XRP’s Grand Waltz: Kraken to Binance, or Just a Liquidity Minuet?

Kraken Subwallet to Binance Subwallet

Kraken Subwallet to Binance Subwallet

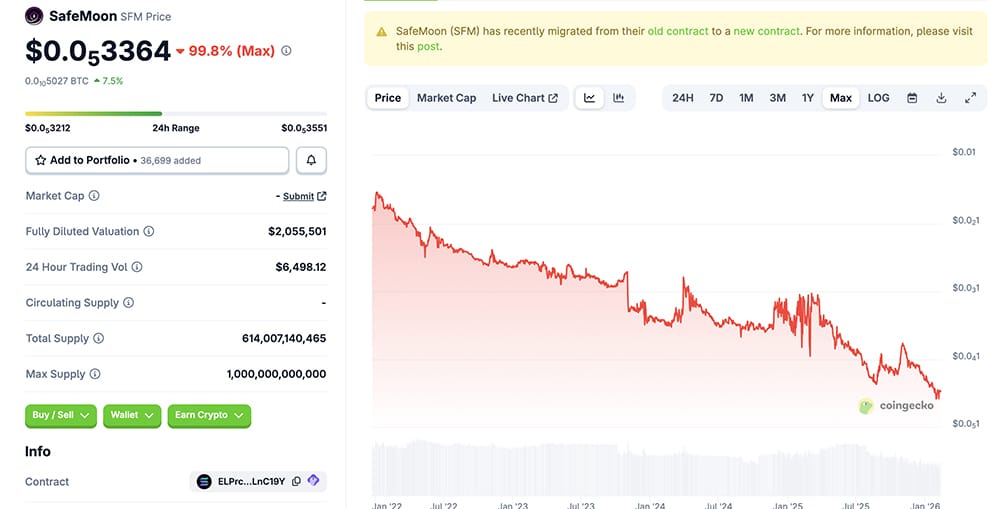

JUST IN: Founder of SafeMoon, Braden Karony, has just been sentenced to 100 months in prison.

If there’s a tech hype cycle for tokenization – you know, where every asset gets a virtual makeover on blockchains like Ethereum – we’re still in the “just getting warmed up” phase.

Goldman Sachs, that bastion of financial gravitas, has unveiled a $2.3 billion exposure to the crypto markets via the sanctified vessel of regulated spot ETFs. How quaint! The firm, ever the paragon of compliance, avoids the vulgarity of direct token ownership, opting instead for the genteel embrace of investment vehicles that whisper sweet nothings to regulators. How utterly civilized.

Just the other day, the Financial Times, that oracle of economic whispers, hinted at the European Commission’s (EC) intentions. It seems they are on a crusade to snip the strings of any crypto transactions tethered to Russia, aiming to thwart the crafty maneuvers of those who would dare to elude sanctions.

On this splendid day, February 11, our hero Hayden Adams, the founder of Uniswap, piped up on X (yes, the social media formerly known as Twitter) to announce that the gavel had struck in their favor. This case challenged the very magic that fuels automated token trading on Uniswap, like a wizard’s spell gone awry!

Industry leaders, those self-proclaimed prophets of finance, gathered to discuss the soaring demand for tokenized real-world assets (RWAs) during a panel at Consensus Hong Kong 2026. The esteemed Evan Auyang (group president at Animoca Brands), Christian Rau (senior vice president, digital assets and blockchain at Mastercard), and Nicola White (VP of crypto institutions at Robinhood) joined moderator Marcin Kazmierczak (co-founder, RedStone). A gathering you might mistake for a secret society if it weren’t for the suits and tech jargon.

To put the cherry on top, that number for Hyperliquid is nearly double what Coinbase managed to rustle up. Imagine the look on Coinbase’s face-like a dog who just found out his favorite bone was buried under a mountain of dirt!

US District Judge Eric Komitee, with a voice as steady as a Dostoevskian protagonist’s tormented conscience, pronounced the sentence after a spectacle of tears, accusations, and the hollow echoes of broken promises. “This is more like theft than fraud,” the judge intoned, his words hanging in the air like a guillotine’s blade. “Mr. Karony, rise. Your journey from crypto king to convict is complete.”

Lors d’un entretien marathon de deux heures dans le Podcast All-In, notre cher Changpeng Zhao (CZ) a partagé des réflexions sur sa vie, depuis ses humbles débuts en tant qu’immigrant chinois au Canada jusqu’à ses exploits dans le monde fabuleux des cryptomonnaies. L’animateur, Chamath Palihapitiya, a pris grand soin de ne pas s’endormir pendant ce récit palpitant.