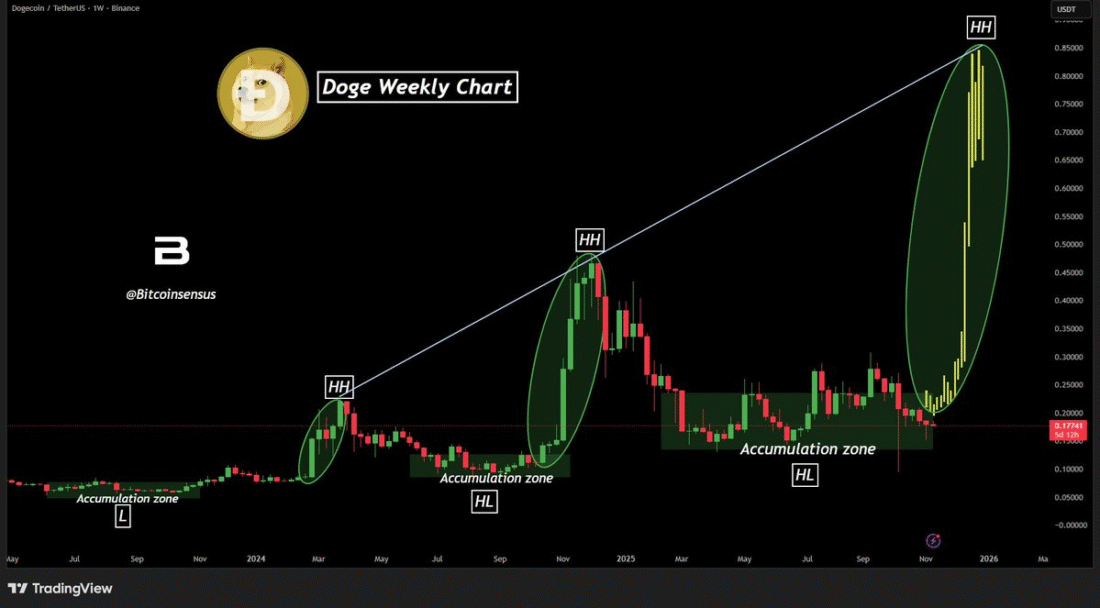

🚀 Doge to the Moon Again? 2021 Déjà Vu or Just Wishful Barking? 🐶

Dogecoin, the memecoin with more lives than a Discworld cat, is quietly hoarding gains like a squirrel with a nut obsession. According to the wizards at CoinMarketCap, it’s up 7.7 percent, trading at a modest $0.176, with a market cap of 26.7 billion clams. 🤑 That’s right, folks, the Doge is back, and it’s got its nose to the ground, sniffing out another surge.