Crypto news

SoftBank’s PayPay & Binance Japan: A Crypto Pact!

This union, fraught with the promise of progress, allows users of Binance Japan to procure cryptocurrencies using the funds of PayPay, a marvel of modern technology. And lo, they may also withdraw their digital treasures directly to PayPay, as if the very gods of finance have smiled upon them. 💰

Bitcoin’s Plunge Sparks Fierce Debate: Will the Next Bull Run Happen This Year or in 2029?

What’s truly surprising is the huge disagreement among top analysts about where Bitcoin is headed – this level of uncertainty hasn’t been seen in the industry for a long time.

Algorand & Coinify: USDC’s New Digital Love Story 🚀

Algorand is now fully entwined with Coinify. This partnership enables USDC payments and settlements. Consumers can use USDC to make direct payments on Algorand at checkout. This is processed through the Coinify gateway. Merchants can also get settled in USDC on Algorand. This is even the case when customers are using other cryptocurrencies. Coinify handles more than $140 million a year for more than 60,000 merchants.

PayPay & Binance: Crypto Meets Cash in Japan 🚀

PayPay, the payment service that’s basically a glorified wallet for your spare change, is now operated by SoftBank Group. A Japanese investment holding company that’s probably just waiting for the next bubble to burst. But hey, at least their crypto fees are lower than their customer service. 😅

Nvidia’s AI Mirage: Burry & Thiel Bet on the Bust 🤑💥

The first act unfolds with a dissonance between numbers and reality. Nvidia’s unpaid customer bills, a veritable cornucopia of $33.4 billion, have grown like ivy on a crumbling wall. Customers now take 53 days to settle their debts, a delay that would make a patient saint twitch. Meanwhile, the company hoards $19.8 billion of unsold chips, claiming demand is “through the roof” while the roof itself is nailed shut. 😂💰

Altcoins Rise as Bitcoin Falls: Gorky’s Take!

Despite the chaos, these ETFs have not once shed a single drop of outflow since their birth, a rarity in this sea of despair. A beacon of hope, or just a fleeting spark? 🌟

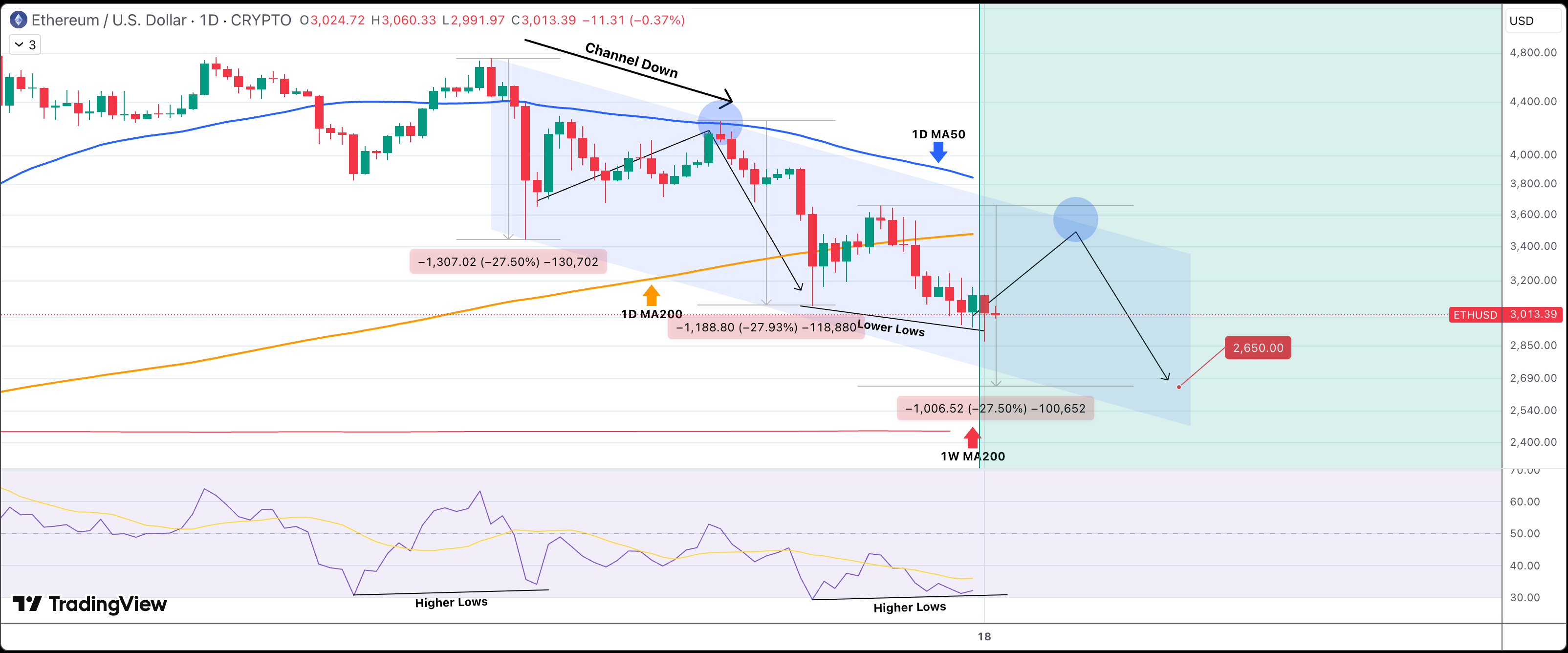

Ethereum’s Big Bounce? Yeah, Sure. Here’s The Real Deal. 🧐💸

This crypto analyst, TradingShot, I mean, who names these guys? Anyway, he says Ethereum’s been in a free fall since early October, falling about 27.5% twice-impressive, huh? First it hits a high, then crashes down, rinse, repeat. The latest? It dips below $3,000, and everyone’s like, “Oh, maybe it’s turning around.” But let’s be honest, that might just be a mirage. Short-term optimism, long-term misery. Classic.

John Woods’ Only Rule to Save Bitcoin from Quantum Catastrophe! 😂

Woods, with the confidence of a man who has already solved all of humanity’s problems (except maybe world peace), tells us the only thing standing between Bitcoin and quantum doom: don’t spend it. Yes, you heard that right-just don’t spend your precious BTC. That’s the key to keeping it safe from the death grip of quantum computers. Simple, no? In his view, any Bitcoin that is transferred to a new account and left untouched is entirely safe from quantum mischief-at least for now.

Pi Coin Surprises Market: The Unlikely Hero in a Red Sea of Crypto 💥🤡

Even after today’s 5% dip, Pi’s monthly chart shows a resilient spirit-like a stubborn mule that refuses to die. It’s only 6.5% away from doing a glorious breakout, as if it’s playing hard to get-such suspense! 📉🥳