Bitcoin’s Coffee Break: Will It Wake Up or Nap Forever?

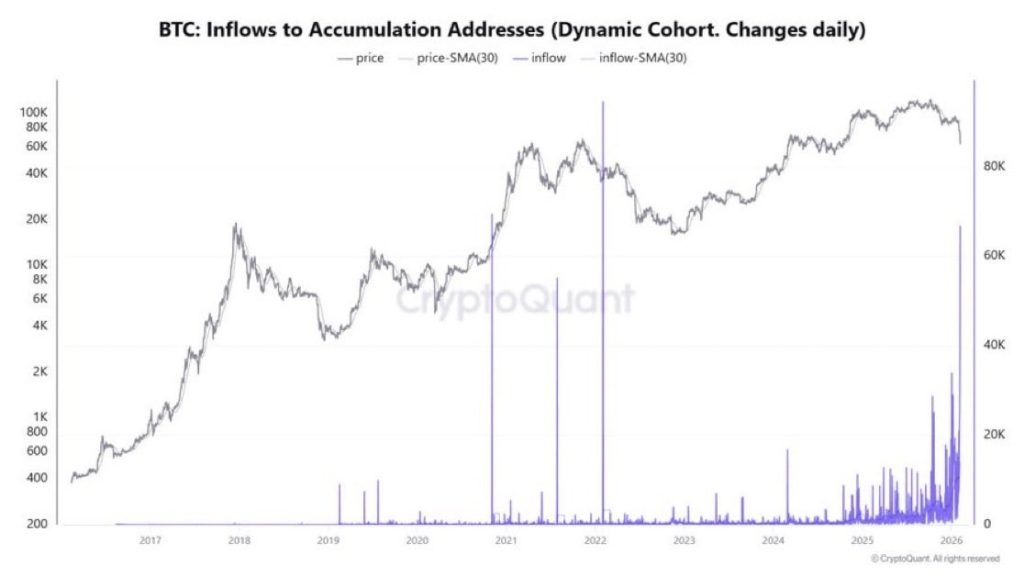

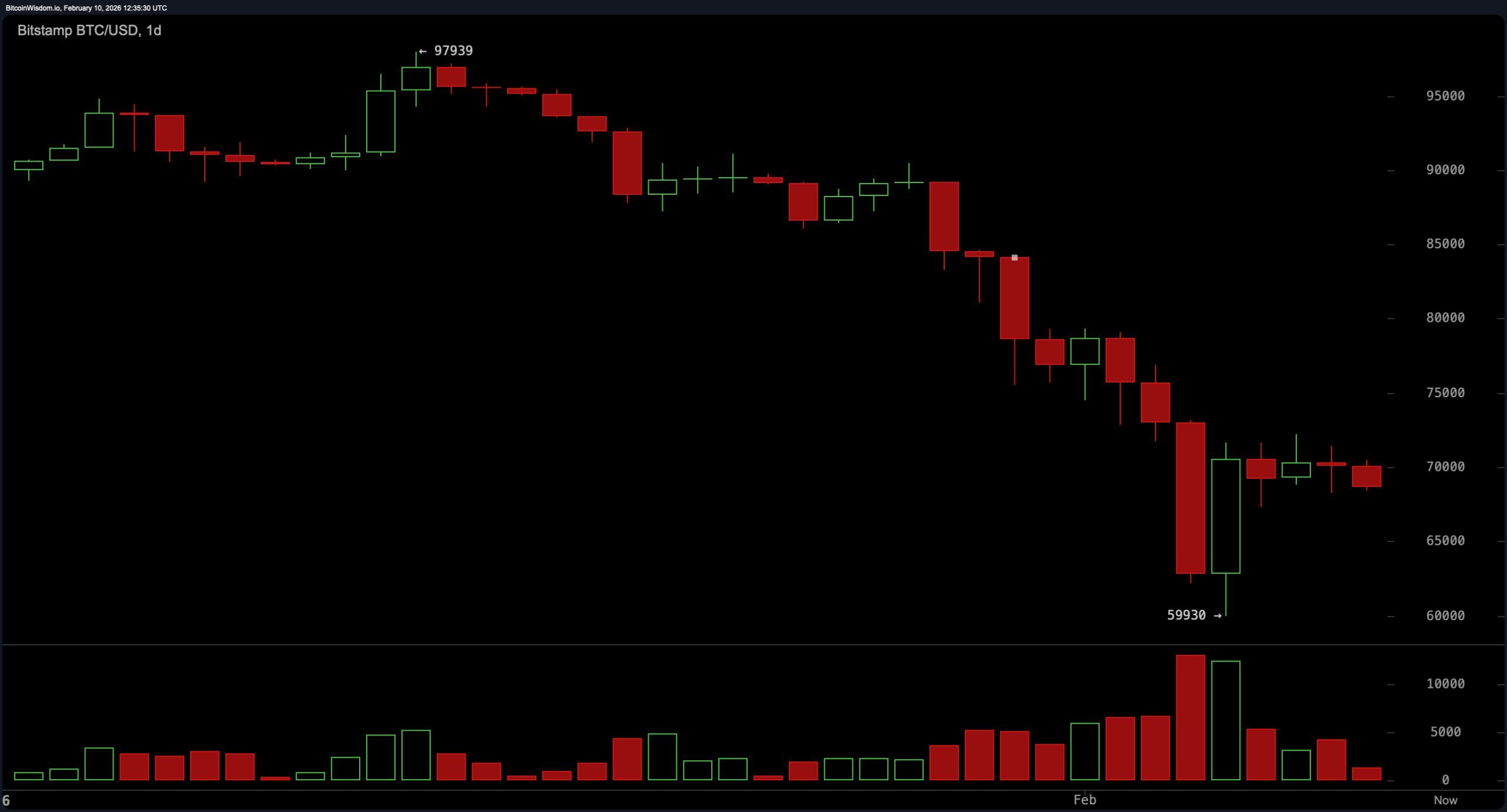

Let us not deceive ourselves with illusions of grandeur. Bitcoin’s daily chart is less a symphony of progress and more a dirge of stagnation. It lingers below key resistance, nursing bruises from its fall beneath $97,900. The $68,000-$70,000 zone? A sanatorium for battered bulls, not a launchpad for heroes. The true pulse beats at $60,000-$62,000, where the last remnants of hope cling like factory workers to their wages. Until $75,000 is breached with conviction, optimism remains a distant, mocking specter.