Bitcoin’s Hidden Struggles: Despite Liquidity Boom, Traders Play It Safe 😅🔍

So, what’s next? Should we saddle up, or is this just another false alarm? 🤔

So, what’s next? Should we saddle up, or is this just another false alarm? 🤔

Behold the chasm between private funding and public market caps-a testament to the cruel arithmetic of reality. The once-mighty narratives, so fervently believed, now crumble like sandcastles beneath the weight of scrutiny. How swiftly the tide turns! 🚨

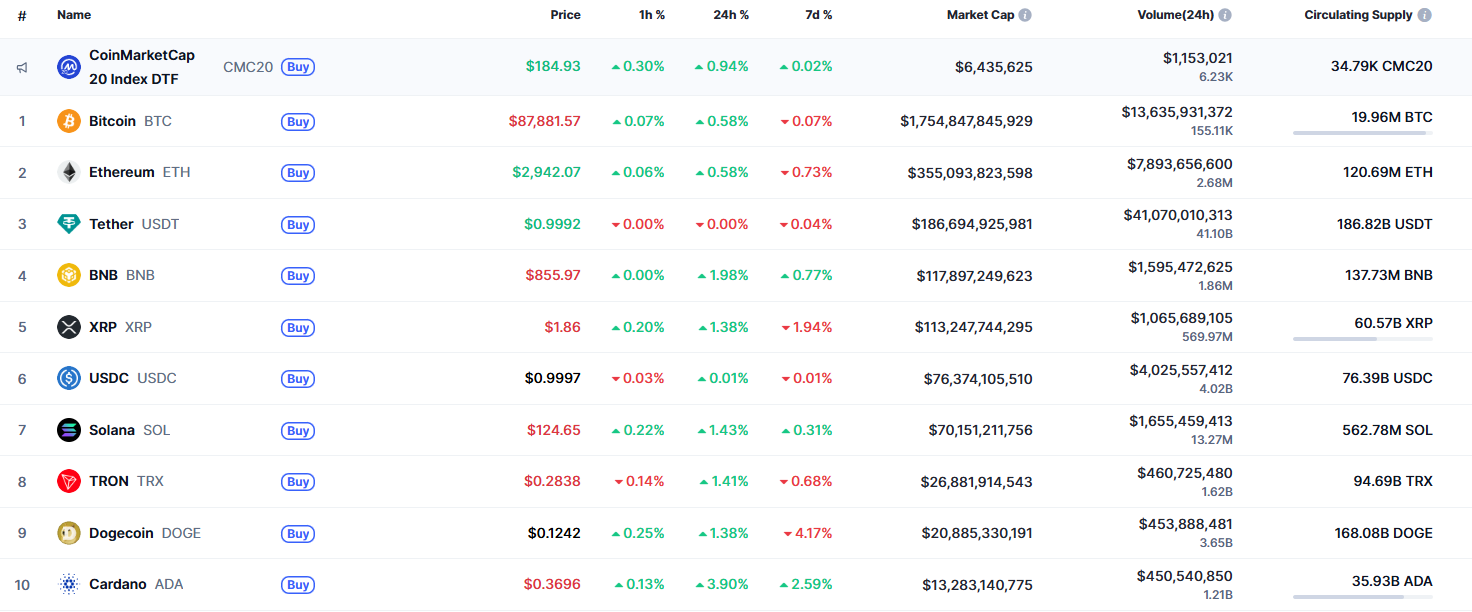

In a remarkable twist befitting a tale of intrigue, our beloved DOGE has risen by a modest 1.38% over the past 24 hours. One might wonder if this is a sign of impending wealth or merely a sprightly dance on the edge of a financial precipice! 🐕💃

The United States crypto industry, much like a soap opera, took a dramatic turn under President Trump. Federal agencies and lawmakers, like synchronized swimmers, moved in unison. Their actions? A mix of structure, clarity, and market access-reshaping how digital assets operate within the U.S. financial system. 🏊♂️

Key Takeaways: Or Why I’ve Stopped Counting My Coins

The market… it writhed, it bucked like a stubborn mule. The early birds, the ones who mined with fans whirring in dusty basements, began to unload. Billions’ worth of this “digital gold” found new homes – mostly in the coffers of those who already had plenty. A grand shifting of fortunes, they called it. I call it the age-old story of sharks and minnows. 😂

XRP is currently residing at $1.84, which is a decline of 14.63% since the start of the year. Which, frankly, is less alarming than some breakfasts we’ve had. Analysts are predicting it’ll…stay put. Until 2026, naturally. Because why rush things?

