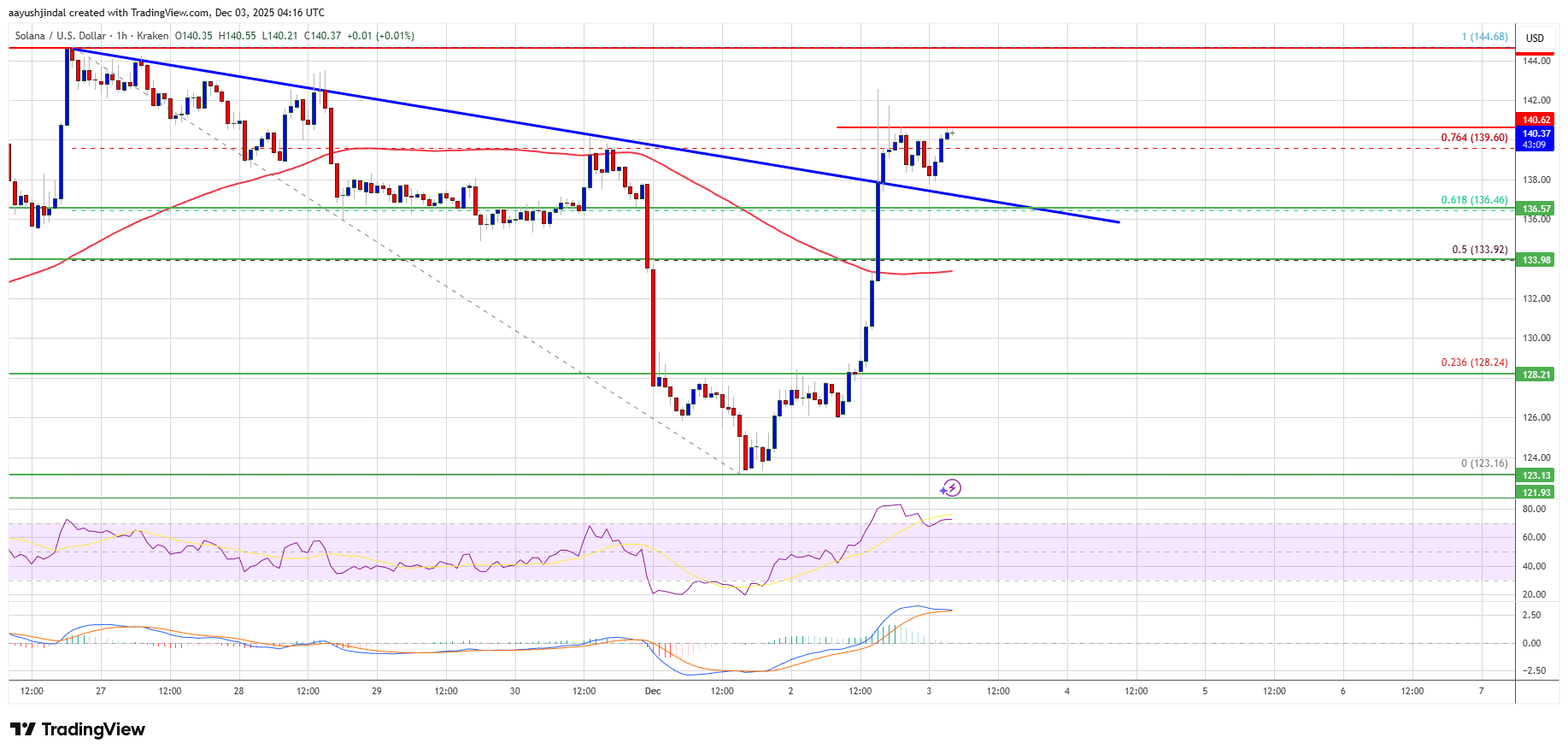

Solana’s Miraculous $135 Comeback – Or Just a Witch’s Trick? 🧙♂️💰

Near $130, Solana paused-like a man tripping over his own boots-gazed upon Bitcoin and Ethereum’s noble strides, sighed, and muttered, “Fine, I suppose I’ll try too.” And lo, it pushed past $135 with the quiet dignity of a Cossack who’s finally remembered where he left his saber. 💂♂️