LEO Surges 17%: Real Conviction or Just Beta Chasing?

Bitcoin, meanwhile, managed a 5.66% ascent, and the total crypto market cap crept 5.33% higher-a parade of numbers marching in lockstep, while the crowd pretends not to watch the feet.

Bitcoin, meanwhile, managed a 5.66% ascent, and the total crypto market cap crept 5.33% higher-a parade of numbers marching in lockstep, while the crowd pretends not to watch the feet.

On that fateful Friday, the Ethereum co-founder Vitalik, in a fit of altruism or perhaps whimsical fancy, bestowed upon Shielded Labs a second round of funding. This act, intended to hasten the development of Crosslink for the Zcash network, shifts it from mere idle speculation into a pulsating, incentivized testnet.

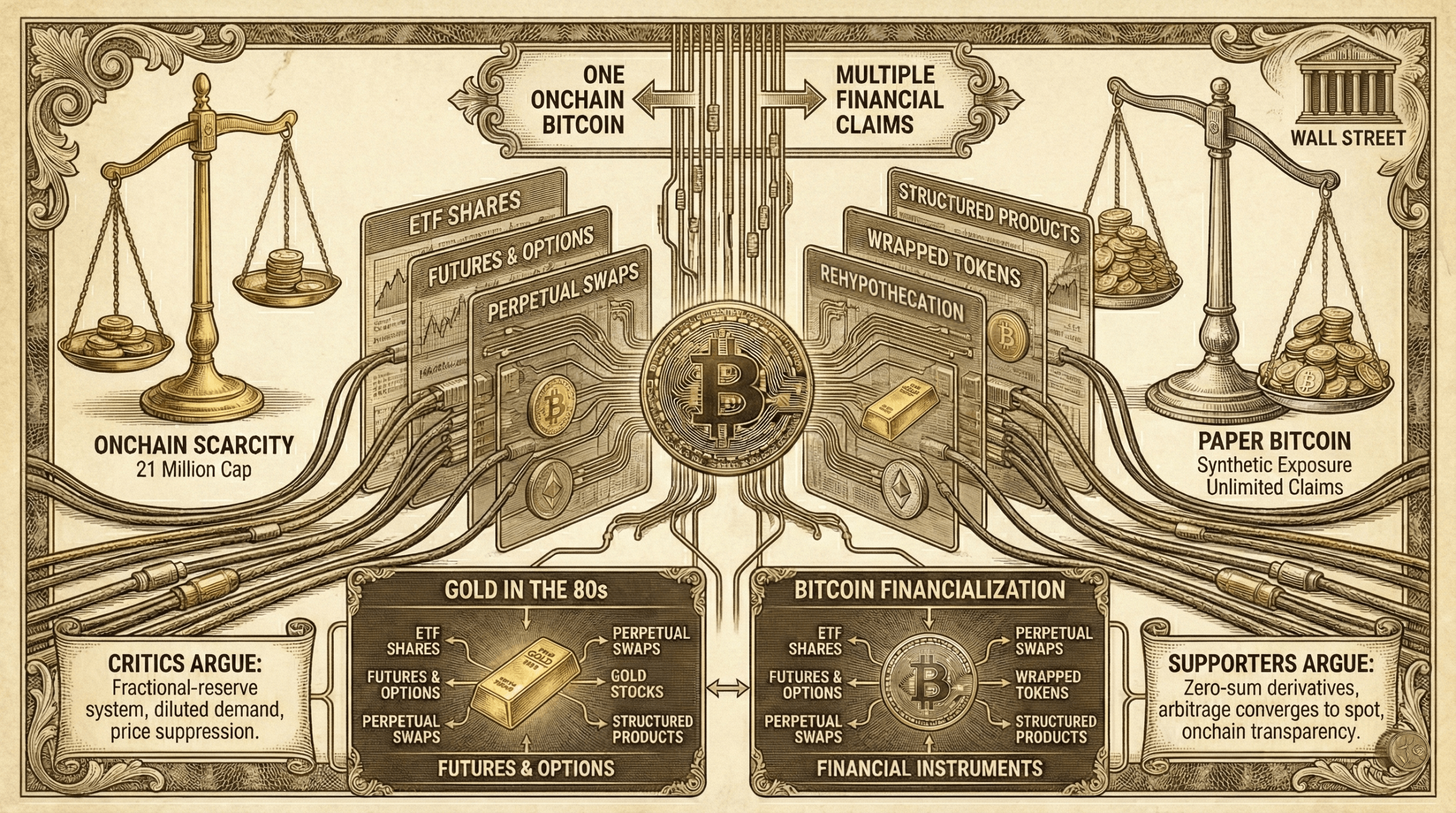

The discourse has crescendoed as bitcoin’s price plummeted, even as institutional interest, ETFs, and derivatives markets swelled. Critics, with the fervor of modern-day alchemists, insist that bitcoin’s fixed onchain supply remains a mythic relic, while price discovery now resides in off-chain layers of synthetic exposure, a system resembling a fractional-reserve bank rather than a scarce digital asset.

Yet not every fall in mood translates into an exodus of tenants. When conviction remains, investors stash their money elsewhere, like a wary landlady hiding the silverware, waiting for conditions to tilt back toward risk-on and for the street loiterers to forget their rudeness.

Yes, indeed! The officials have deemed it wise to treat crypto transactions with the same gravity as stock trades, rather than allowing them the carefree nature of casual peer-to-peer exchanges. Remarkably, this levy is set to apply even when one walks away from a trade without so much as a single gain in their pocket!

The daily chart paints a parable of hubris and collapse. After the failed ascent to $97,900-a peak as ephemeral as a mirage-the market plummeted to $59,930, a wick of despair. The rebound? A reflexive twitch, not a resurrection. Volume surges like a last gasp, then fades into the void. Such is the rhythm of panic and pretense, a dance where no one believes the encore.

On February 6, as fate would have it, Lookonchain-a noted oracle in the land of crypto chatter-revealed that our dear Bithumb had played the role of the jester and accidentally transferred not 2,000 KRW (a trifling $1.34), but a whopping 2,000 BTC (that’s around $134 million, if your math is as good as mine) to certain lucky recipients. Naturally, these fortunate souls didn’t waste a moment and promptly sold their newfound riches, triggering a delightful little flash crash that sent prices tumbling down by a whole 10%. Prices dipped to around $55,000, making many a heart skip a beat!

This update explicitly authorizes futures commission merchants (FCMs) to accept stablecoins issued by national trust banks as margin. Because nothing says “financial inclusivity” like a government agency finally realizing they accidentally excluded a whole class of institutions.

On a Thursday, when the world was busy with its trivialities, Reuters proclaimed that Sberbank, the behemoth of Russian assets, is poised to offer crypto-backed loans to its corporate vassals. The bank, ever the diligent servant of progress, is meticulously crafting the infrastructure and methodology required for this grand expansion, all while bowing to the Central Bank of Russia (CBR) for regulatory blessings.

One might wonder whether this unfortunate decline shall continue its downward spiral or if a recovery, however meager, shall soon be in sight.