DeFi Drama: Developers Threaten to Ghost Congress Over Legal Snubs 😱

Apparently, these tech wizards are quivering in their boots, fearing they’ll be treated like poor Roman Storm of Tornado Cash fame. Oh, the horror! 👻

Apparently, these tech wizards are quivering in their boots, fearing they’ll be treated like poor Roman Storm of Tornado Cash fame. Oh, the horror! 👻

Behold, the miracle of tokenized real-world assets! U.S. Treasurys, collateralized loan obligations, and the occasional existential crisis-all now serve as collateral for stablecoins. Because nothing says “institutional compliance” like a 24-hour borrowing window with more rules than a Victorian tea party. 🧠

Gaze upon the short-term time-frame chart for $BTC, which shows it wrestling with a confounded descending trendline and stubborn horizontal resistance-like trying to lasso a mudcat on greased rails. If the price stays level enough for a fresh 4-hour candle to dance without interruption, we may witness it vault over this balky trendline. 🚀

The whole operation is now being run by Animoca Brands, which sounds like a questionable off-brand anime distributor but is apparently a very serious company. Their CEO, Yat Siu, has taken the helm, presumably because someone had to and the previous captains were busy arranging digital furniture. 🛋️

This audacious move mirrors a nationwide trend. Over 16 million South Koreans are already trading on exchanges like Upbit, Bithumb, Coinone, Korbit, and Gopax. By 2025, this number is expected to balloon to 20 million, leaving the 14.1 million domestic stock investors in the dust. With trading apps making crypto as accessible as ordering takeout, it’s no wonder citizens and politicians alike are embracing the future of finance-one meme coin at a time. 🚀📱

Finney, you see, was not merely a man; he was a visionary, a hopeful soul clinging to the promise of digital privacy like a drowning man to a life raft-all while battling ALS, the cruelest of ironies. While lesser mortals might have crumbled under the weight of such a diagnosis, Finney remained steadfast, his fingers dancing across keyboards, his mind a labyrinth of cryptographic dreams. 🧠✨

August 27 will go down in history, my friends, as the date when Horizon made its grand debut, marking Aave’s (AAVE) most audacious leap into the glittering waters of institutional finance combined with decentralized finance. Can you hear the trumpets? 🎺

In this predicted future, should Bitcoin be as generous as the Bolsheviks imagined during their early years, its price might climb from its current $111,148 to approximately $160,000 come the twilight of December. Such is the whimsical prediction of the oracles at Cointelegraph Markets Pro and TradingView.

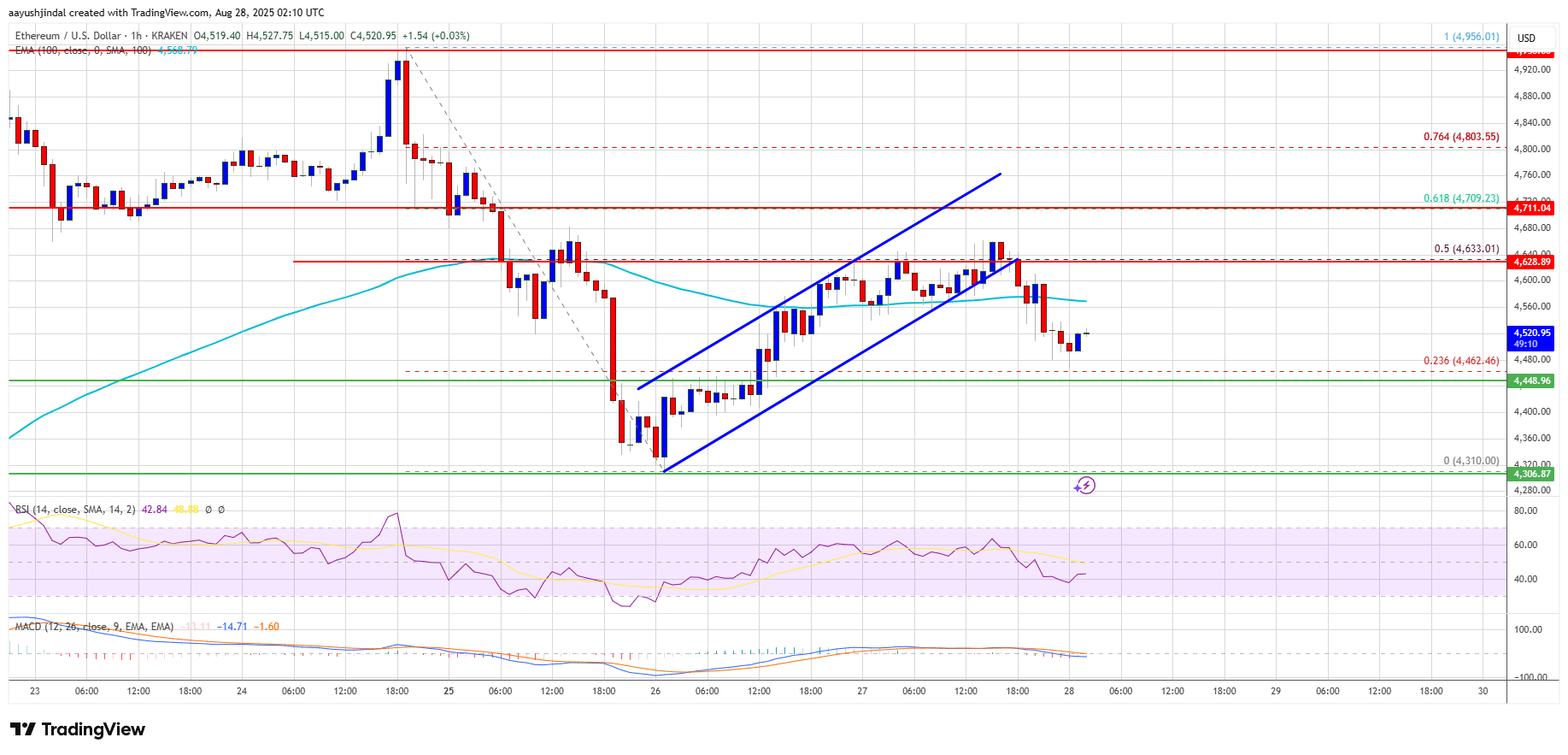

So, Ethereum decided to take a little vacation to the $4,310 zone, just like Bitcoin. 🌴✈️ But then, plot twist! It found support and started climbing again. Because, you know, drama.

In the report-an expose as bleak as a Petersburg winter-men and women, driven by greed-or perhaps some other inner demon-use Claude not just for guidance but to commandeer hacking endeavors. They venture into digital realms with naught but rudimentary codes, executing attacks that would make a Russian nihilist happy-vibe hacking, they call it, as if ‘vibe’ could mask the chaos beneath. Ransom demands soaring past half a million dollars-money, after all, is the true obsession of this modern madness. 💸