Robinhood Gets Wild with BNB and HYPE – Here’s What’s Next! 😱🚀

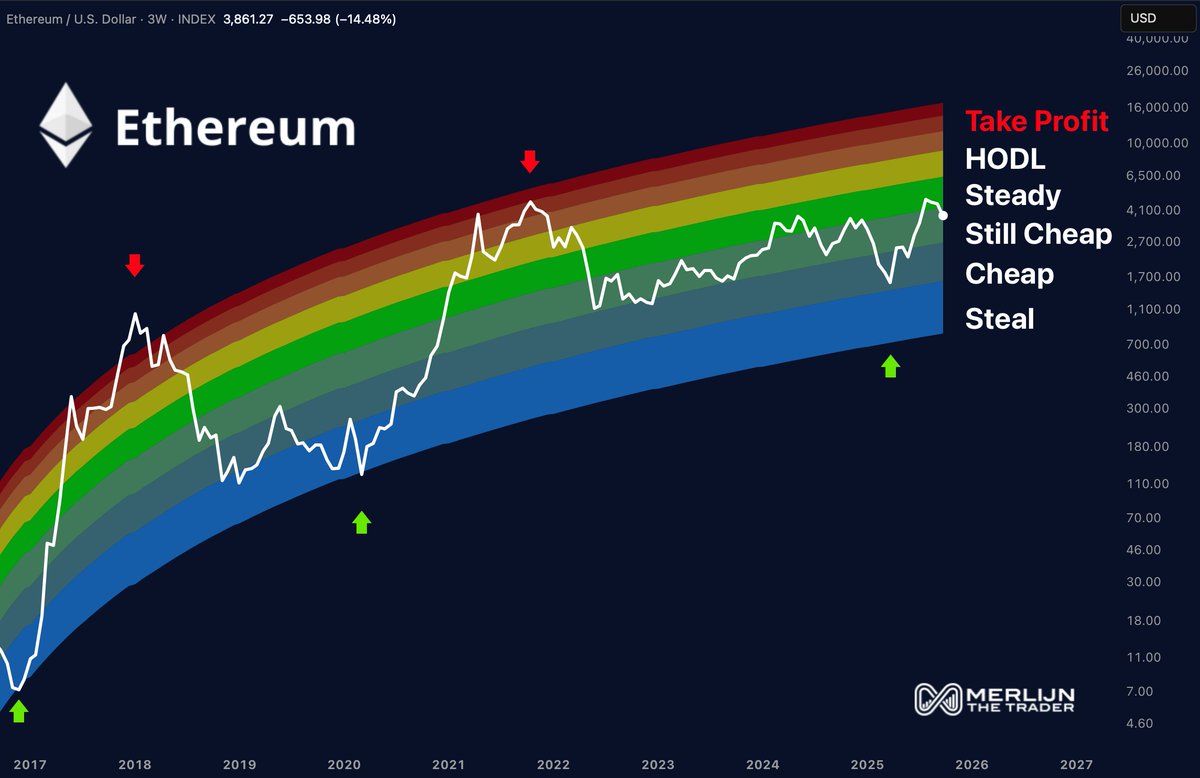

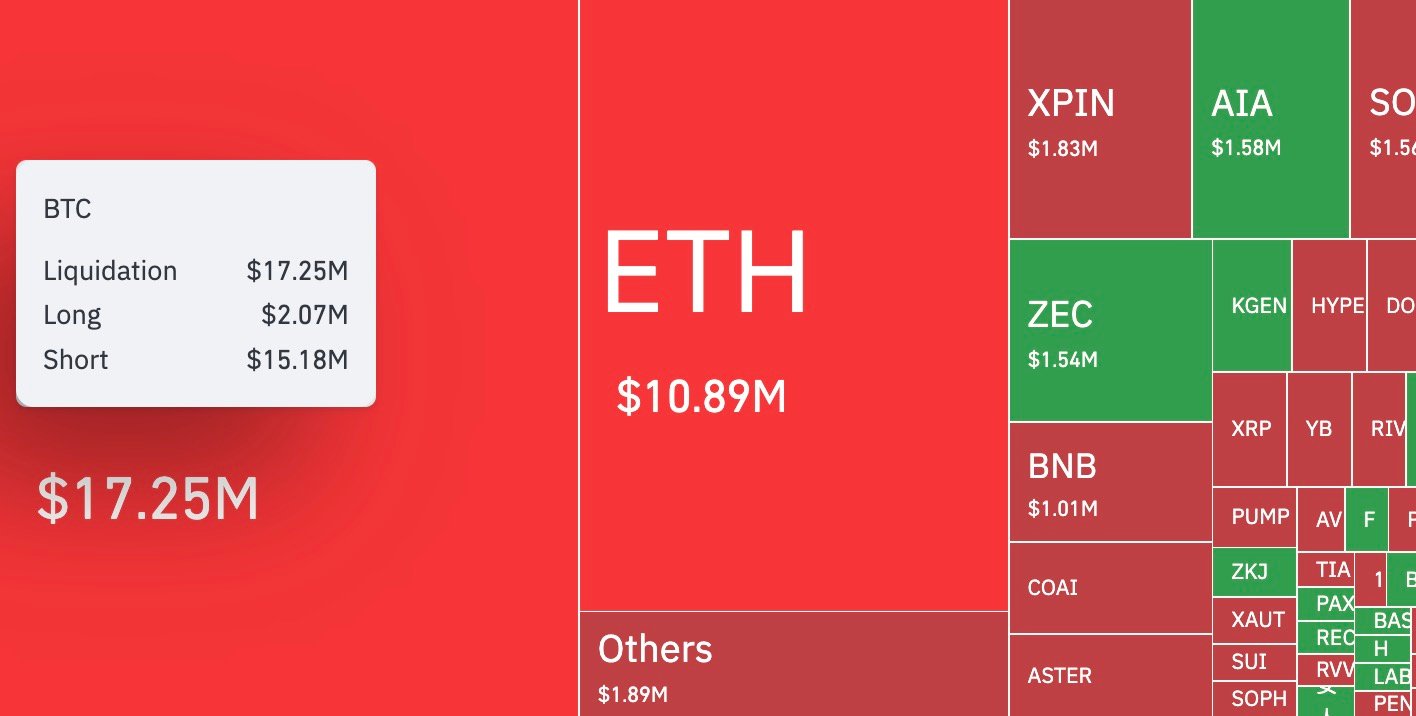

With a staggering 26 million users, Robinhood has become the playground for wannabe Wall Street wolves (or perhaps sheep? 🐑). And now, they’re adding BNB to the mix, which means your portfolio can finally be as complicated as your Netflix recommendations. Other crypto options already on the platform include the classics-Bitcoin (BTC), Ethereum (ETH), and that Dogecoin you pretend to understand. No biggie.