🚀 Tron’s 60% Fee Slash: Sun’s Gambit or Desperate Hail Mary? 🤑

Tron network transfer fees reduced by 60%! Come and try it out!

Tron network transfer fees reduced by 60%! Come and try it out!

August was a rollercoaster for Binance – skyrocketing toward $900, then slipping down to $854 faster than you can say “pump and dump.” But fear not! BNB’s still riding the bullish wave, cruising within its long-term channel like a yacht in the Gulf Stream. 🌊

Sonic Token (S), a token as elusive as a unicorn, has been hovering around the $0.30 mark, a high timeframe level that aligns with several major technical factors. Despite the lack of a sudden surge in price, its resilience at this level hints at a gathering storm of accumulation. The confidence in the project has grown, much like a young wizard gaining power, as Sonic Labs, a spin-off from the mystical land of Fantom, won the hearts and minds of the community with its first governance proposal. If this consolidation is indeed a prelude to a bullish breakout, it could very well be the start of a grand adventure, setting the stage for the next upward rotation. 📈✨

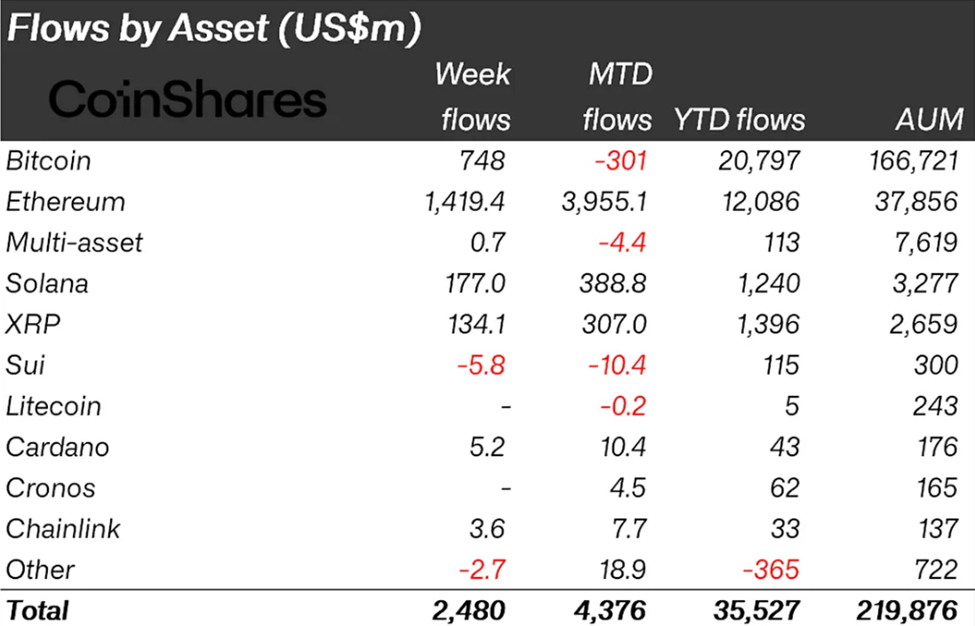

Yet, alas! Amidst this carnival of greed and glory, the total assets under management (AUM) took a tumble, slipping 10% to a mere $219 billion. Friday’s macroeconomic phantoms, those spectral harbingers of doom, cast their shadow once more. 👻💼

Jordi says companies these days are like fast food burgers: made quickly, consumed instantly, and forgotten before dessert arrives. Business models don’t even have time to cool down anymore before some shiny new idea comes along and replaces them. Poor equities! They’re stuck in this endless cycle of trading, like they’ve been swiping left and right on Tinder but never actually finding love. Meanwhile, long-term wealth creation sounds more like a fairytale than reality. Spoiler alert: no happily-ever-afters for stocks. 😭📉

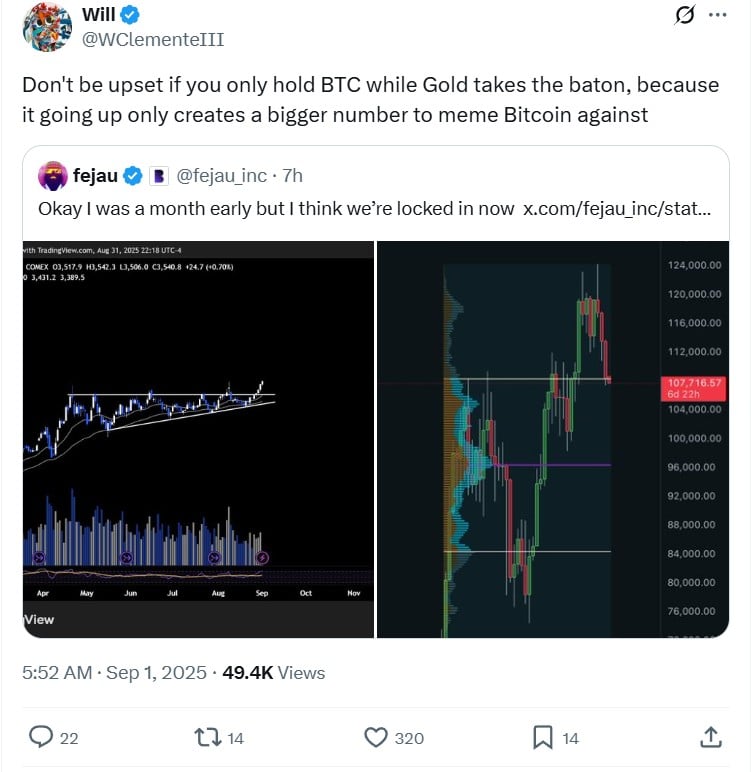

Now, don’t go thinking that just because the charts might suggest otherwise, Bitcoin is about to throw in the towel. Far from it! The recent rally in gold, one might argue, actually bolsters Bitcoin’s long-term case. After all, with gold futures breaking above the $3,500 resistance level, completing a multi-month consolidation breakout with all the flair of a matador at a bullfight, and backed by strong volume, it’s a sign that the market is on the move. 📈

Amidst this tempest, the pressing question on everyone’s lips was: where would Pi’s price venture next? Would it rise from the ashes, or sink further into the abyss? 🤔🔥

And a name, of course. There is always a name. A major player, they say, a shadow moving behind the curtain. Something, it seems, is explaining this rather…substantial reduction in holdings.

According to their announcement on Monday-because Monday’s the best day to make announcements, obviously-a whopping 1,009 BTC hit the cart and they reached 20,000 for about 16.479 billion yen (which I think is almost like $112 million). On the same cosmic day, they announced this fancy issuance of 11.5 million new shares last week, because of some investor, you know, flexing their warrant muscles to snag some stock. 🤼♂️

The industrious Hoskinson painted Leios as the keystone of a grand long-term endeavor to propel Cardano from the stultifying chains of consensus ceilings into a more liberating realm governed by network constraints. “The design objective,” he declared with serious understatement, “is to reach a one-minus-delta protocol, where barriers are not the shackles of consensus arrangements but rather those heaven-sent, network accords.” Carefully, the initial design sought to do away with unnecessary complexities, ensuring that various client teams could co-create something that, quite frankly, promised to be transformative, enabling iterative upgrades thereafter.