Is Crypto’s Bull Run Dead? Lekker Capital CIO’s “Don’t Miss The Forest” Warning 🌲📉

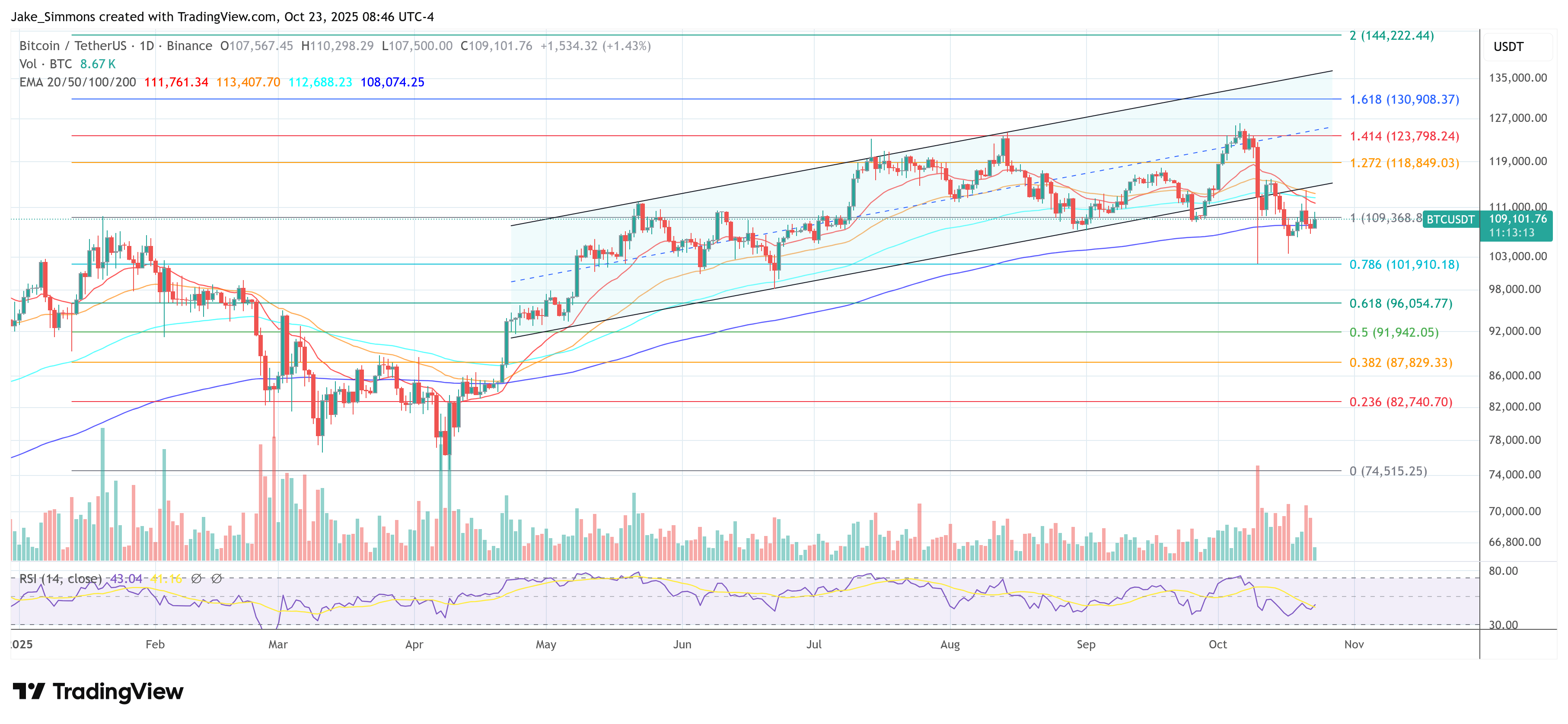

Thompson’s thesis, as delicate as a moth’s wing, insists the October 10 open-interest purge was not a death knell for Bitcoin and Ethereum, but a prelude to a grander tale. “Behold! The positioning here is rare-a tempest of liquidation on the cusp of macro ‘goldilocks’,” he wrote, comparing the event to a Trumpian victory in 2024. “A 10/10 liquidation, cleansing leverage more fiercely than the entire Jan-Apr ’25 saga,” he declared, as if summoning a storm to clear the air.