Crypto Stocks: Boom or Bust? 🎢💰

As the winds of sentiment shift, investors, ever the optimists, now turn their gaze to the stocks that might ride this wave, or perhaps, drown in its wake. 🌊🤡

As the winds of sentiment shift, investors, ever the optimists, now turn their gaze to the stocks that might ride this wave, or perhaps, drown in its wake. 🌊🤡

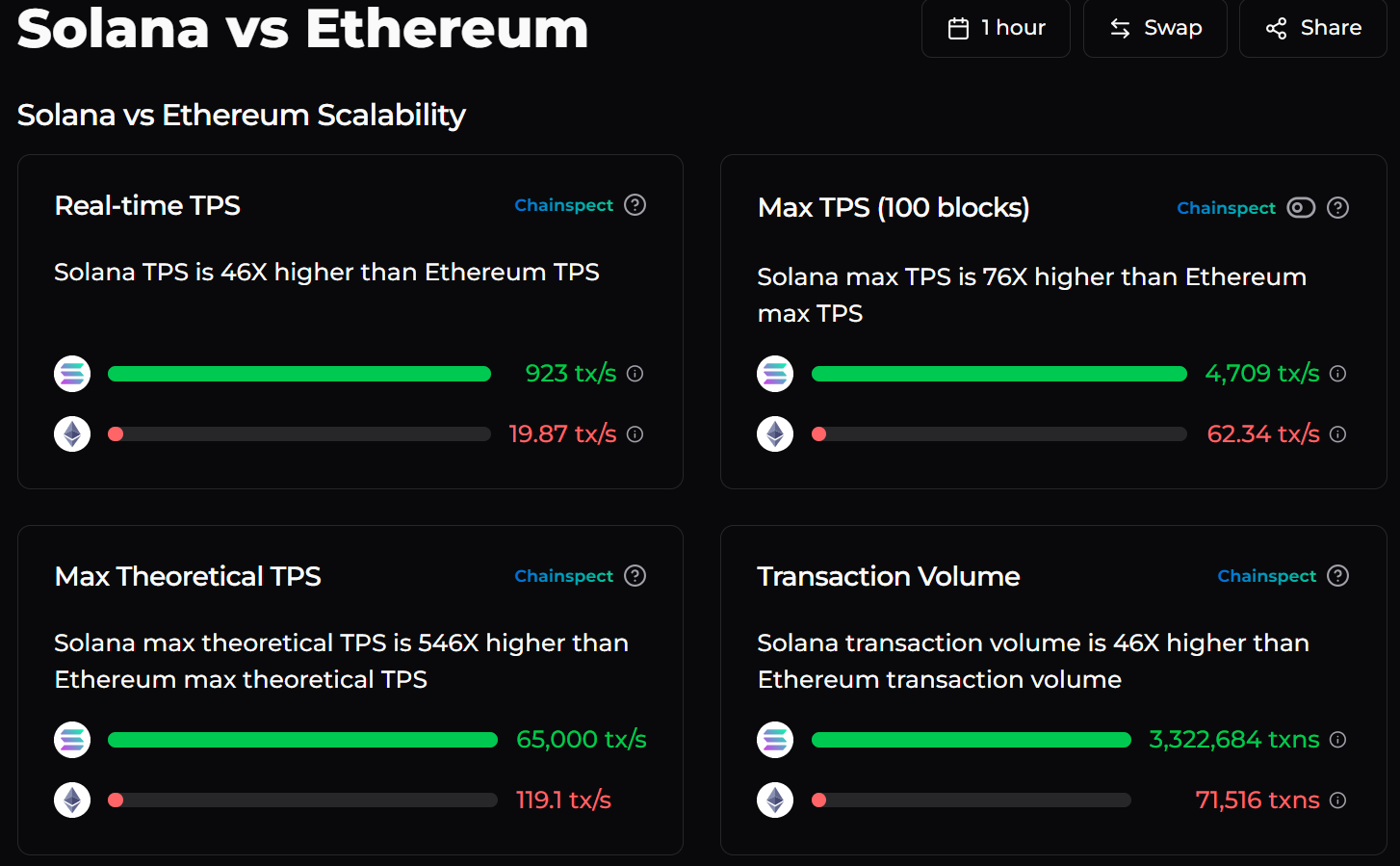

Bitcoin’s dominance is like, sooo last year. Ethereum’s looking ready for a huge breakout (maybe), and tokens like Cardano, Solana, and Chainlink are in that “should I start planning for a party or what?” phase. Basically, they’re giving off major rally vibes. Will they deliver? Only time will tell – and let’s be honest, who has time for patience?

“What folly is this?” one might imagine him exclaiming, as he pointed out how a single bot sent nearly eleven million transactions within thirty days, wherein 99.95% met with failure. Such an assertion could only inspire mirth among those who delight in observing rival networks exchange barbs over block sizes and consensus mechanisms.

Hyperliquid, in a Friday Discord missive that felt more like a wanted poster, declared its desire for a “Hyperliquid-first” stablecoin. Native Markets fired the first shot, suggesting Stripe’s Bridge payment processor handle the job. They promised to toss some reserve proceeds into Hyperliquid’s Assistance Fund treasury, mint directly on the ecosystem, and stay squeaky clean with regulators. But oh, the drama was just beginning.

Justin Sun, the self-styled Tron czar, threw a party for this event, waving his hands and proclaiming that at last, the splendid plebs have a decentralized stablecoin to call their own on Ethereum.

So, as of Sept. 7 at 8:30 p.m. Eastern (because timing is everything when you want to brag), Bitmine drools about a total stack north of $9.21 billion. They’re holding on to 2,069,443 ether (priced at a casual $4,312 each), 192 bitcoin (BTC), and wait for it – $266 million in cash, no strings attached. They’re trading on the NYSE American under ticker BMNR, which sounds like a robot trying to say “bit mine.” Oh, and yeah, they just HAD to put this in a press release on Sept. 8.

Buying 21 bitcoin for Bitcoin Day. – Nayib Bukele (@nayibbukele) September 7, 2025

What has stirred the pot, you may ask? In the month of August 2025, Bank Frick, with a flourish worthy of a seasoned maestro, managed to process a staggering $15.4 million worth of transactions in the form of the beloved POL token. This monumental feat, akin to a small village suddenly finding itself the center of a bustling metropolis, speaks volumes about the growing influence and acceptance of Polygon within the hallowed halls of traditional banking.

The launch is scheduled for this month, likely just in time for everyone’s monthly existential crisis about whether Bitcoin is going to zero or mooning. Apparently, the brand partnership is with Uphold, the trading platform, who must be delighted to discover there will soon be a new way for people to lose their money, but with much lower fees. Stelios claims this is badly needed since, shockingly, big exchanges like Binance aren’t exactly falling over themselves to offer discounts. So altruistic of him, really: crypto, but cheaper. Almost sounds like a Ryanair promo, if Ryanair understood anything about crypto or feelings.