Ethereum’s Grand Escapade: Towards $3,500? 🚀📈

Fortuitously securing its footing above $2,920, Ethereum mirrored the Bitcoin dance-a curious pas de deux. Across the $3,000 and $3,050 divides, strength surged, even lofting it atop $3,150.

Fortuitously securing its footing above $2,920, Ethereum mirrored the Bitcoin dance-a curious pas de deux. Across the $3,000 and $3,050 divides, strength surged, even lofting it atop $3,150.

Now, let’s not ignore the elephant in the room: Ethereum’s Net Unrealized Profit/Loss (NUPL) on Binance. At 0.22, it’s like a perfectly mixed martini-neither too strong nor too weak. This delicate equilibrium suggests holders are still in moderate profit, which is less “greedy tycoon” and more “cautious baron.” A gentle nudge toward optimism, but not quite ready to throw confetti. 🎉🚫

This move is leaving traders stuck in a real “Choose Your Own Adventure” moment – continue the rally toward resistance or take a detour back to where it all started. The suspense is killing me! 😱

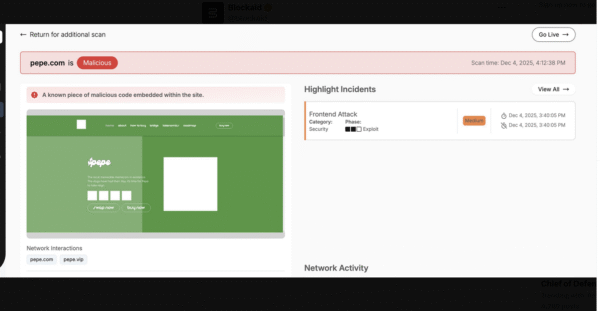

The official Pepe website suffered a disruptive breach on December 4, as attackers injected Inferno Drainer code into its front end. Users were then joyfully redirected to malicious pages-because who doesn’t want their crypto wallet drained while screaming into the void? 🎉🔥 Blockaid, ever the party pooper, issued an alert urging everyone to avoid the platform immediately.

After November’s “sell-off opera,” this bullish formation is here to remind us that hope is eternal, even when wallets are empty. A confirmed breakout might catapult SOL into a euphoric jig toward $165. Or it might collapse like a poorly timed punchline.

The milestone is, by all accounts, rather significant (if you’re into that whole “growing adoption” thing). Indeed, since the birth of Tron in 2017, over 350 million addresses have been conjured into existence, as though the blockchain had suddenly become a fashionable accessory. But wait-there’s more! In just the past 24 hours alone, the network added a staggering 261,000 new registrations. That’s not merely growth, that’s a growth spurt on the blockchain equivalent of a teenager’s shoes size. 👠

With Ethereum, after its Fusaka upgrade, basking in the glow of newfound vigor, BMNR clings to its coattails like a leech at a buffet. Traders, ever the optimists, whisper: Could this be the spark for a stock price eruption? Or merely a pyrotechnic illusion?

XRP, that sly fox, now refuses to descend further, its resolve as unyielding as a Russian winter. Crypto analyst Henry, that modern-day prophet, hath declared on X that the token’s whispers are loud enough to shake the heavens, rising boldly from its trendline support after days of bleeding like a wounded beast. This level, tested and scorned with precision, now feels different-cleaner, calmer, as if the price itself hath donned a new coat of paint. Whether it breaks free or not, the stage is set for a grand spectacle.

According to Citadel, DeFi platforms-and even the clever little goblins who code smart contracts or build wallets-are actually behaving like “exchanges” or “broker-dealers.” Naturally, Citadel thinks they should all march in step with the same securities laws that rule traditional markets. No exceptions. No elbow room. No fun. 😏

To achieve this, Solana plans a “direct distribution model,” which is corporate speak for “we’re skipping the middlemen because no one trusts us anyway.” A whopping 30% of the 10 billion tokens will be airdropped to active users, a gesture as generous as it is desperate. 🤑