Is Bitcoin on the Brink? $74K Max Pain Has Traders Sweating Like It’s Hot Yoga!

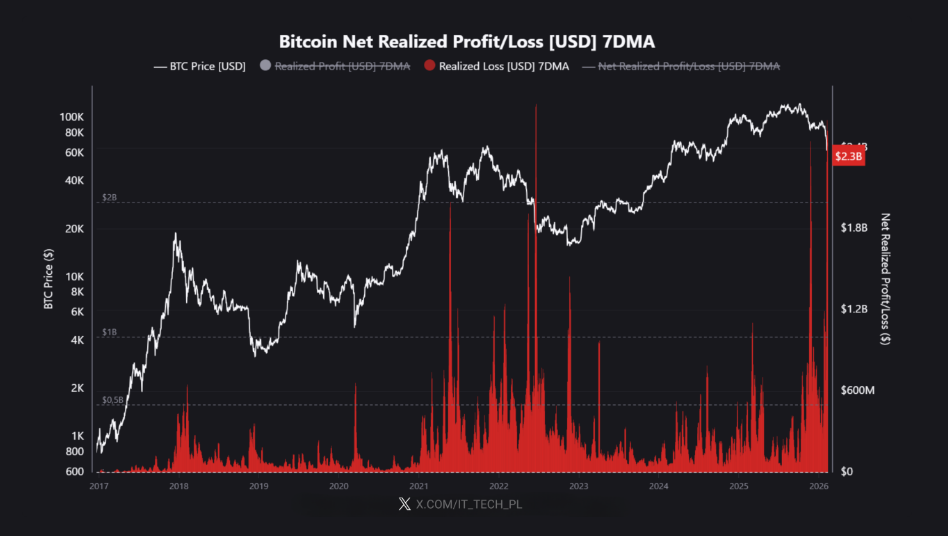

The crypto assets took another plunge off the diving board of despair last Friday, with a nice big splash as the market floundered. In a dazzling display of financial acrobatics, about $2.9 billion in Bitcoin and Ether contracts expired faster than my New Year’s resolutions. Who knew watching numbers drop could be this thrilling?