Bitcoin’s Emotional Breakdown: Is It Throwing a Tantrum or Just PMS-ing?

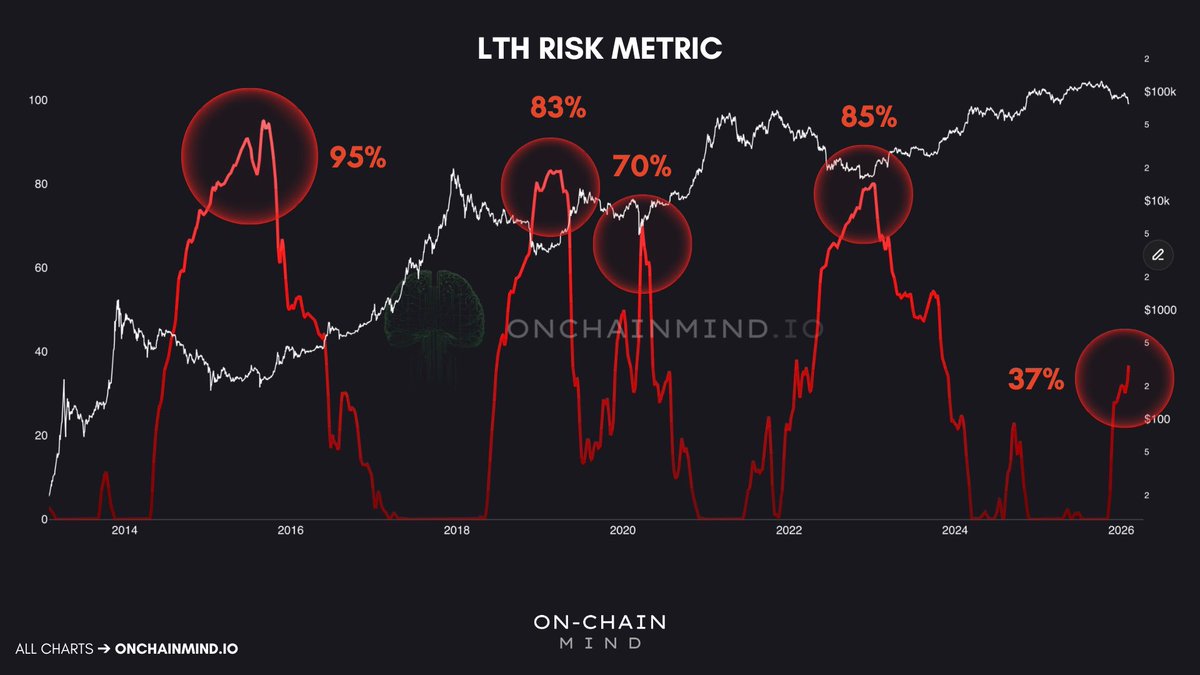

According to the ever-so-wise On-chain Mind (who sounds like a mystical guru but is probably just a guy with a laptop), Bitcoin’s price is about as reliable as a weather forecast in Britain. The real tea? It’s all about holder behavior. Long-term investors are usually the cool cucumbers of the crypto world, but when they start sweating, you know it’s serious. Like, “Where’s my fainting couch?” serious.