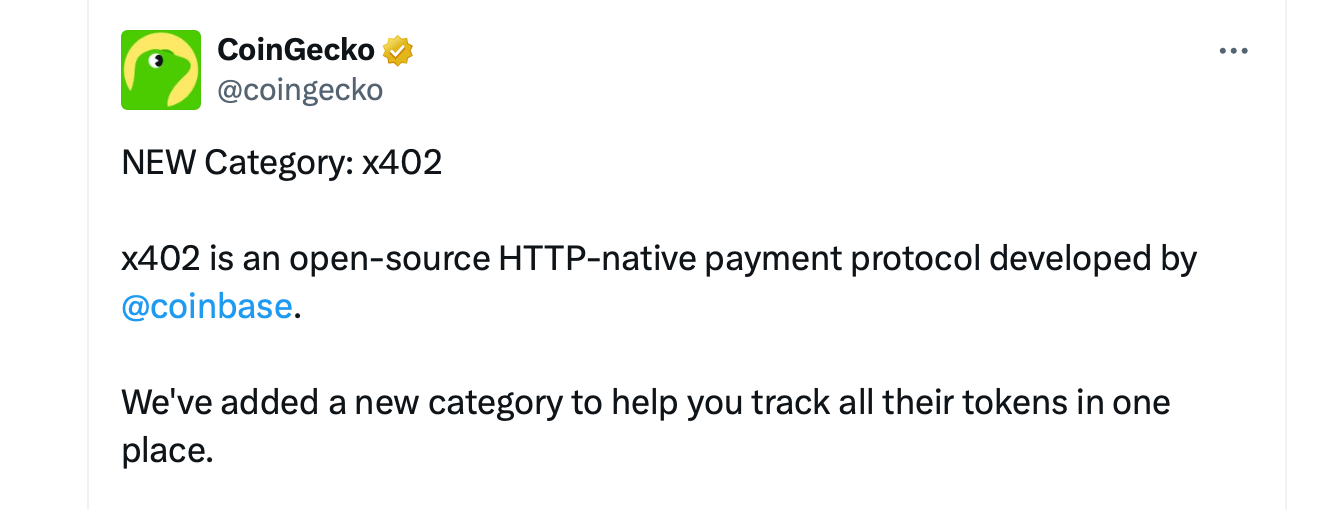

AI Micropayments Just Got Wild: Meet x402 (Yes, It’s Real) 💸

x402 is Coinbase’s open-source genius plan to weaponize the HTTP 402 status code-a relic so old it probably still uses dial-up. In layman’s terms: websites, APIs, and AI bots now demand cash (usually USDC) mid-conversation. “Hey, I’ll fetch that data… for a fee.” 💸