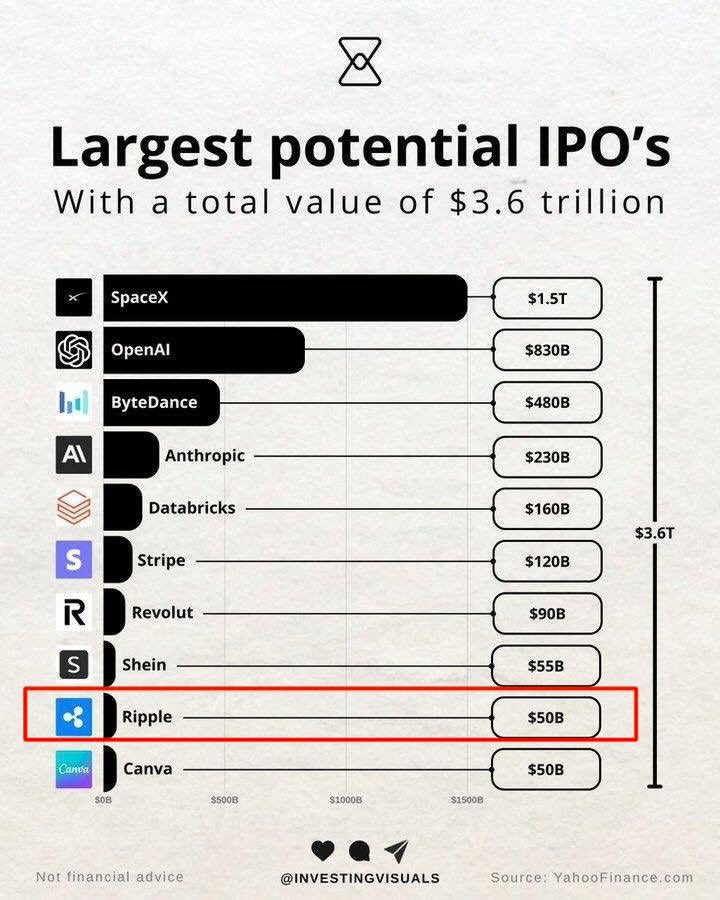

🚀 Ripple’s $50B IPO: Fact or Fantasy? 🤑

Industry analysts, those modern-day soothsayers, have anointed Ripple among the titans of potential public listings, with valuations soaring to the dizzying heights of $50 billion. Yet, in the grand tapestry of human endeavor, what is wealth but a fleeting illusion? 💸