В отличие от «серьёзных» проектов, мемкоины не продают дорожных карт или «фундаментов» – они продают участие, внимание и скоростной заезд в пропасть. Нет обещаний, нет планов, только вайбсы… и миллиарды на балансе (в 2026). Но давайте разберёмся: мемкоины не притворяются. Нет белой бумаги, которую стоит прочесть – и тем более понять. Нет «десятилетней мечты». Обычно есть собака, лягушка или шутка, которую интернет забудет через час.

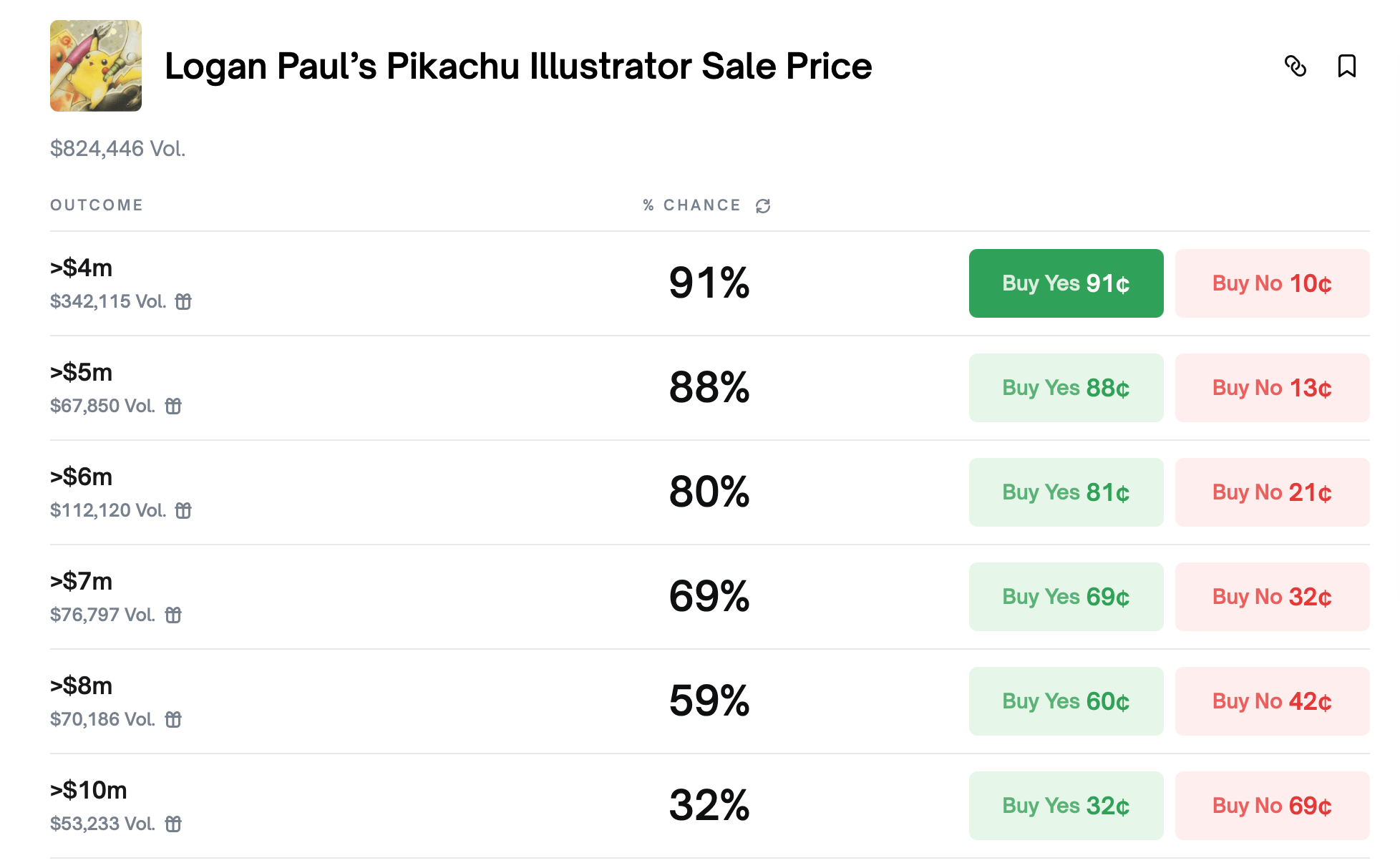

It wasn’t long ago, just a knee to Christmas in the last chapter, when our hero Logan, erstwhile internet luminary turned fervent collector, announced his intent to sell this prized artifact. Ah, what joy! For quite a spell, his precious Pikachu has captured the imagination of the masses, twinkling in its glass prison like a refined jewel. 🎩

This little selling spree coincided quite conveniently with DOGE trading at the lower end of its recent range. It appears our beloved whales have chosen caution over exuberance, perhaps deciding to protect their assets rather than chase after a fleeting upside. 🐳💸