Stablecoins Soar: Is DeFi Back from the Dead? 💰🚀

Ah, decentralized finance (DeFi), that fickle friend, seems to be regaining its footing, with stablecoin activity hitting a new high. Who would have thought?

Ah, decentralized finance (DeFi), that fickle friend, seems to be regaining its footing, with stablecoin activity hitting a new high. Who would have thought?

In a report that reads like a funeral oration for prosperity, UBS declares that real GDP is crawling along at a paltry 1.2% annualized rate in the first half of 2025-a pace so sluggish, one might mistake it for a tortoise on a Sunday stroll. 🐢

The last FOMC palaver saw a distinctly agreeable turn of events, with the Fed deciding against piling on the pressure with higher interest rates. No cuts, mind you – a chap can’t have everything – but keeping things as they were managed to keep the markets on an even keel, resulting in a rather tolerable degree of jiggling in the riskier sectors, like Bitcoin and its crypto companions.

On a perfectly ordinary Monday-well, as ordinary as Mondays can be when you’re fighting financial chaos-the ICBA penned a letter to the OCC. Their argument? Ripple’s proposed stablecoin, RLUSD, is basically trying to dress up as a bank deposit for Halloween. And unlike your neighbor’s overenthusiastic attempt at a vampire costume, this disguise might actually work. The ICBA warns that if RLUSD succeeds, it could suck funds out of community banks faster than you can say “cryptocurrency.” 🧛♂️💰

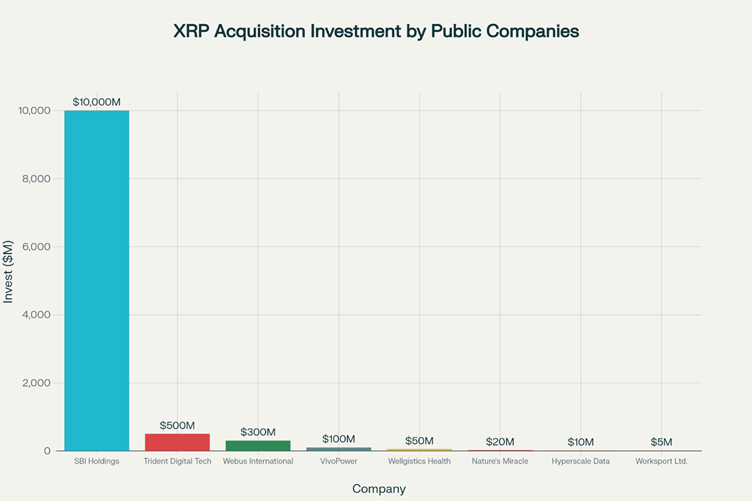

Across the globe-United States, Asia-Pacific, Canada-companies big and small have begun disclosing their secret loves: XRP holdings, or at least, they speak of plans to hoard this digital treasure. This report by CoinPedia pulls back the curtain to reveal institutional amorousness for XRP, and, oh yes, the allure of swift, borderless transfers. Cue the dramatic music: these corporations are betting their future on the quick settlement, and some probably on their morning coffee, too. ☕️

Imagine the scene: President Trump, ever the master of the drama, boasts on CNBC about attempting to pour a billion dollars into the bank-a veritable river of green-only to be turned away with a flourish of regulatory hand. Moynihan, ever diplomatic, sidesteps like a seasoned socialite at a scandalous ball, refusing to confirm or deny, but instead waving the banner of reform. Because nothing says “I understand the gravity of the situation” like a vague reassurance of fixing the rules-quelle surprise!

In these modern times, a growing number of corporations – those titans of industry ever in search of diversification – have cast their lot with digital assets, most notably with Bitcoin. Yet, emerging trends now whisper of another tale: a veritable flock of companies is beginning to embrace Ethereum, drawn by its dual promise of yield and its subtle deflationary charm. For those who hold its tokens, the opportunity to stake them, to reap the rewards of network revenues, and to partake in the grand theatre of decentralized finance is as alluring as it is unexpected – a modern twist on the age-old pursuit of fortune. (Ah, if only our ancestors could see how even the most stately of assets now bow to the caprices of technology! 🤑)

From the bustling streets of Hong Kong emerges a new era-regulation, like a stern gatekeeper, opens doors for licensed entities to issue stablecoins backed by the good old fiat, those paper notes and metal tokens of yore. Imagine, a sandbox-small, controlled, yet brimming with the promise of chaos and order in equal measure! Sure, the mainland keeps a tight lid on private crypto adventures, but here in this pocket of experimentation, digital dreams dance under Beijing’s watchful eye. 🙃

Bitcoin, much like a tipsy uncle at Christmas dinner, found solace near the $112,000 zone before lurching upward. It staggered past $113,500 and $114,200 with the grace of someone trying to parallel park while drunk. There was even a minor victory against a bearish trend line at $114,300, though the bears themselves seemed less than impressed.

The discussion kicked off with a whiff of speculation about Ripple’s supposed “regulatory blessing.” You know, like finding a unicorn in your backyard. Long didn’t hold back-she said that idea “overstates how important that network is,” which is a polite way of saying, “It’s not that special, honestly.”