Strategy Eyes Bitcoin Lending Partnerships With Big Banks

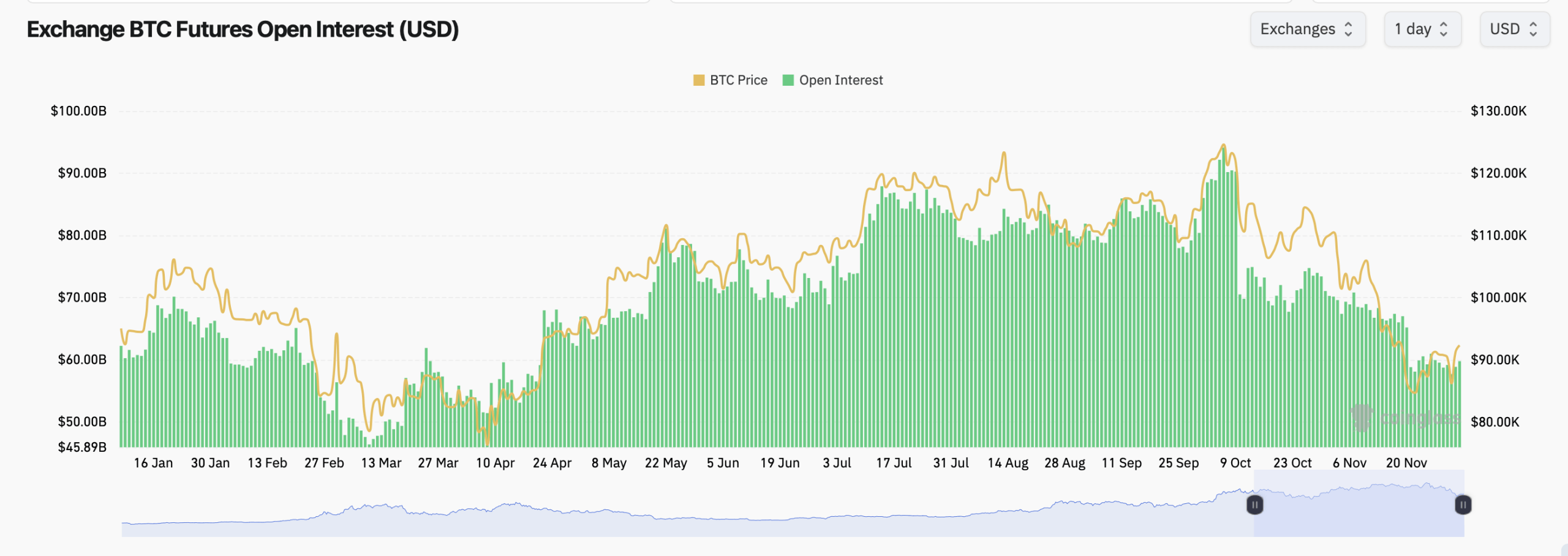

On December 2, during a delightful chat on Bloomberg Crypto, Le regaled us with tales of how Strategy carefully built a $1.4 billion dollar reserve, despite the fact that Bitcoin prices have seen their fair share of dramatic dips. You see, even when BTC prices plummeted from their October peak of $125,000 to a ghastly 17% decline in November, Le kept his cool, explaining that the reserve was there to fund dividends and interest-because, you know, it’s always nice to have a rainy-day fund when your assets are as volatile as Bitcoin.