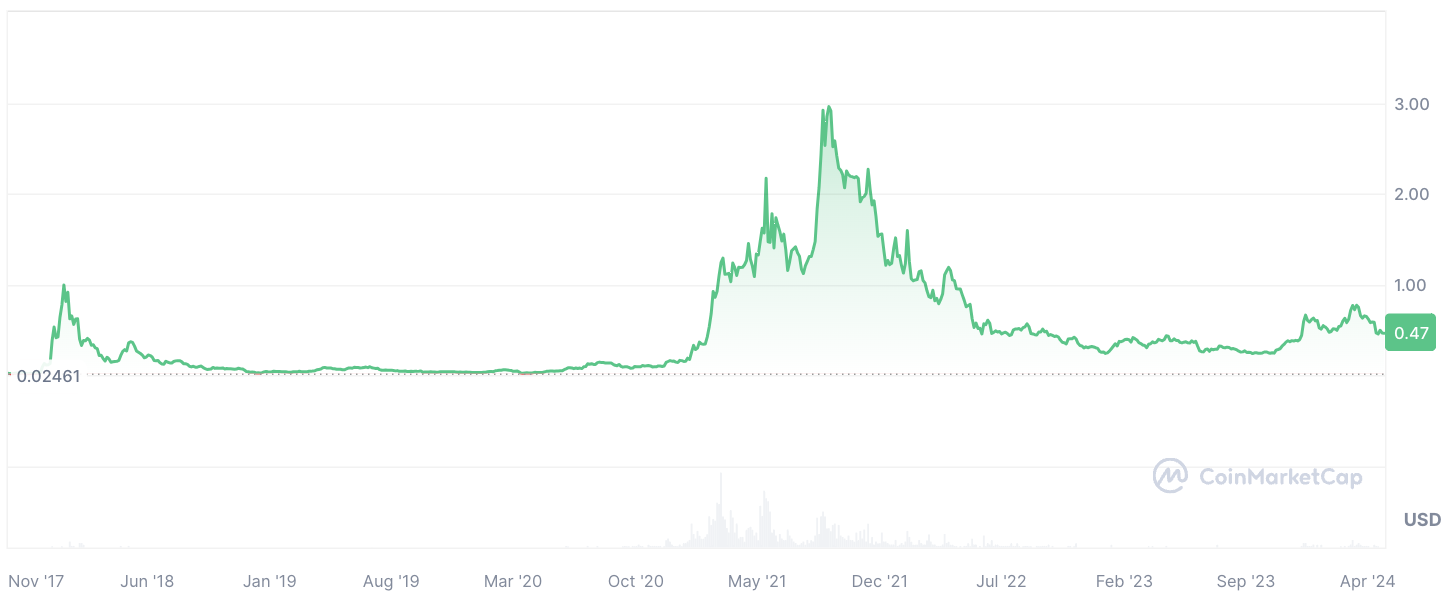

As someone who has closely followed the crypto market for several years now, I find the recent report by IntoTheBlock on Cardano (ADA) holders’ profitability a cause for concern. The data reveals a stark disparity between ADA and other leading cryptocurrencies like Bitcoin, TRX, Dogecoin, and Ethereum.

According to a recent study by data analysis company IntoTheBlock, there’s a troubling finding about the Cardano (ADA) community: a large number of ADA owners are currently experiencing losses. This insight comes from an in-depth examination of profitability among holders across different blockchain networks, which highlights noticeable discrepancies.

I’ve noticed an interesting trend in the cryptocurrency market lately. Bitcoin has taken the lead, boasting a significant number of investors who are currently in profit. TRX is right behind it, also showing strong profitability among its holders. Notably, Dogecoin and Ethereum have robust profitability as well. However, Cardano’s performance stands out differently. Only 35% of its investors are currently seeing a profit.

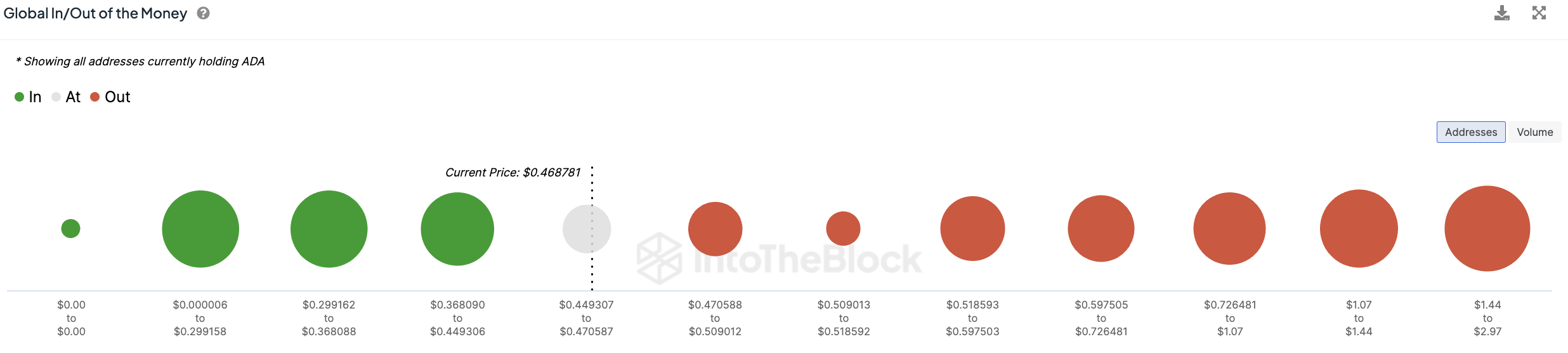

Exploring the details of the data further reveals that many ADA address holders are facing profitability issues. Out of the 1.59 million addresses holding a total of 14.07 billion ADA, approximately half (5.71 billion ADA) were bought for prices between $0.000006 and $0.299162 per token.

I’ve come across an intriguing statistic: approximately 2.73 million Ada wallet addresses have seen losses, totaling around 20.07 billion ADA. Most of these losses occurred during transactions between the price ranges of $0.5975 and $0.7265 per ADA.

Currently, approximately 152,940 Cardano address owners are at a breakeven point, meaning they have not made any profit or loss yet, collectively holding around 947.87 million ADA. This complex data setup invites diverse understandings. On the one hand, the accumulated losses for Cardano holders put considerable pressure on the cryptocurrency’s price to decrease.

However, despite this, it may indicate that the stock is underpriced based on current market conditions, implying significant price growth if favorable news emerges unexpectedly.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- TON PREDICTION. TON cryptocurrency

- Strongest Magic Types In Fairy Tail

- AAVE PREDICTION. AAVE cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- THL PREDICTION. THL cryptocurrency

2024-04-25 13:54