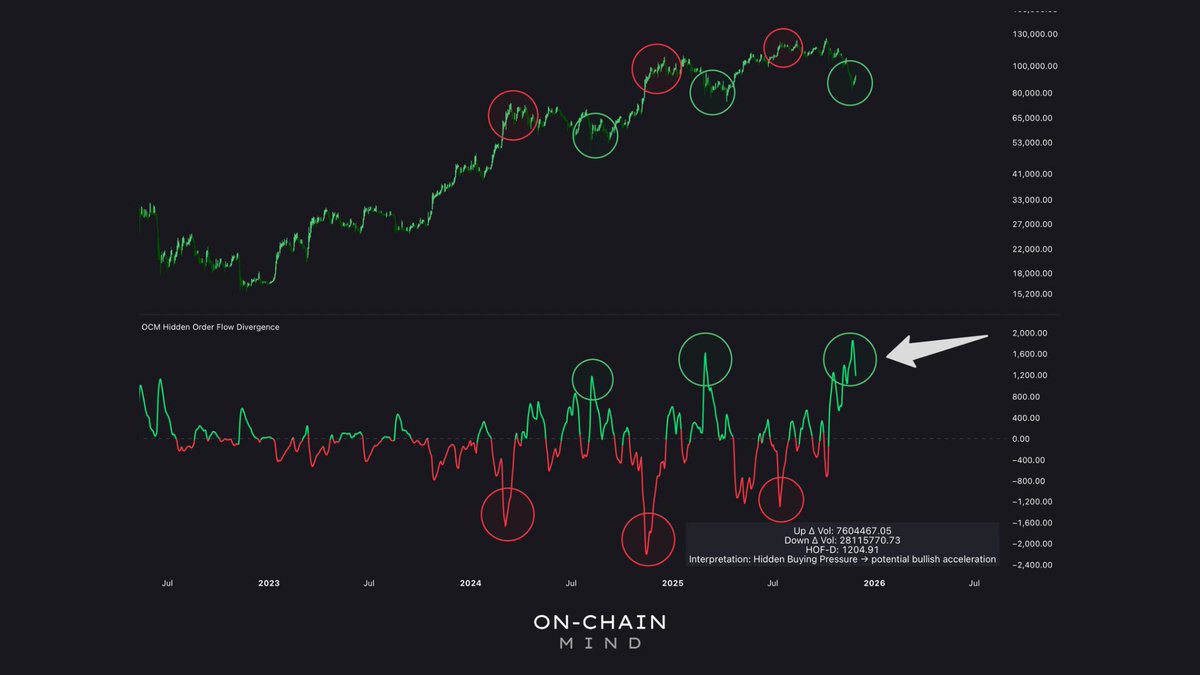

Bitcoin’s Bizarre Drop: Japanese Bonds Cause Chaos, But Is $75K Next?

Enter the hero of this rollercoaster ride: Japanese government bonds. Yes, you heard that right, bonds. Market expert Shanaka Anslem has waved his sword at what he calls “the weapon” behind this latest fiasco. And if you think he’s kidding, think again.