Ark Invest Dives into Crypto Stocks Like a Swimmer in a Shark Tank 🦈💸

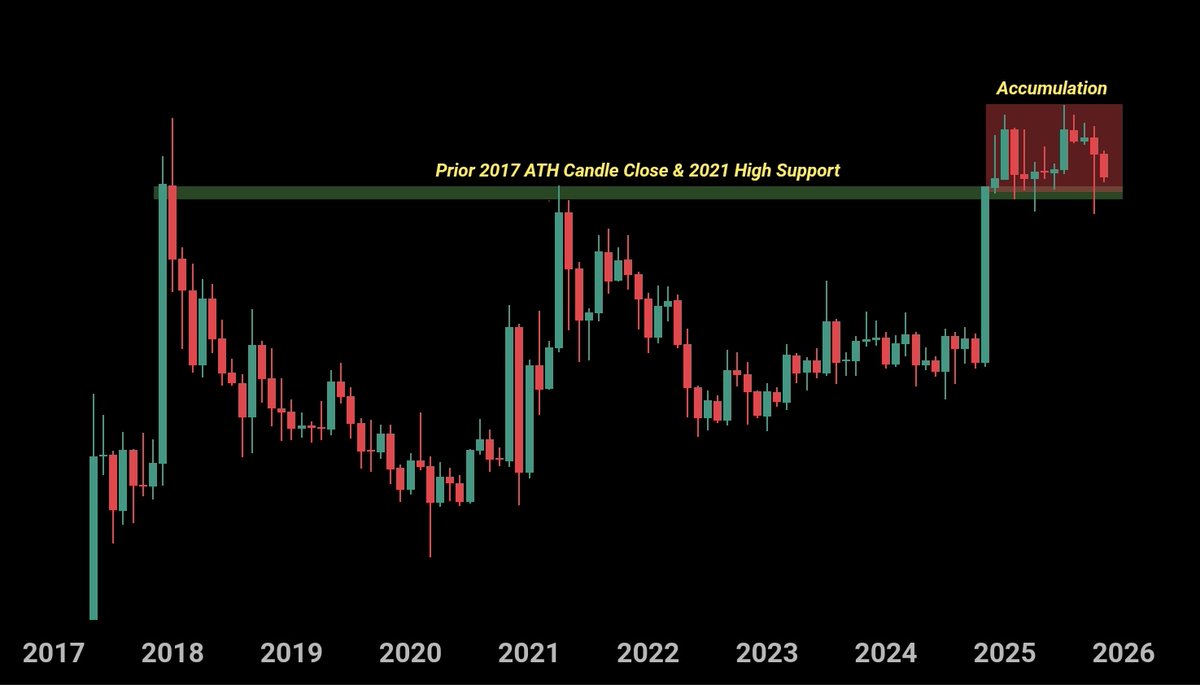

Apparently, this was all part of their routine portfolio rebalancing, which is corporate code for “charge headfirst into chaos, as per usual.” Meanwhile, the market’s chorus of crying meow continuously signals that crypto stocks are as popular as a fart in an elevator – BMNR, for example, is down by 9.52%, now trading at $29.18, perhaps contemplating its life choices. BLSH took a 3.63% tumble to $36.39, and CRCL closed at $69.72 after an 8.98% nosedive. Share prices are tumbling faster than a sumo wrestler in a bathtub, yet Ark Invest’s mammoth purchase says, “Yes, please, more dips!”