State Street & JPMorgan’s Blockchain Bonanza: When Money Gets Tokenized! 💸

JPMorgan’s “Digital Debt Service” platform lets big-shot investors trade blockchain-based IOUs. Imagine a circus, but instead of clowns, they juggle digital bonds. 🤹♂️

JPMorgan’s “Digital Debt Service” platform lets big-shot investors trade blockchain-based IOUs. Imagine a circus, but instead of clowns, they juggle digital bonds. 🤹♂️

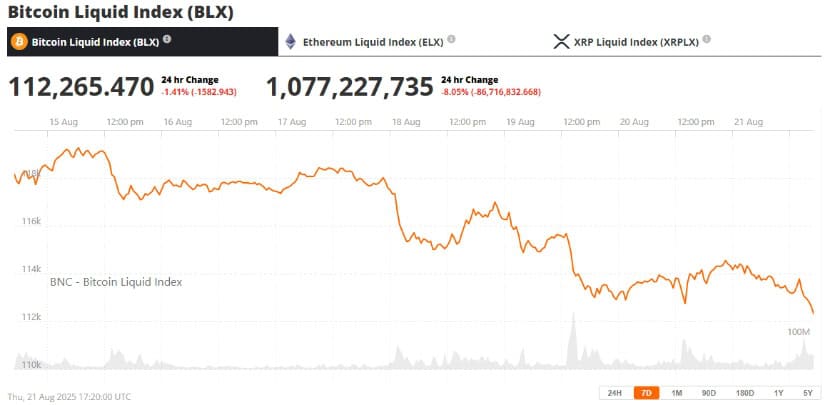

So apparently, one single Bitcoin is now worth approximately one hundred and twelve thousand pounds. Which is frankly absurd. That’s more than I spent on my entire flat. And my flat has a working toilet, which is more than can be said for the blockchain, which just has a lot of people arguing. It briefly got a bit wobbly, like me after three chardonnays, but then it perked up again. Resilience, darling. We could all learn a bit from Bitcoin.

On a sunny August day, Coinbase, the grand wizard of cryptocurrency exchanges, waved its wand and added five new altcoins to its magical roadmap. Among them was the ever-so-popular meme coin SPX6900 (SPX) and a few others with names that sound like they belong in a sci-fi movie: AWE Network (AWE), Dolomite (DOLO), Flock (FLOCK), and Solayer (LAYER). 🚀

This rise happened in only one year, which is *very* fast for any crypto platform. Wait, isn’t that the point? 🤔

Wealth managers, bless their cotton socks, say clients are suddenly asking about “decentralized finance” like it’s the next big thing. Cryptocurrency exchanges? They’re busier than a Starbucks at 7 a.m. New crypto funds? Selling out faster than a NFT collection at a gas station.

For the second time this week, the XRP derivatives market has revealed a number so shocking, it could make even the most stoic of gentlemen gasp. In a mere hour, the liquidation tracker displayed an imbalance of 101,445% between long and short positions. Naturally, the majority of this calamity befell the bullish side, as if fate itself had conspired against them.

Why, you ask? Well, my clever friends, this makes MetaMask the very first self-custodial wallet to perform such a marvelous trick! And no, we’re not talking about pulling a rabbit out of a hat – this is Ethereum’s enchanting magic at work! 🪄

In this age of digital intrigue, where fortunes are made and lost with the click of a mouse, Trezor users may now venture into the realm of decentralized applications with the utmost propriety. Fear not, dear reader, for their security remains paramount; each transaction must be confirmed with a physical gesture upon their Trezor device, ensuring private keys remain as guarded as a maiden’s reputation. 🕵️♀️

Our dear friends at StrategicETHReserve offer figures so dazzling, they could cause a minor swoon in the average financier: these holdings represent about 3.39% of the total circulating Ethereum supply, boldly announcing ETH’s latest audition as a long-term store of value alongside Bitcoin. Because nothing says “stability” like a digital asset that could vanish faster than a monocle at a boxing match. 🎩🔍

Shiba Inu, the canine coin with more drama than my last break-up, has enthusiastically followed the crypto crowd off the correction cliff-down by 9% this past week. Market cap is currently lurking around $7.3 billion-a tragic figure compared to last December’s flirtation with $20 billion (those were the good old days, eh?).