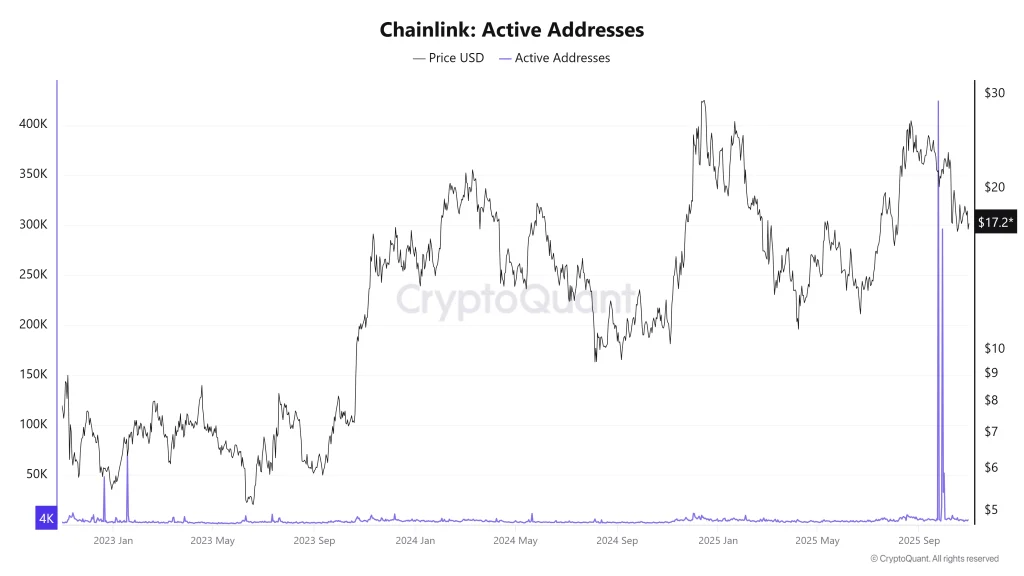

Chainlink’s Plunge: A Tale of Woe, Whales, and 🤡🤸♂️

Yet, amidst this gloom, there glimmers a faint ray of hope. Virtune, in its wisdom, hath embraced Chainlink’s Proof of Reserve, and ONDO hath anointed LINK as the oracle for its tokenized securities. Alas, the path ahead is fraught with volatility, and the fate of this beleaguered asset hangs in the balance. Will it rise like a phoenix from the ashes, or shall it be consigned to the annals of forgotten tokens? Only time, that implacable arbiter, shall tell. ⏳