Bitcoin Crashing? Peter Schiff’s Predictions Are So 2025 😬

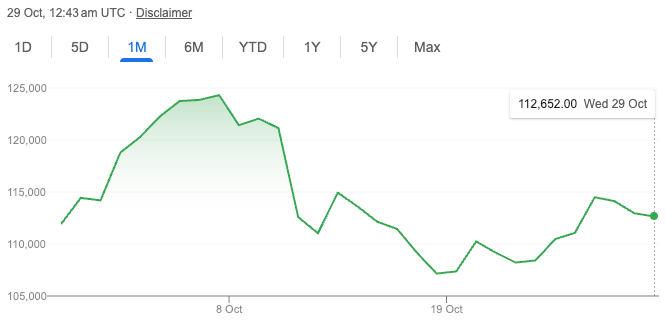

And guess what? There’s no real reason for this disaster! Just “profit-taking” over the weekend? Because who wouldn’t panic-sell after a week of pretending crypto is a real thing. And where are the fundamentals? Oh right, there are none. It’s just people hoping Elon tweets something stupid. 💀