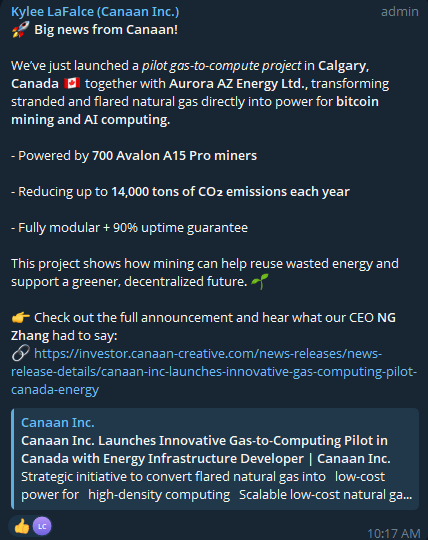

🚨 OpenSea’s SEA Token: Link or Miss the Crypto Treasure Chest! 🚀

In a post on X (formerly known as Twitter, but who’s keeping track? 🤷♂️), OpenSea dropped a bombshell: “Connect your EVM wallet by October 15 or miss out on the biggest rewards since sliced bread!” 🍞 Apparently, if you’re still logged in via Solana or Web2, you’re basically getting the NFT equivalent of a participation trophy. 🏆 And let’s face it, nobody wants that.