XRP’s Panic Selling: Holders Crying Over Spilled Crypto

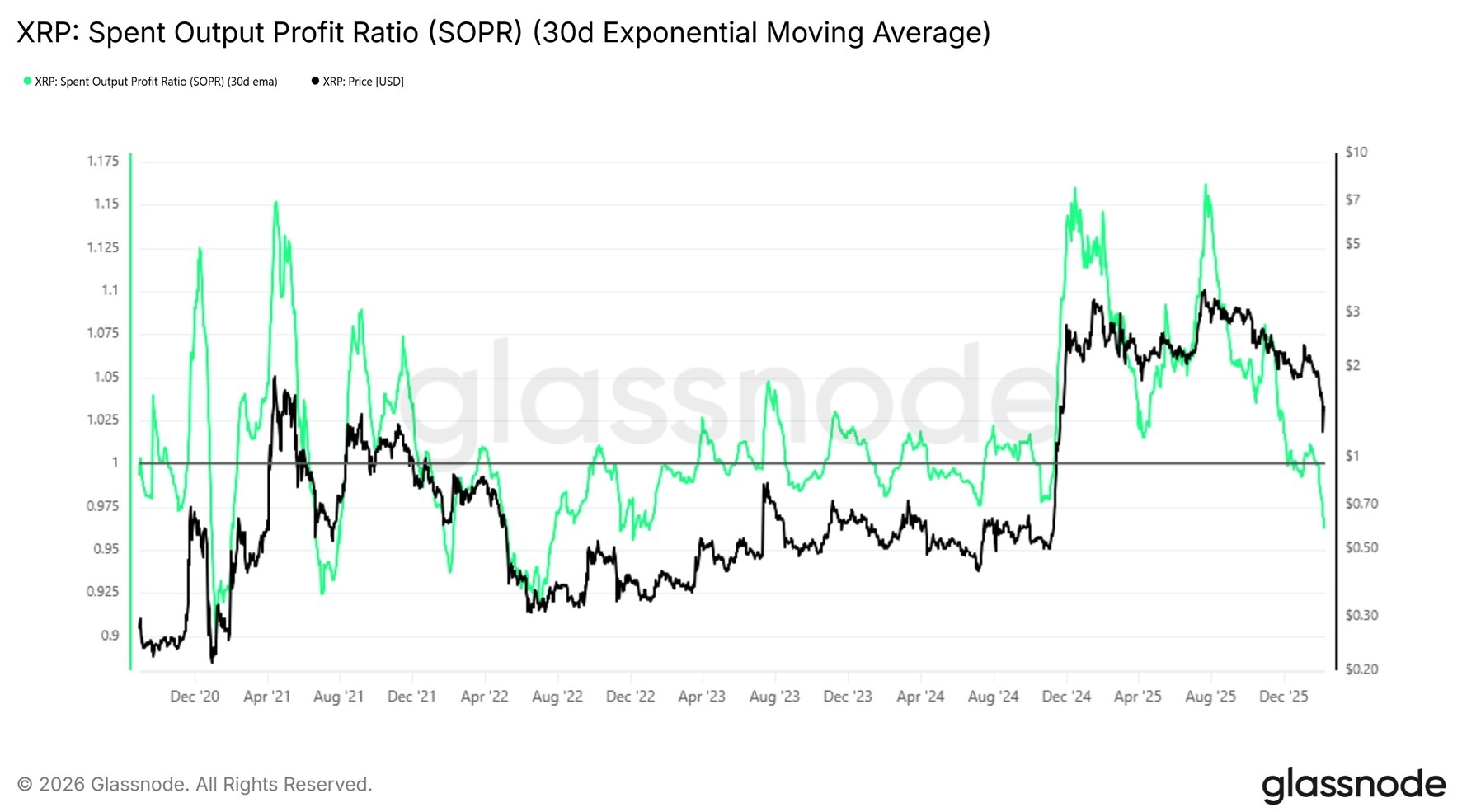

According to a delightful analysis shared by the oh-so-reputable Glassnode on February 9, XRP is showing signs of crumbling profitability. Apparently, the cost basis has broken down faster than my willpower at a dessert buffet.