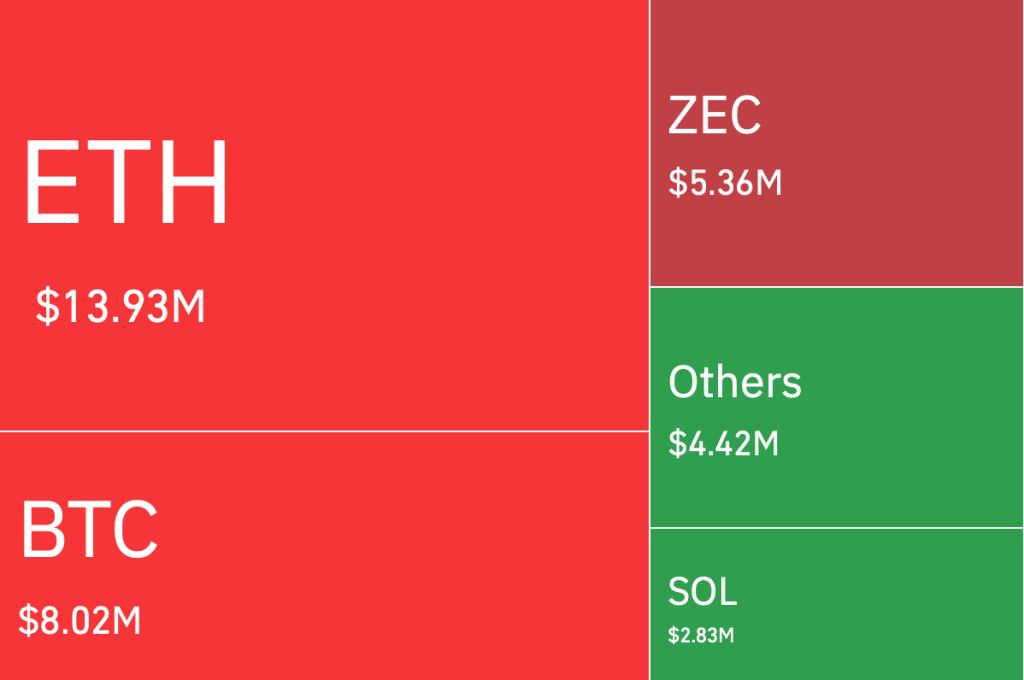

Zcash’s Wild Ride: Will Bulls Whip ZEC to $500? 🚀💸

Volatility, that mischievous jester, is on the rise, and liquidity, the lifeblood of the market, flows like a river in spring. Analysts, those modern-day soothsayers, peer into their charts with furrowed brows, wondering if ZEC can reclaim its throne before the weekend’s curtain falls. 🧙♂️🔮