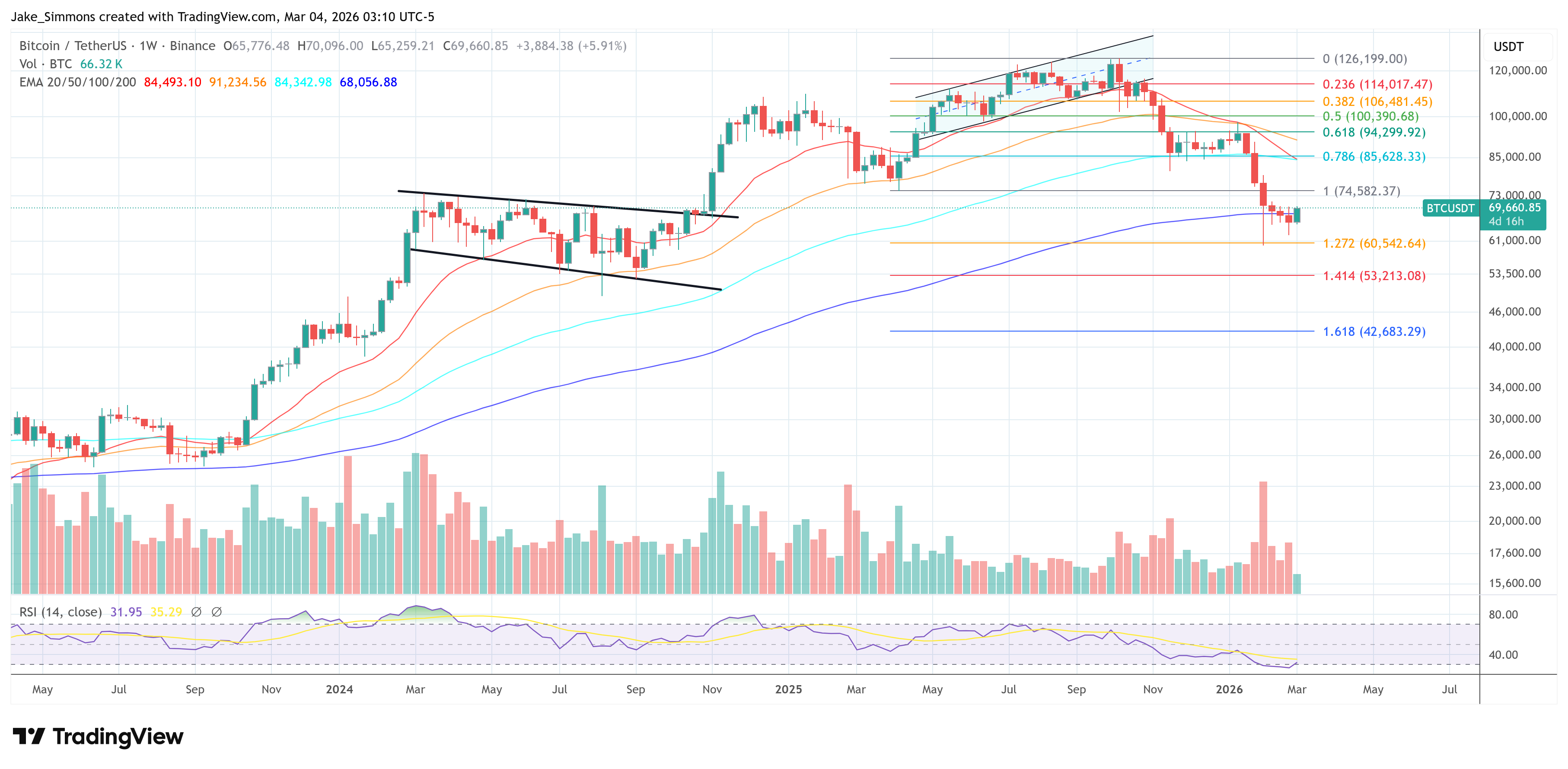

Bitcoin’s Meteoric Rise: Where Will It Stop This Week?

The current rally is powered by none other than the cacophony of activity in derivatives markets, where an unexpected wave of bearish bets were unceremoniously liquidated. Yes, you heard that right-traders who placed their bets on Bitcoin’s demise are now scrambling to buy back, desperately trying to escape the wreckage of their own making.