How high can DOGE price go when a Dogecoin ETF is approved?

The Rex-Osprey DOGE ETF is expected to launch this week.

The Rex-Osprey DOGE ETF is expected to launch this week.

In this grand ballet of finance, institutions can pirouette through spot and derivatives trades on Bybit while their precious assets recline safely in the vaults of Sygnum-off-balance sheet, no less! And what’s this? Balances updated in real time? Profit and loss settled every eight hours? Sacré bleu! It is as if convenience itself has donned a powdered wig and taken center stage.

Here’s every move Cathie Wood and Ark Invest made in the stock market yesterday 9/8

The announcement not only cleared months of feverish speculation, but also shattered all reasonable expectations. Who knew that something as simple as a blockchain could leave us all questioning the meaning of life?

“There’s a large-scale supply chain attack in progress,” declared Guillemet, with the solemnity of a man announcing the arrival of locusts. “If you wield a hardware wallet, scrutinize each transaction like a philologist parsing ancient runes-then you’re safe. If not, refrain from blockchain frolics for the nonce.”

Eightco Holdings, who clearly woke up one morning thinking, “Why not?” revealed plans on Monday for a share sale aimed at hauling in roughly $250 million to pioneer a “first-of-its-kind Worldcoin treasury strategy.” This involves a private placement of exactly 171.23 million common shares priced at the humble asking price of $1.46 each-because apparently, getting that many shares typed out *just so* is important to the process.

This opinion piece comes to you courtesy of James Murrell, a seasoned crypto wizard with over six years of experience navigating the choppy waters of fintech startups. James began his blockchain odyssey in 2013, though we suspect he didn’t predict NFTs of pixelated apes back then 🐒.

On the eighth day of September (which may or may not be portentous, but it certainly sounds official), Coinshares International Ltd. (that’s Nasdaq Stockholm: CS for those who collect ticker symbols like rare stamps, and US OTCQX: CNSRF for everyone else) revealed plans to perform the magical corporate dance known as “merging with a SPAC”-specifically, Vine Hill Capital Investment Corp., which already lurks on Nasdaq like a well-funded goblin waiting in the wings.

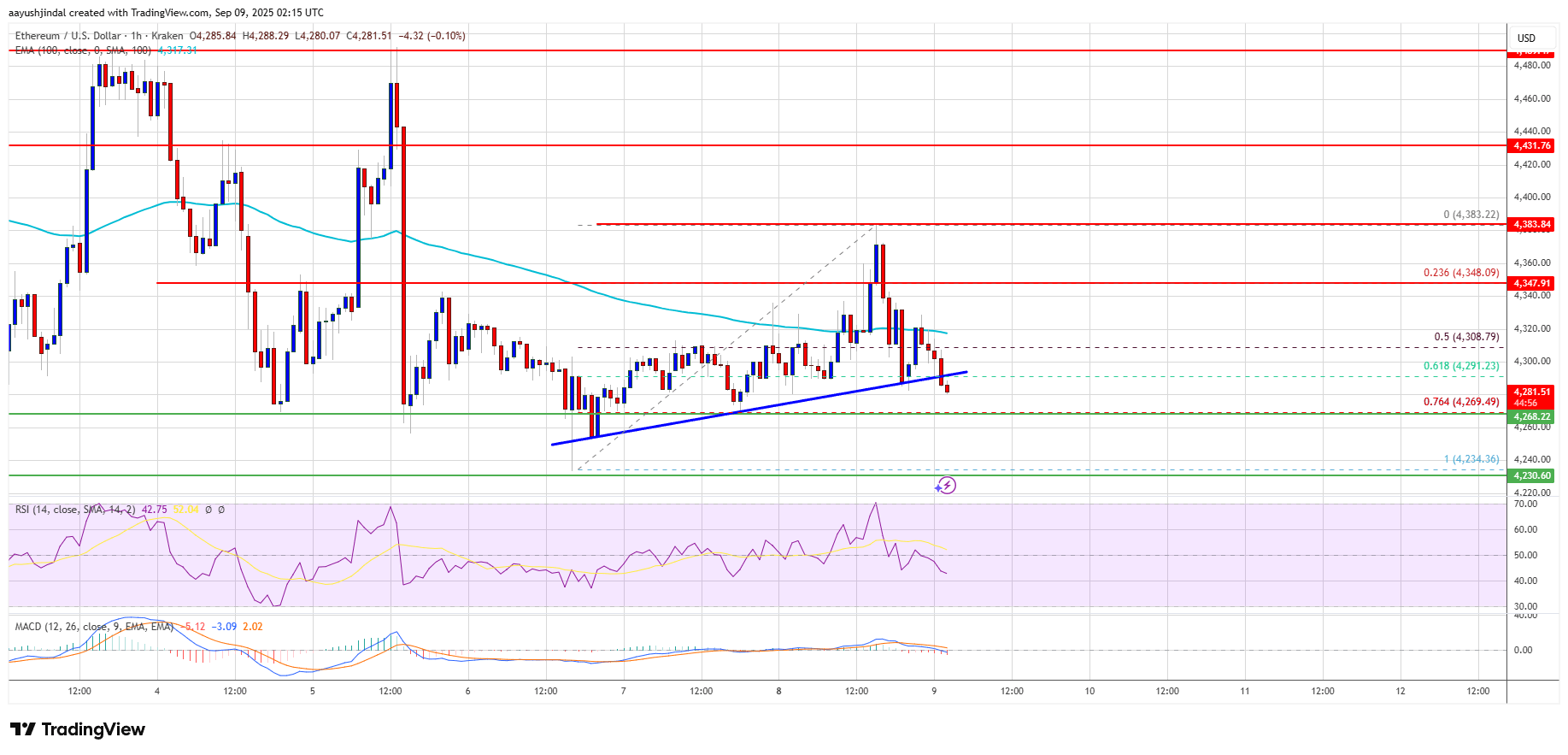

Once, our hero ETH, with a glimpse of optimism ignited, surged forth above the $4,220 zone, mimicking the enigmatic journey of Bitcoin. Climbing with ambition over the $4,300 and $4,320 guids, the bears suddenly emerged, as disinterested onlookers at a tedious play.

In a statement dripping with corporate jargon, the Singapore-based company announced its plan to “gradually” exchange its SOL and SUI holdings. Why? To “take advantage of market volatility,” of course. Because nothing says “stability” like riding the rollercoaster of crypto prices while humming a cheerful tune. 🎢 CEO Wilson Wang described this as a “disciplined accumulation process,” which sounds far more dignified than “we’re gambling everything on a blockchain trend.” Bravo, sir. Bravo. 👏