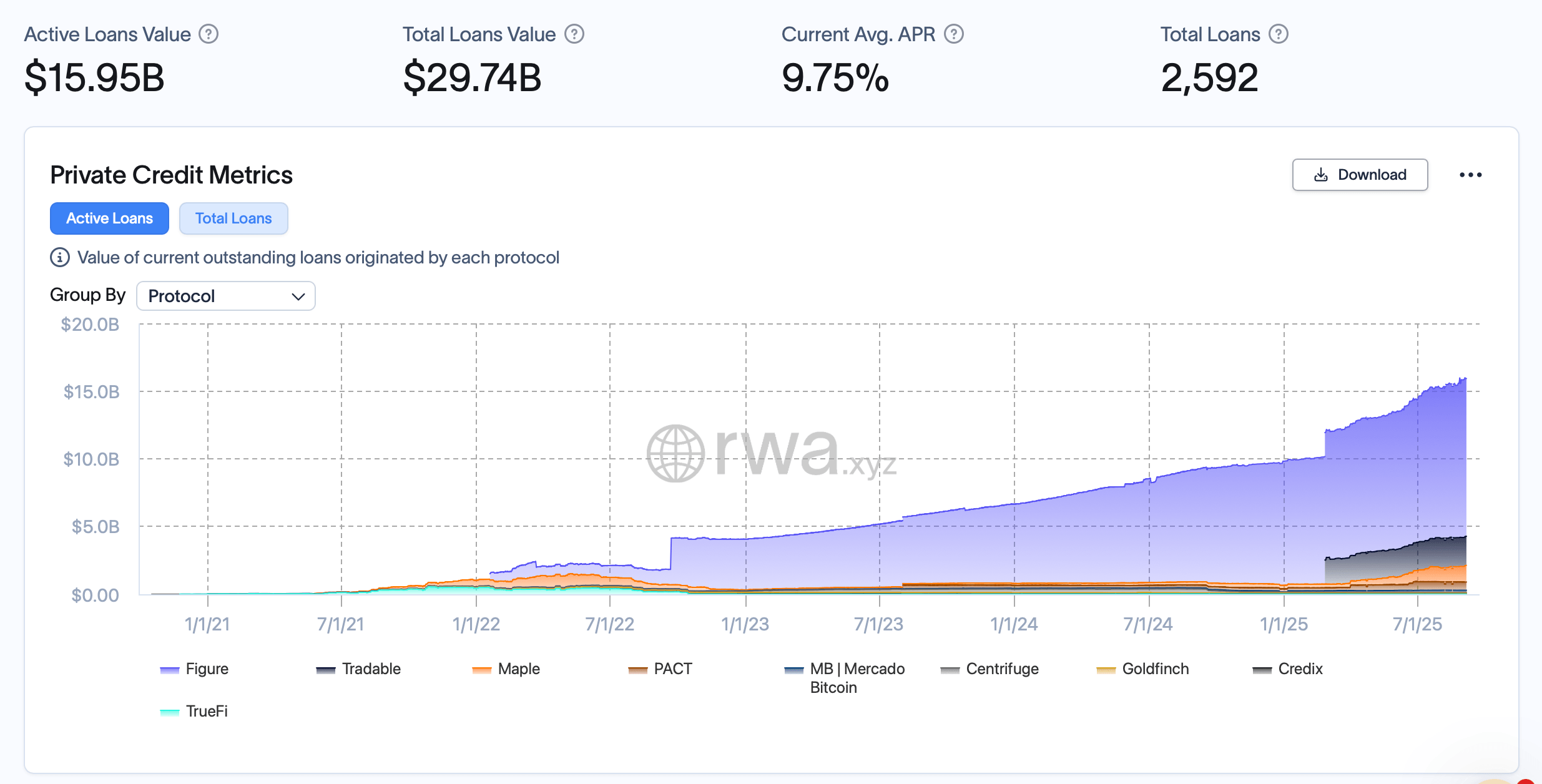

Tokenized Private Credit Loans Soar: APR Dips, But Risks Loom Large! 😱

The world of tokenized private credit has been growing faster than a toddler on an espresso binge since mid-June. With a cool $2 billion added to active loans and a cumulative $4.3 billion in lending, things are definitely heating up. As of September 6, rwa.xyz stats reveal active loans have now hit $15.95 billion, while total loans originated are a mighty $29.74 billion across 2,592 onchain loans. In a surprising turn of events, the average annual percentage rate (APR) has slipped from a slightly saucy 10.33% to a more sedate 9.75%, implying that lenders might be shifting to safer bets-or just offering a discount. 🙄